- The Daily Brief, by The Kenyan Wall Street

- Posts

- A Deferred Listing

A Deferred Listing

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street

In today’s newsletter edition, the Privatization Commission has begun scouting for advisors to steer the Kenya Pipeline Company’s long-awaited IPO, a process that will bring one of the country’s largest state firms to the stock market by March 2026.

Harry Njuguna writes…

The listing was originally targeted for September 2025 after Cabinet approval, but was temporarily derailed in August when a High Court issued a conservatory order halting the sale pending a full hearing into legal and procedural concerns.

That injunction forced the government to pause the rollout and regroup its documents, valuation, and stakeholder engagement. Although the court lifted the hold in mid-September, the delay reshaped the timetable and added a layer of caution to what had been presented as a fast-tracked privatization.

The revision now offers a longer runway but also raises new questions about momentum, credibility, and whether the process will survive scrutiny as the country hurtles towards a General election.

For the Treasury, it’s about filling revenue gaps without new taxes; for markets, it’s a chance to prove that state listings can still inspire confidence. For many Kenyans, privatization remains a bitter pill to taste.

Read more here >>>>>

Greenlight for Crypto Regulation

By Brian Nzomo

Parliament has finally passed the long-debated Virtual Asset Service Providers Bill, but only after stripping out a controversial clause that would have handed a Binance-linked lobby group influence over a new crypto regulator.

The compromise keeps supervision under the Central Bank of Kenya and Capital Markets Authority, reflecting a broader shift toward tightening oversight without reinventing bureaucracy. What began as an effort to build a standalone authority has evolved into a shared model.

Lawmakers also held firm on requiring crypto firms to set up physical offices and local boards, a move meant to anchor a borderless industry in domestic law. The bill now awaits presidential assent, positioning Kenya among the few African nations to give digital assets a clear, enforceable legal home.

Read more here >>>>>

Car & General’s Comeback at the Stock Market

By Harry Njuguna

After years of muted performance, Car & General has become the unlikely star of the Nairobi Securities Exchange (NSE). The company’s share price has more than doubled in six weeks, lifted by a 920% profit surge and its first interim dividend in decades.

Behind the rally lies a recovery in its core motor business and stronger earnings from Watu Credit, its fast-growing financing arm now betting on electric mobility across East Africa.

Investors, who have for a long time being indifferent, are re-evaluating a company once seen as traditional and slow-moving.

Read the full analysis here »»»»»

More Stories

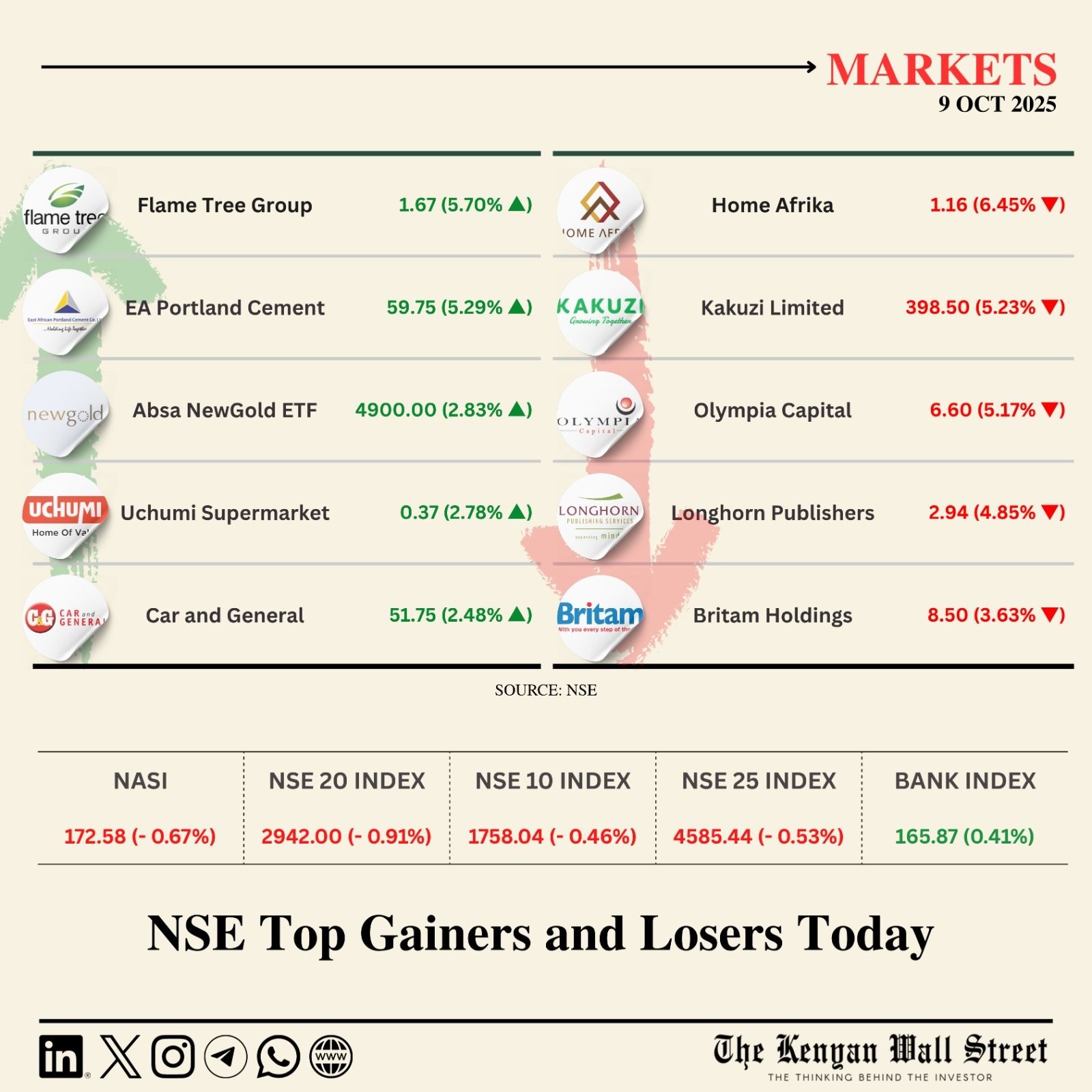

NSE Gainers & Losers

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

In a market where traditional banks often shy away from risk, CIB Kenya CEO Abhinav Nehra is doing the opposite. He sits down to discuss the bank's bold new approach to SME lending and its plans to change the financial landscape in Kenya and beyond.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.