- The Daily Brief, by The Kenyan Wall Street

- Posts

- At Bullish Kenya event in NYC, Kenya's Vast Potential for Investments Takes Center Stage

At Bullish Kenya event in NYC, Kenya's Vast Potential for Investments Takes Center Stage

Kenya's #1 newsletter among business leaders & policy makers

After Inaugural Bullish Kenya event, Wall Street Africa, The Kenyan Wall Street, Plan New Events

Guests at the inaugural Bullish Kenya event in New York.

Attendees and speakers at the inaugural high-level Bullish Kenya event on the sidelines of the UN General Assembly in New York City, highlighted Kenya’s vast potential as an investment destination.

The Bullish Kenya event on Thursday, September 25th, brought together 100+ leaders in finance, economics, and industry.

Stakeholders at the event represented over US$ 50T in assets under custody and US $300B in direct assets under management.

Top global firms at the event included JP Morgan, Bank of America, BNY Mellon, Well Fargo, Banco Santander, Barclays, and Citigroup among many others.

S

Among the attendees included Kenya’s leading decision makers from the private and public sector, who set out the country’s vast potential to grow in its the region’s financial powerhouse.

“The inaugural Bullish Kenya reception at UNGA80 was a powerful showcase of Kenya’s investment story — and global investors made it clear: they are bullish on Kenya and Africa’s capital markets,” Ambassador Philip Thigo, Kenya’s Special Envoy on Technology, who spoke at the event, said in a post-event post on X.

“I highlighted Kenya’s leadership in technology and our approach to foreign direct investment- anchored on clarity, predictability, and fairness. With a business-friendly regulatory environment and incentives spanning green energy, broadband infrastructure, fintech sandboxes, and sovereign GPU clusters, Kenya is signalling not just opportunity, but certainty,” he added.

KCB Group, which was one of the event’s sponsors, has said that it is vying to deepen its support of businesses and invested focused on the East Africa and US markets, riding on its scale across the region.

“We want to do more in facilitating cross-border trade, remittances and investments between East Africa and the US,” Paul Russo, KCB Group CEO, said, “KCB has over the years been at the center of this but we want to leverage more on our understanding of the region and footprint to boost trade and inflows. KCB sees greater prospects ahead in this space and we are on the table to partner and catalyze investments.

Still More to Come

“I'd like to give a special thank you to all of our Partners for Bullish Kenya including KenInvest, Ministry of Foreign & Diaspora Affairs, Safaricom, KCB Group, Conrad Law Advocates LLP, Nairobi Securities Exchange, and Hisa App,” WSA CEO Andrew Barden said.

“We used the word "inaugural" strategically because Bullish Kenya is not a one-and-done event. We have many future events planned over the next year with Riyadh, Nairobi, and NYC (for the 81st UNGA) already in the works! If you are keen to get involved or be there, please do not hesitate to reach out,” he added.

Learn more about the conversations at Bullish Kenya, and future events by Wall Street Africa, on kenyanwallstreet.com.

More Stories

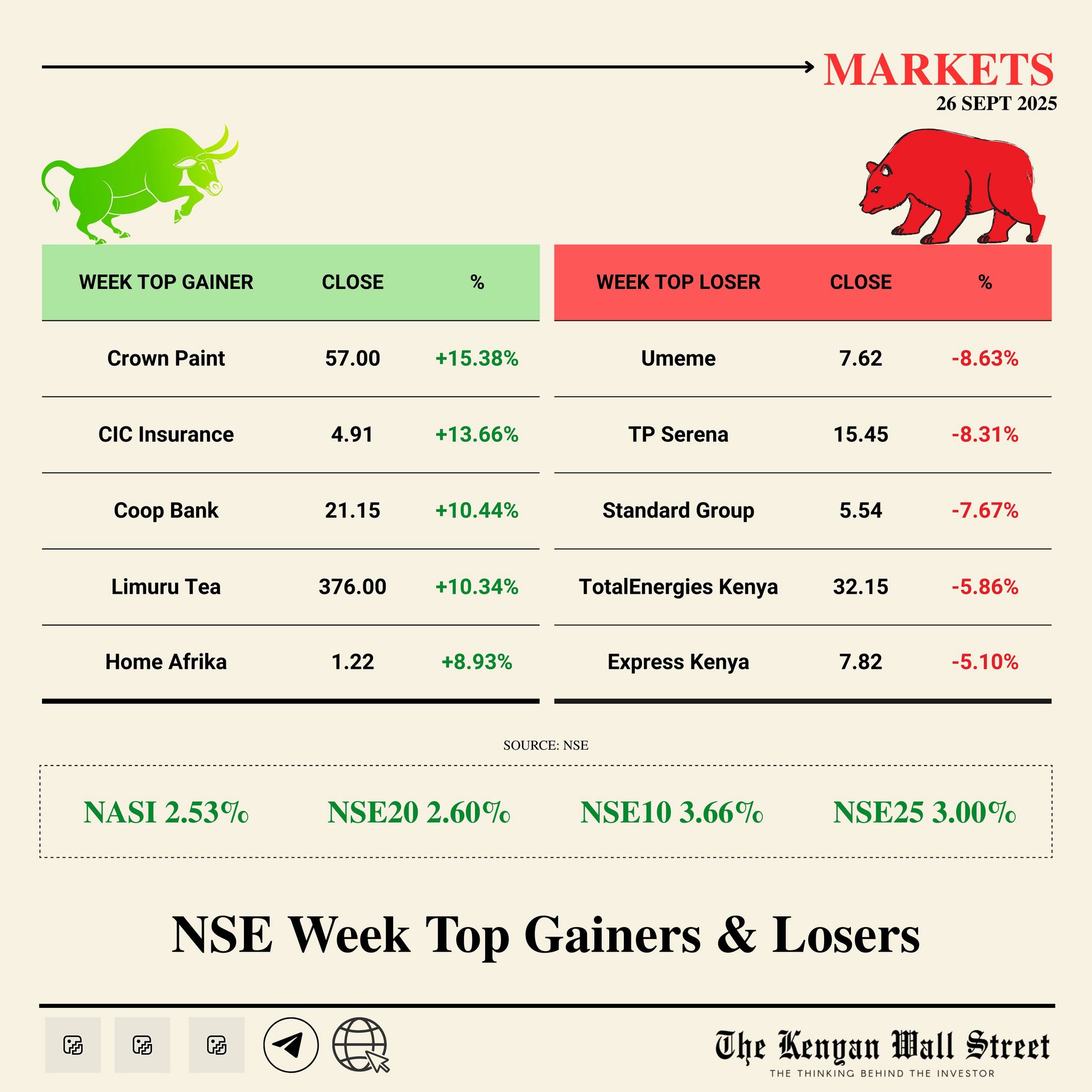

NSE Gainers & Losers Last Week

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.