- The Daily Brief, by The Kenyan Wall Street

- Posts

- Diageo, a final toast to EABL?

Diageo, a final toast to EABL?

Kenya's #1 newsletter among business leaders & policy makers

In today's dispatch, Diageo is weighing the sale of its East African Breweries stake in a shake-up that could redefine the region’s beer market. Meanwhile, KETRACO faces deepening financial distress after an audit flagged suspected corruption and looming insolvency.

I am Brian from The Kenyan Wall Street and this is today's edition of our daily newsletter…

Diageo Considers Selling Its East African Crown Jewel

The global drinks giant is rethinking its biggest African asset.

By Harry Njuguna

East Africa’s most famous brewer may soon change hands, as Diageo quietly reviews its stake in East African Breweries Ltd. Bankers have been called in, and early whispers suggest the price tag could make the market sit up.

Potential suitors circle, but the company is keeping its cards close.Investors and beer lovers alike are wondering what this could mean for the future of Tusker and Guinness in the region.

Diageo has been retreating from Africa, yet this move would mark its boldest step back. With earnings due this week, the market is holding its breath. Read more >>>>>

Also on Capital Markets

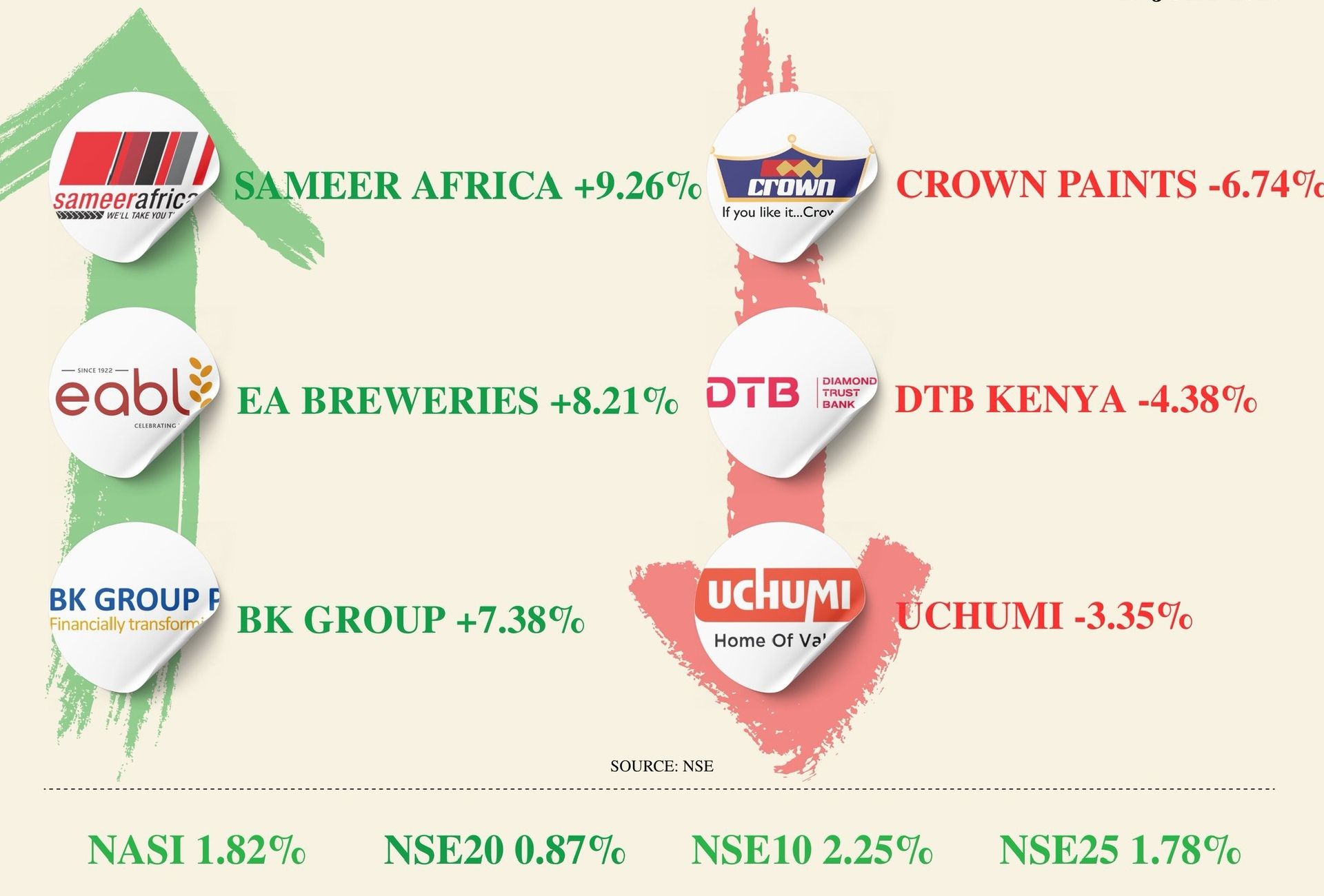

NSE Gainers & Losers

Source : NSE

KETRACO Audit Flags Corruption and Insolvency Risks

Kenya’s power grid builder is drowning in debt and mismanagement.

By Brian Nzomo

Kenya Electricity Transmission Company (KETRACO) is facing a storm after a new audit revealed suspected corruption and mounting financial trouble. Duplicate payments, murky staff loans, and stalled projects are testing the company’s ability to stay afloat. The state utility’s liabilities now outstrip its assets, with a High Court insolvency petition adding to the pressure.

Projects meant to secure Kenya’s power future remain half-built or abandoned, despite billions already spent. Management has yet to fully disclose the risks to investors or the public, deepening concerns about oversight. As demand for electricity surges, KETRACO’s crisis could become Kenya’s next big energy headache. Read more >>>>>

Canal+ Wins Green Light for MultiChoice Takeover

South Africa’s regulator approves the US$1.9 billion deal…but under strict conditions.

By Fred Obura

French media giant Canal+ has finally secured conditional approval to acquire MultiChoice Group, Africa’s largest pay-TV operator. The decision comes with strings attached, including a three-year ban on job cuts for South African employees.

Regulators also pushed for local ownership measures and a structural split of MultiChoice’s broadcasting arm to meet licensing rules. The takeover arrives as the pay-TV giant battles shrinking subscribers, rising competition, and pressure from streaming platforms.

Showmax is growing fast, but DStv and GOtv are bleeding customers across the continent. The deal could reshape Africa’s entertainment market, if Canal+ can turn a looming decline into opportunity. Read more »»»»»

Also Read

Opinion : Strengthening Africa-Caribbean Trade and Investment in an Era of Global Trade Disruption

By Benedict Oramah & Pamela Coke-Hamilton

Africa and the Caribbean are closer than they seem: culturally, commercially, and now, strategically. With bilateral trade stuck below 6% and US$2.1 billion in untapped potential, a new era of South-South cooperation is quietly taking shape. From fashion to film, from processed goods to fintech, both regions are aligning their strengths to outmaneuver global trade turbulence. But logistics, tariffs, and weak infrastructure still threaten the promise. As ACTIF 2025 kicks off in Grenada, bridging the Atlantic is on the spotlight. Click here to read the full article »»»»»

Stories you missed

♦️ Energy. Kenya’s national electricity demand hit a historic peak of 2,362.28 MW on July 23, 2025, marking the highest level ever recorded on the national grid.

♦️Narcotics. Kenya has become a major player in the continent’s illicit drug trafficking economy, with industrial-scale methamphetamine production, widespread cannabis cultivation, and an emerging threat of synthetic opioids, even as cocaine floods in from Latin America.

♦️ Telcos. Ethiopia’s leading telco Ethio Telecom capped its three-year LEAD Growth Strategy with all-time high revenues, reinforcing its dominance in Ethiopia’s liberalizing telecoms sector.

On your watchlist

In this exclusive interview, The Kenyan Wall Street Founder, Eric Asuma sits down with Marula Mining PLC CEO Jason Brewer as he unveils ambitious plans for value addition, local processing, and strategic partnerships like the landmark Baosteel deal.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.