- The Daily Brief, by The Kenyan Wall Street

- Posts

- A New Language for Kenyan Loans

A New Language for Kenyan Loans

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

I am Brian from The Kenyan Wall Street…

In today's newsletter edition, the Central Bank of Kenya (CBK) is about to phase in the new loan pricing mechanism. We are also looking into the financial performance of Kenya Airways (KQ), understanding how it slipped into loss territory again…

A New Language for Kenyan Loans

The Central Bank’s push to anchor borrowing costs to an overnight rate is designed to tame arbitrary pricing and align Nairobi with global finance...

By Harry Njuguna

CBK Governor Kamau Thugge

Starting September, the cost of borrowing in Kenya will rise and fall with a freshly christened benchmark, KESONIA, a name that sounds more like a sci-fi planet than a financial index.

The Central Bank is betting that tying loans to this rate will make credit cheaper, fairer, and more predictable, despite banks grumbling their way to compliance. Behind the jargon is a quiet revolution: instead of opaque discretion, lenders will have to show their math, posting what they charge and why.

The shift places Kenya in the same club as London and New York, where SONIA and SOFR already call the tune. But borrowers may wonder whether this new rhythm will mean relief at the till or just another dance with fees and fine print. Read full article here >>>>>

More on Banking & Credit…

KQ Sinks into Red Territory in H1

Grounded planes, soaring costs, and a fragile recovery leave the national airline navigating turbulent financial skies.

By Harry Njuguna

Kenya Airways is grappling with turbulence of its own making. After a fleeting profit last year, the national carrier posted a staggering half-year loss of KSh 12.15 billion. The confluence of grounded Dreamliners, supply-chain bottlenecks, and currency pressures paints a grim picture for the airline’s fragile recovery.

Financial Snapshot :

🔴 Total revenue fell 19% to KSh 74.5 billion.

🔴 Passenger numbers dropped 14%, with available seat kilometres shrinking 16%.

🔴 Operating loss widened to KSh 6.24 billion, reversing a KSh 1.3 billion profit a year earlier.

🔴 Other costs surged to KSh 5.97 billion, compared to KSh 0.69 billion previously.

🔴 Net margin plunged to -16.3%, from a modest 0.6% in HY2024.

🔴 Total equity slipped further into the red at KSh -129.57 billion, while liabilities rose to KSh 309.95 billion.

Read the full financial analysis here >>>>>

East African Portland Cement: New Hands On the Deck

By Harry Njuguna

Holcim’s departure from East African Portland Cement marks more than a routine sale. It is a quiet reshuffle of influence in Kenya’s cement sector. Kalahari Cement, a newly minted Kenyan company with Tanzanian ties, is snapping up nearly a third of EAPC at a discount that has traders whispering. The deal, though exempt from mandatory takeover rules, still requires approvals from local competition and mining authorities, underscoring the regulatory choreography behind every strategic move. EAPC’s tightly held share structure leaves retail investors watching from the sidelines as regional consolidation accelerates under Amsons-linked entities. While Kalahari pledges to keep the company public, the transaction hints at a future where cross-border investment quietly reshapes domestic industries. Read more here »»»»»

More on Capital Markets…

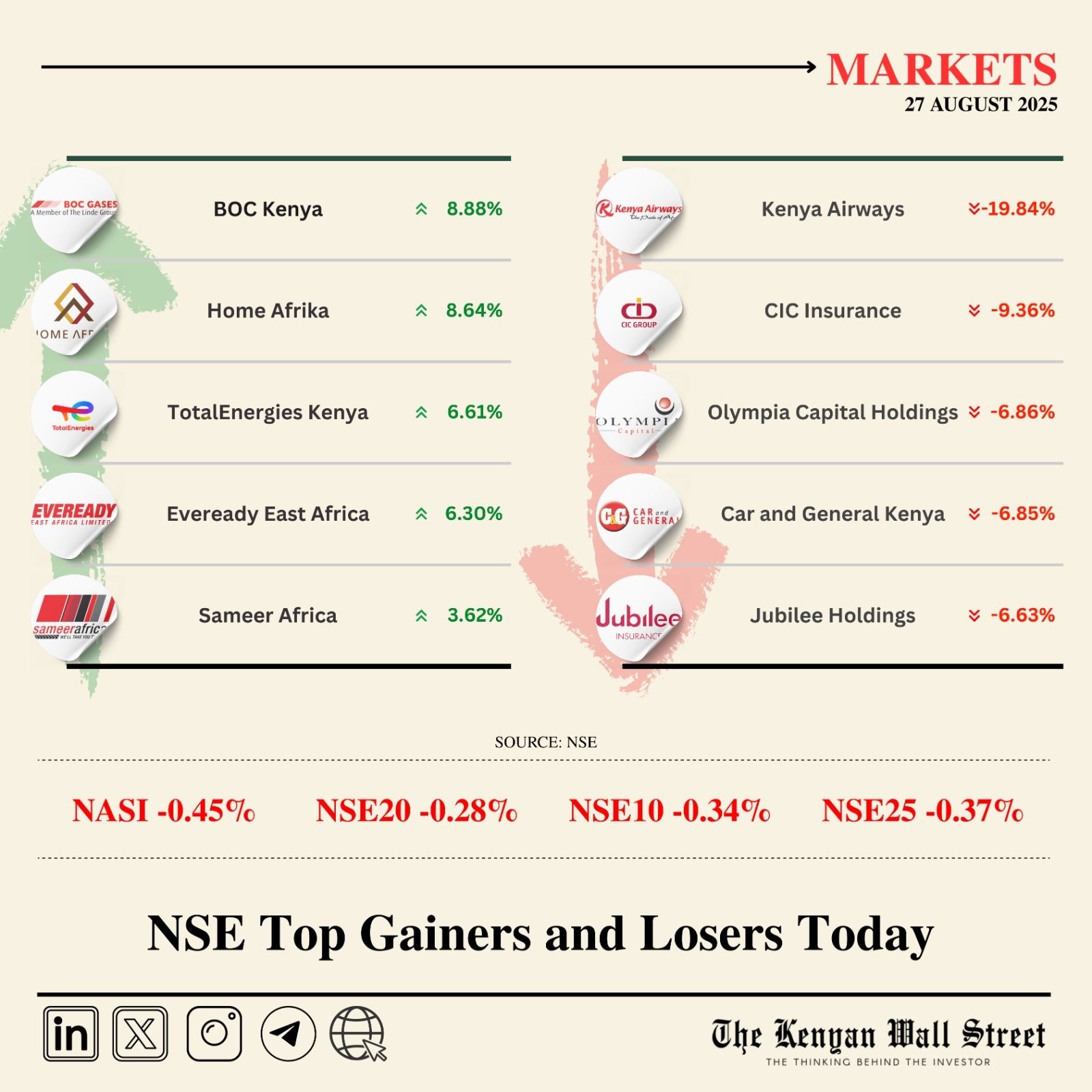

NSE Gainers & Losers

Source : NSE

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

INSIGHT : East Africa Faces Climate Shocks That Could Hit Agriculture, Energy Markets

By Fred Obura

The Horn of Africa is once again staring down a season of precarious skies. Climate scientists meeting in Nairobi warn that La Niña’s cool shadow could strip rainfall from Somalia, Kenya’s coast, and swathes of Ethiopia, while the west of the region faces the opposite: cloudbursts and floods.

The result is a split-screen forecast: drought tightening its grip on fields in the east, bumper rains threatening soil and settlements in the west. Governments and aid agencies have been told to ready both relief and rescue, but the region’s fragile economies have little cushion against another climate swing. For farmers, the October–December rains are not just weather but survival, and their unpredictability makes planning nearly impossible. Read more here >>>>>

OPINION: Why Satellite Towns Are Kenya’s New Property Hotspots in 2025

By Lulu Kiritu

Nairobi’s old promise that proximity to the city center was the surest bet for wealth and convenience is quietly being rewritten on the outskirts. Satellite towns once dismissed as dormitories for commuters are now flexing into full-fledged investment frontiers, pulling families, developers, and speculative capital out of the capital’s core. The shift isn’t accidental: new expressways and bypasses have collapsed the tyranny of distance, while a yearning for gardens, privacy, and permanence has outgrown the cramped towers of Kilimani and Westlands. But the boom comes with a caveat. These towns are not blank canvases; they are fragile ecosystems where haphazard estates and speculative sprawl can quickly erode value. The opportunity is immense, but so is the responsibility. The question is whether investors, developers, and policymakers will treat satellite towns as Nairobi’s backyard or as the country’s next frontier. Read the full piece here »»»»»

Also Read

Stories you missed

♦️ Public Finance. Treasury Cabinet Secretary John Mbadi has warned ministries, departments and agencies (MDAs) that they risk losing funding if they fail to conduct proper public participation in the budget process.

♦️ Insurance. Listed financial services group Old Mutual Holdings PLC has posted a sharp earnings decline for the half year ended June 30, 2025.

♦️ Investment. Kenya’s foreign-owned enterprises are doing more than bringing in capital- they are also reshaping the country’s labor market, promoting gender inclusion, and driving innovation.

♦️ Capital Flows. Kenya’s net capital outflows surged nearly fourfold to KSh 217.6 billion in 2023, as money moved aggressively into offshore financial centers even as foreign inflows decreased by 28.8%.

♦️Companies. Longhorn Publishers Plc has announced that its CEO, Maxwell Wahome, will step down at the end of September 2025 after nine years at the company.

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.