- The Daily Brief, by The Kenyan Wall Street

- Posts

- Bank Profits Rebound, Bad Loans Hit 20-Year High

Bank Profits Rebound, Bad Loans Hit 20-Year High

Here's what you need to know to start your week

Direct to your inbox every Monday at 9am (EAT)

What's Inside

Bank Profits Rebound, but NPLs Rise

Kenya’s banking sector entered 2025 on a cautiously optimistic note, according to the Central Bank of Kenya’s Q1 2025 Credit Officer Survey.

While profitability rebounded and liquidity buffers remained robust, a sustained rise in non-performing loans (NPLs) continues to pose risks to asset quality.

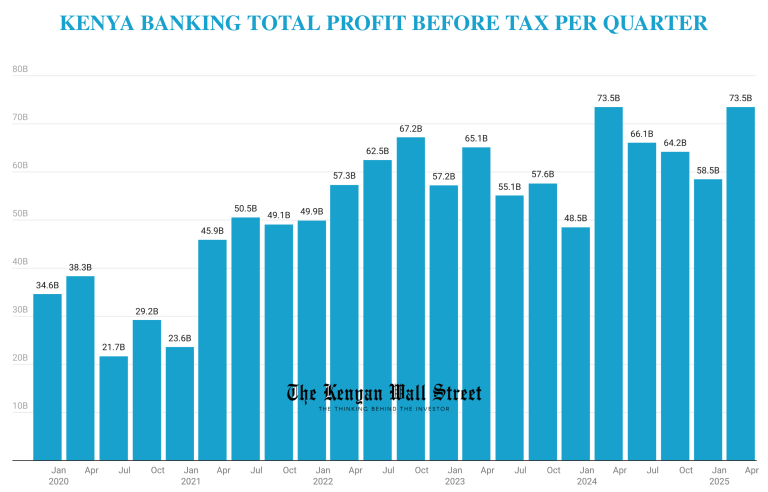

The lenders posted a profit before tax of KSh 73.5 billion in Q1 2025, up 25.8% from KSh 58.5 billion in Q4 2024.

This rebound was driven primarily by a KSh 27.6 billion cut in expenses, which outpaced a KSh 12.6 billion decline in income.

This performance ties with Q1 2024’s peak, and reflects a 12.9% year-on-year increase compared to Q1 2023 (KSh 65.1 billion), affirming the sector’s resilient earnings power amid macroeconomic uncertainty.

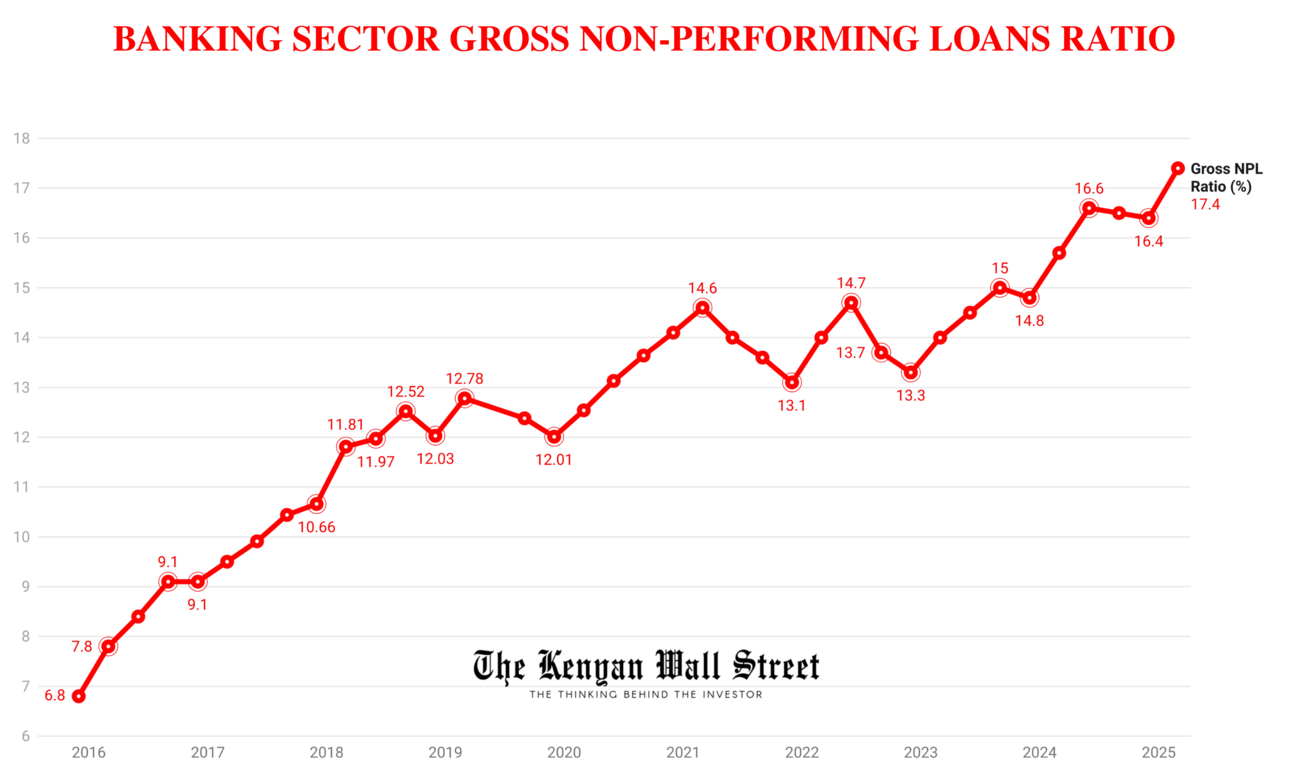

The gross non-performing loan (NPL) ratio rose from 16.4% in Q4 2024 to 17.4% in Q1 2025, the highest level in over two decades, according to data seen by The Kenyan Wall Street.

Gross NPLs increased by 6.6%, while total gross loans grew by just 0.6%, indicating rising borrower stress across several sectors.

From 6.8% in 2015 to 17.4% in 2025, the NPL ratio has more than doubled, signaling structural repayment challenges in the economy.

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.”

-Adam Smith

More Banking News

NCBA Group has reported a net profit of KSh 5.5 billion in Q1 2025, up 3% year-on-year, driven by an 8% increase in operating income and improved net interest margin at 6.1%, the highest in recent years.

Family Bank is planning to list by 2026 through introduction or failing that, issuing new shares. The lender’s Q1 2025 KSh 1.05bn represent the first time the lender has crossed the KSh 1bn mark in a quarter.

Listed lender Standard Chartered Bank Kenya has posted a 13.5% decline in net profit to KSh 4.86 billion in Q1 2025, marking its first earnings contraction in recent years.

Headlines You Might Have Missed

Insights

Interview of the Week

Have a great week!