- The Daily Brief, by The Kenyan Wall Street

- Posts

- African Banking Giants Zero in on Nairobi

African Banking Giants Zero in on Nairobi

Kenya's #1 newsletter among business leaders & policy makers

iNewsletter Sponsor

Hello 👋🏽 from The Kenyan Wall Street.

Have you noticed the ‘sudden’ interest of Africa’s banking giants, from Lagos to Cairo to Johannesburg, on Kenya’s financial sector?

In this issue, delve into the pattern so far, and what’s likely coming. In the stock market, local investors are back in action.

African Banking Giants Zero In on Kenya as Capital Rules Spark Acquisition Rush

From Lagos to Cairo to Johannesburg, Africa’s banking titans are converging on Nairobi.

In just two years, Kenya has witnessed a surge in cross-border acquisition attempts, with Nigerian and Egyptian lenders already sealing deals and South African giants now circling.

The drivers are a mix of regulatory reforms, market potential, and Kenya’s role as a regional financial hub.

Expect increased deal activity through 2026 and beyond, especially as foreign banks race to secure first-mover advantages in a consolidating market.

Harry Njuguna interrogates why here >>>>>

Does Kenya Need a Sovereign Wealth Fund?

By Fred Obura

Kenya’s proposed Sovereign Wealth Fund (SWF) will introduce an election-year safeguard requiring that all funds under its control be audited and certified before every General Election, a move aimed at insulating public money from last-minute political spending. That’s just one of the safeguards in the draft Kenya Sovereign Wealth Fund Bill (2025), which is currently undergoing public participation. Read the full article here >>>>>

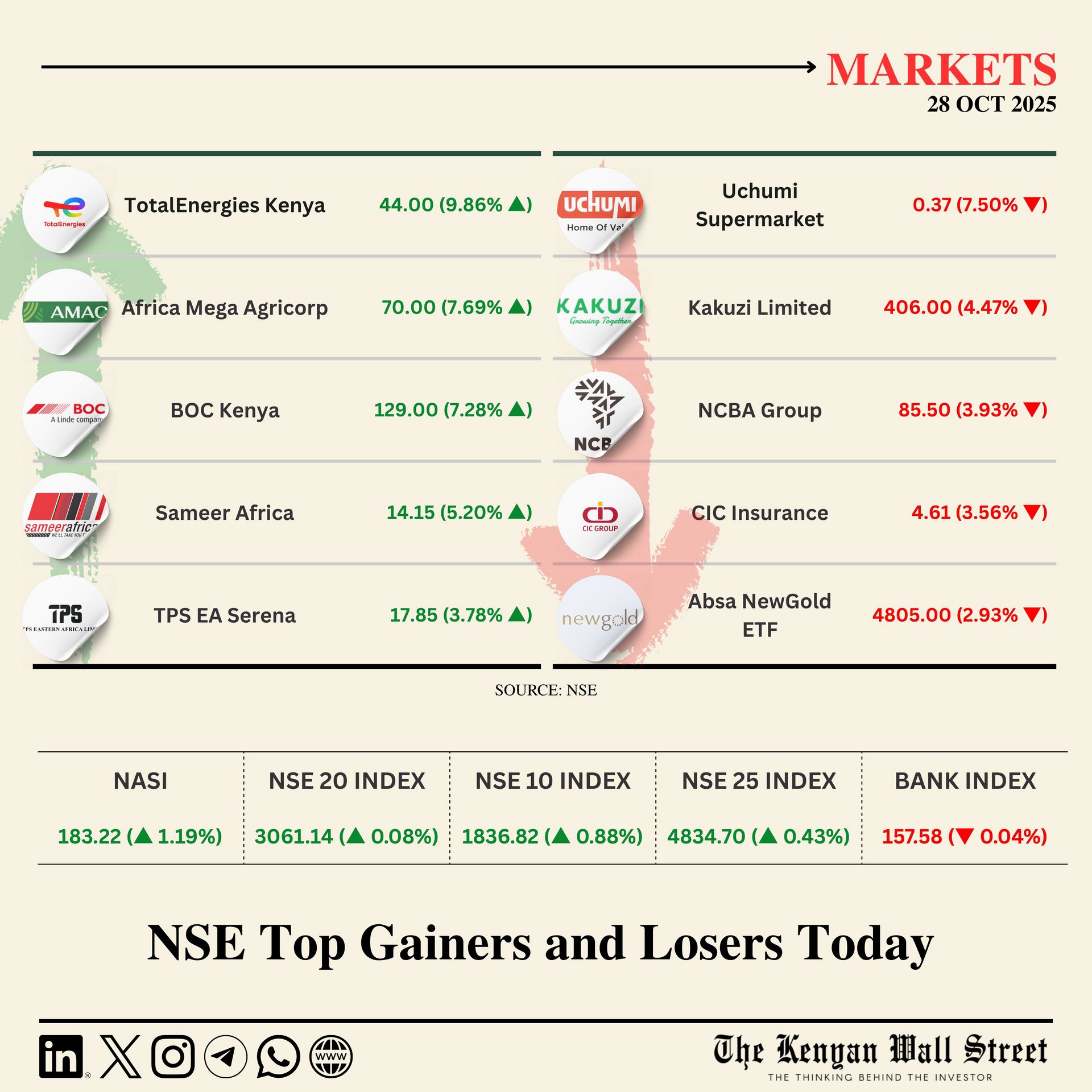

The Markets Today

Local investors are now driving most of the trading at the Nairobi Securities Exchange, with their share surpassing 70% in September 2025 and averaging about 70% for Q3. Read More

Opinion

Why Kenya is Becoming a Long-Term Real Estate Powerhouse

By Leo Toroitich

Kenya’s real estate boom isn’t just a story of bricks and mortar but a reflection of faith in a country that’s still building itself. Every new expressway, every apartment tower, every gated estate rising from former farmland speaks to an optimism that refuses to fade, even in the face of inflation and fiscal strain. The housing deficit looms large, yet so does the appetite to fill it…driven by a young, restless middle class seeking permanence in a volatile economy.

Read the article here »»»»»

More Stories

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

Yesterday's Poll Results

Do you think the new cybercrimes law will make online interactions safer or is it just a tool for frustrating political dissent?

⬜️⬜️⬜️⬜️⬜️⬜️ It will make digital spaces secure (6%)

🟩🟩🟩🟩🟩🟩 It will be abused by the state (94%)

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.