- The Daily Brief, by The Kenyan Wall Street

- Posts

- A Market Bleeding Foreign Investors

A Market Bleeding Foreign Investors

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

A Happy New Year 😀

It's Brian from The Kenyan Wall Street.

In today's newsletter, the Kenyan stock market is becoming less and less dependent on foreign investors to sustain its rally…

Also, a new investigation into a coffee co-operative society reveals how the sector remains prone to weak governance and shaky regulation.

These are our top business stories today…

A Market Bleeding Foreign Investors

By Harry Njuguna

Foreign inflows

Foreign investors have now spent six straight years quietly walking away from the Nairobi Securities Exchange (NSE), even as prices have staged an impressive local rally. The paradox defines today’s market: gains driven not by returning offshore confidence, but by domestic money stepping into the gap. Pension funds, insurers, and retail investors have absorbed selling that would once have rattled prices. Offshore funds, by contrast, appear content to treat Kenya as a source of liquidity rather than conviction. The result is a market increasingly shaped at home. Read more here >>>>>

A Co-operative With Baggage

By Brian Nzomo

Coffee berries

Murang’a’s coffee world is caught in a storm as a new cooperative faces suspension and potential liquidation. Marga Farmers’ Cooperative is under scrutiny after investigators linked its leadership to a KSh117 million probe at a previous society and flagged serious flaws in its registration. Inspectors also raised concerns about cash-based cherry buying and risky borrowing practices, questioning the cooperative’s viability. For farmers, the situation highlights how fragile trust and governance remain in local cooperatives. Read more here »»»»»

Courting Green Investment

By Chelsy Maina

Green bonds

Kenya’s green bonds are not tax-free by accident but by design, embedded in policy to pull private capital into climate projects. By exempting qualifying interest income from withholding tax, the state quietly boosts investor returns without raising coupons. That advantage lowers financing costs for issuers and makes long-term, climate-aligned projects easier to fund. Safaricom’s bond shows how large corporates can translate tax policy into broad investor appeal. The risk, as always, is uncertainty: incentives work best when they are stable, predictable, and rarely rewritten. Read the full article here »»»»»

Briefs

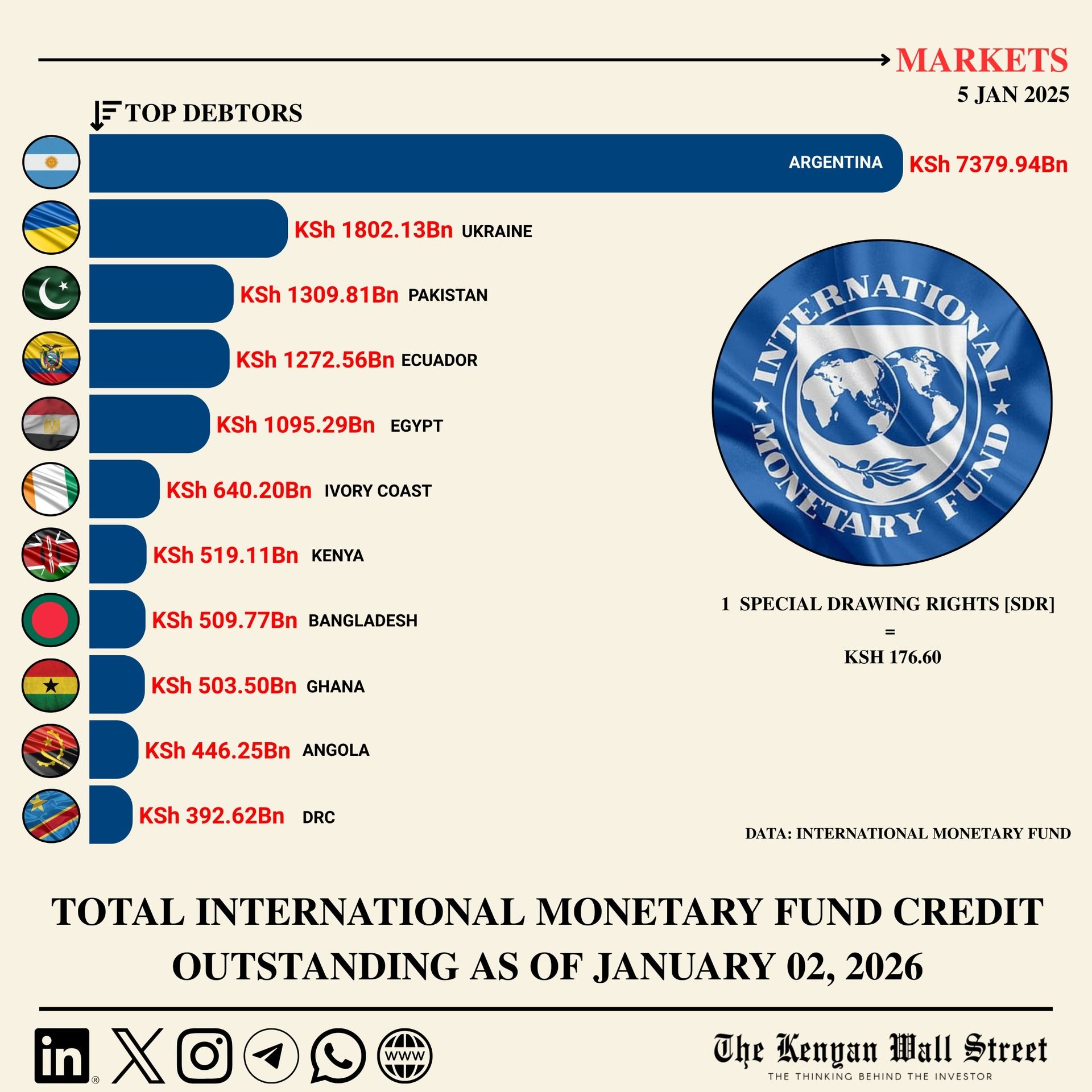

🏦 Kenya made a KSh 2.92Bn repayment to the International Monetary Fund (IMF) in December 2025, cutting outstanding IMF credit to KSh 519.04Bn.

🇪🇹 Ethiopia said it reached an agreement in principle with bondholders to restructure a US$1 billion Eurobond on which it defaulted in 2023.

Snapshot

Countries most indebted to the IMF

INSIGHT : What Kenya Can Learn from South Africa’s Real Estate Playbook

By Lulu Kiritu

Real estate property in Cape Town, South Africa

Kenya’s real estate market is growing fast, but it is still building the systems that make growth durable. South Africa offers a glimpse of what happens when property markets mature around data, regulation, and financing rather than momentum alone. The contrast is clearest in mortgages, planning, and post-construction management, where structure quietly does most of the work. The lesson is not imitation, but timing: grow now, but put the rules in place before growth hardens into disorder. Read the full article here »»»»»

Visit our new website here to get updated on this story and others…

Capital Markets

More Stories

On your watchlist

The Nairobi Securities Exchange (NSE) held its inaugural NSE Arts Wealth exhibition, an evening that brought together business leaders, renowned artists, collectors, and investors to explore a powerful but often overlooked idea: art is not just culture — it is capital.

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Today in History

Kenya Airways’ shares resumed trading on the Nairobi Securities Exchange (NSE) after a five-year suspension, following the withdrawal of a nationalisation proposal and a return to profitability, with the airline posting its first net profit in a decade