- The Daily Brief, by The Kenyan Wall Street

- Posts

- A clash of interests...

A clash of interests...

Kenya's #1 newsletter among business leaders & policy makers

The Central Bank of Kenya (CBK) introduced a new model it wants banks to use in pricing their credit. It aims at cheapening the market interest rates but the bankers’ lobby is not pleased. Here is why?

Good evening! It's Brian from The Kenyan Wall Street. This and more business stories in today's edition of ‘The Daily Brief’

A CLASH OF INTERESTS : Banks Oppose CBK Rate Cap Plan

Central Bank of Kenya (CBK)

The Kenya Bankers Association (KBA) has pushed back against the Central Bank of Kenya’s (CBK) proposal to peg lending rates to the Central Bank Rate (CBR), warning it could trigger a credit crunch.

Banks argue the move reintroduces rate caps akin to the 2016–2019 era, which hurt SME lending and economic growth. KBA proposes using the interbank rate as a more market-aligned benchmark that better reflects liquidity and cost structures. They warn that CBK’s model could make it less viable to lend to higher-risk segments like MSMEs, jeopardizing the KSh 150 billion annual lending pledge.

The CBK’s critique of the existing Risk-Based Credit Pricing Model includes issues like unrealistic outputs, poor governance, and unapproved charges. Both parties are now seeking a replacement model that ensures responsible lending while supporting economic activity. Read more details here »»»»»

Today's Poll

Between CBK and the Kenya Bankers Association (KBA), who do you think has presented a viable loan pricing model? |

PAY YOUR DUES : Former CEO’s Ghost Haunts Standard Group

Former Standard Group CEO Orlando Lyomu

In a legal tussle, Standard Media Group has been ordered to pay the first installment of KSh 38.34 million to its former CEO, Orlando Lyomu, by May 5, 2025. The media house failed to honor an agreement to pay monthly installments of KSh 750,000, leading to a court ruling for payment of outstanding dues, including salary arrears, leave, and a bonus. Lyomu's claims have been pending for over a year, with the media group struggling financially due to digital disruption. This comes as Standard Group continues restructuring efforts, including layoffs and a rights issue to bolster its balance sheet. Read more details»»»»»

TIGHTENING THE LOOSE ENDS : Conflict of Interest Bill Rejected

The National Assembly

President William Ruto has declined to sign the Conflict of Interest Bill, citing concerns over weak provisions on gift disclosures for public officials and their families. In a memorandum to Parliament, he proposed stricter definitions and stronger oversight by the Ethics and Anti-Corruption Commission (EACC). He also wants officials barred from doing business with entities they work for. The move comes as Kenya eyes a KSh 97 billion World Bank loan, with accountability reforms seen as key to unlocking funds. Read more »»»»»

On the Headlines

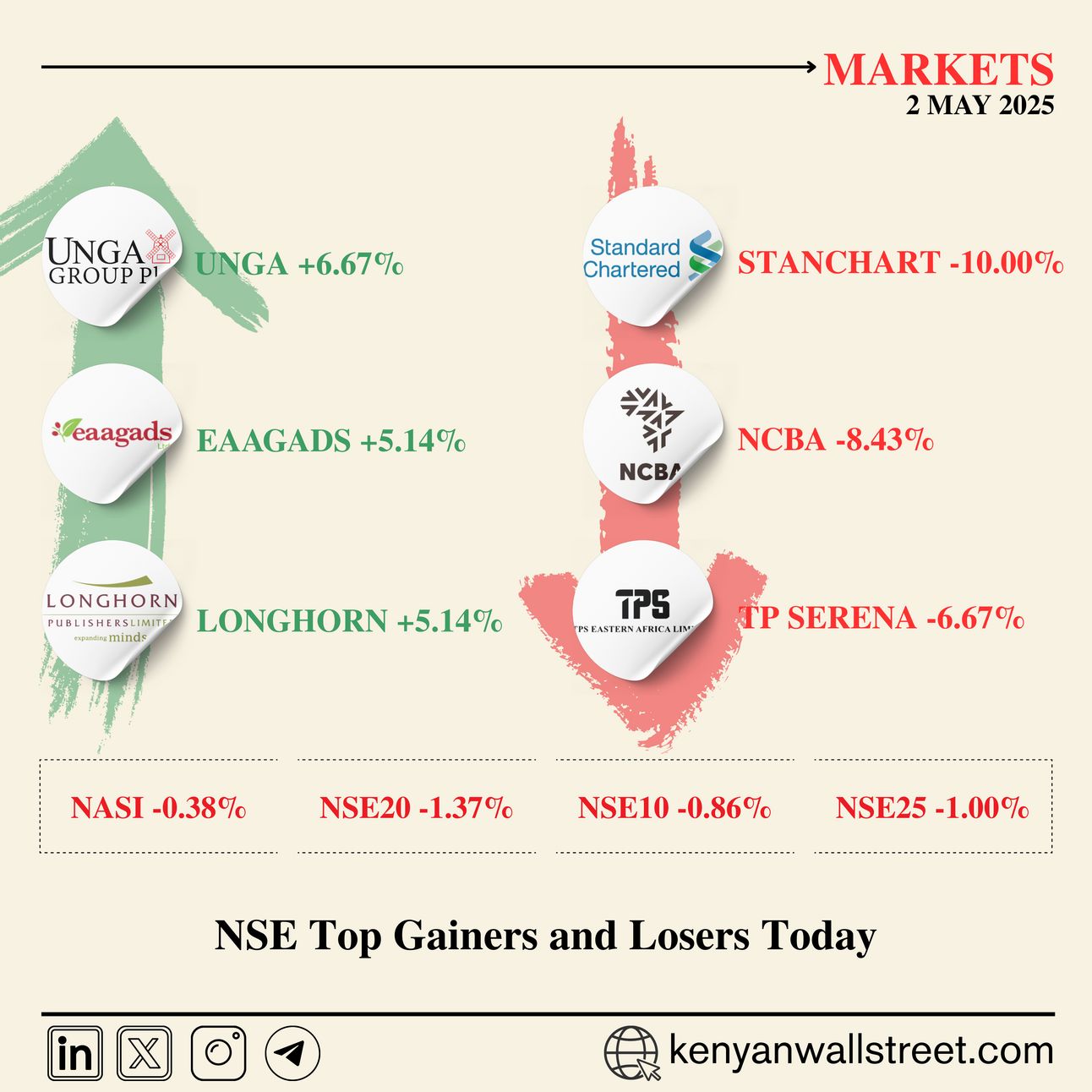

Markets

🔴 Umeme has delayed publishing its FY2024 results to 31 May 2025 as talks with the Ugandan government on the Buy Out Amount continue. The AGM, originally set for 22 May 2025, is postponed to no later than 15 August 2025.

🟢 Limuru Tea Plc will hold its 100th AGM on 23rd May 2025 at 11:00 AM at Golden Tulip, Westlands, Nairobi.

▪️ No dividend recommended for FY2024

▪️ Director re-elections and Board Audit Committee appointments

▪️ KPMG Kenya proposed for reappointment as auditors.

Proxy forms due by 21st May 2025.

Source : NSE

If you know someone who would enjoy this newsletter, please share this link

ENTREPRENEURSHIP : Changing Nairobi's Haircut Scene

Regional Focus

On your watchlist

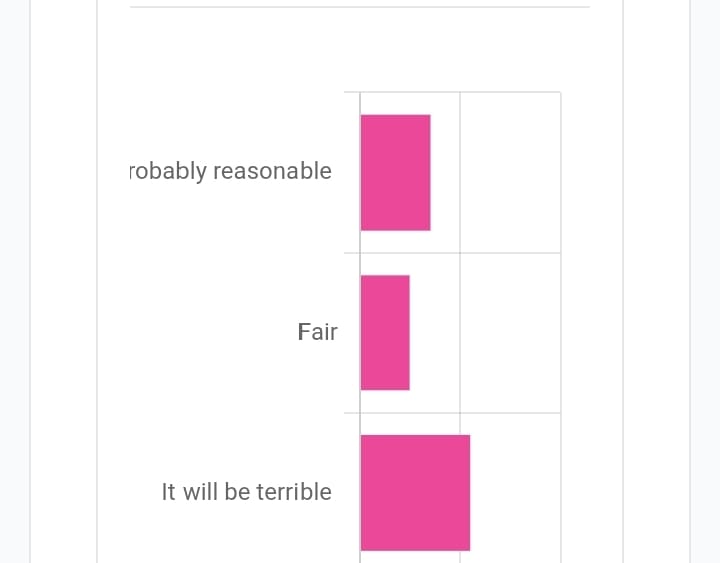

Yesterday's Poll Results

The Finance Bill 2025 is about to be tabled. What are your expectations of this year's tax plan?

Most voted ‘It will be terrible’

The road to success is dotted with many tempting parking spaces.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.