- The Daily Brief, by The Kenyan Wall Street

- Posts

- Family Bank Shareholders Ignite the Listing Engine

Family Bank Shareholders Ignite the Listing Engine

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Happy Monday from The Kenyan Wall Street.

Today, Family Bank’s shareholders have moved the needle towards the lender’s listing next year, Little Cab faces a 1% equity stake judgement, and we’ve launched Just Money, a new podcast on the most pervasive myths in finance.

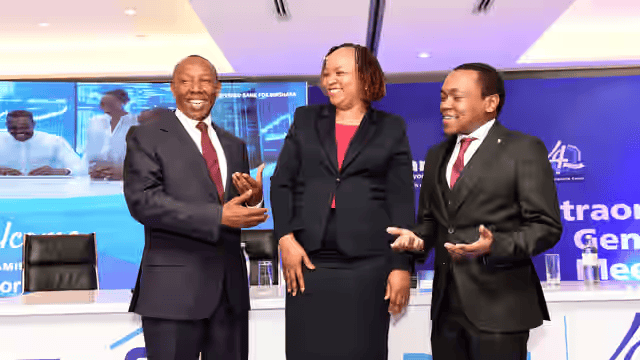

Family Bank Readies Itself for Listing

At an Extraordinary General Meeting, the shareholders approved a plan to list the lender by introduction, paving the way for submissions to regulators, including the Capital Markets Authority and the Central Bank of Kenya.

Listing by introduction means the bank’s 1.305 billion shares can begin trading publicly without issuing new shares.

This provides liquidity for shareholders while avoiding the immediate dilution of their ownership stakes that would occur if new shares were sold.

The bank’s biggest shareholders include the Kenya Tea Development Agency Holding Ltd (KTDA) 16.26%, the Estate of the Late Rachael Njeri 12.81%, and Daykio Plantations Ltd 12.14%.

Harry Njuguna explores what this means for the bank, and the markets.

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Nothing Little About This KSh 98mn Case

By Staff Reporter

In 2017, Craft Silicon fired Little Cab’s first general manager, Ronald Otieno Mahondo, after promising him a chunk of the ride-hailing company for his efforts in setting it up. But before they did that, Mahondo recorded Craft Silicon CEO promising the equity stake, and that secret audio recording has undone the ride-hailing company.

Now, an Employment court has found that Mahondo’s firing was meant to avoid paying him his due, and ordered Craft Silicon and its subsidiary, Little Ltd, to pay Mahondo his 1% stake worth KSh 97mn, and an extra million for unlawful termination. Read the full article here >>>>>

Shining on the International Stage

Elly Savatia - Winner of the 2025 Africa Prize for Engineering Innovation

By Brian Nzomo

Elly Savatia’s win at the Africa Prize for Engineering Innovation is more than a personal victory, it’s a signal that African tech is maturing beyond convenience into conscience. His AI-powered Terp 360 doesn’t just translate speech into sign language; it translates intent into inclusion. For millions who live in silence, it’s a gesture that says they were never invisible, only unheard. The £50,000 award is less about the money than the meaning; a recognition that empathy, too, can be engineered.

Read the story here »»»»»

Analysis

Confronting Child Marriage in Somalia

By Chelsy Maina

Every year in Somalia, childhoods are quietly stolen. Thousands of girls- many still in primary school- are married off before they turn eighteen. Some are barely teenagers; others, shockingly, as young as eight. Protecting girls requires not only legislation but also education, social safety nets, and sustained humanitarian relief that reduce the desperation driving early marriages. It also requires the active participation of men and community elders, voices that carry weight in dismantling harmful norms in these communities.

Read the article here »»»»»

More Stories

President William Ruto signed the much-anticipated Privatization Act 2025 on October 15th, replacing the 2005 law and creating a new framework for the sale of state-owned enterprises. Harry Njuguna breaks down what’s in the new law, and what’s up ahead for the Kenya Pipeline listing. Read More

Formalizing and scaling university foundations across Africa can unlock new streams of capital and reduce overreliance on government subventions, writes Nicasio Karani Migwi. Read More

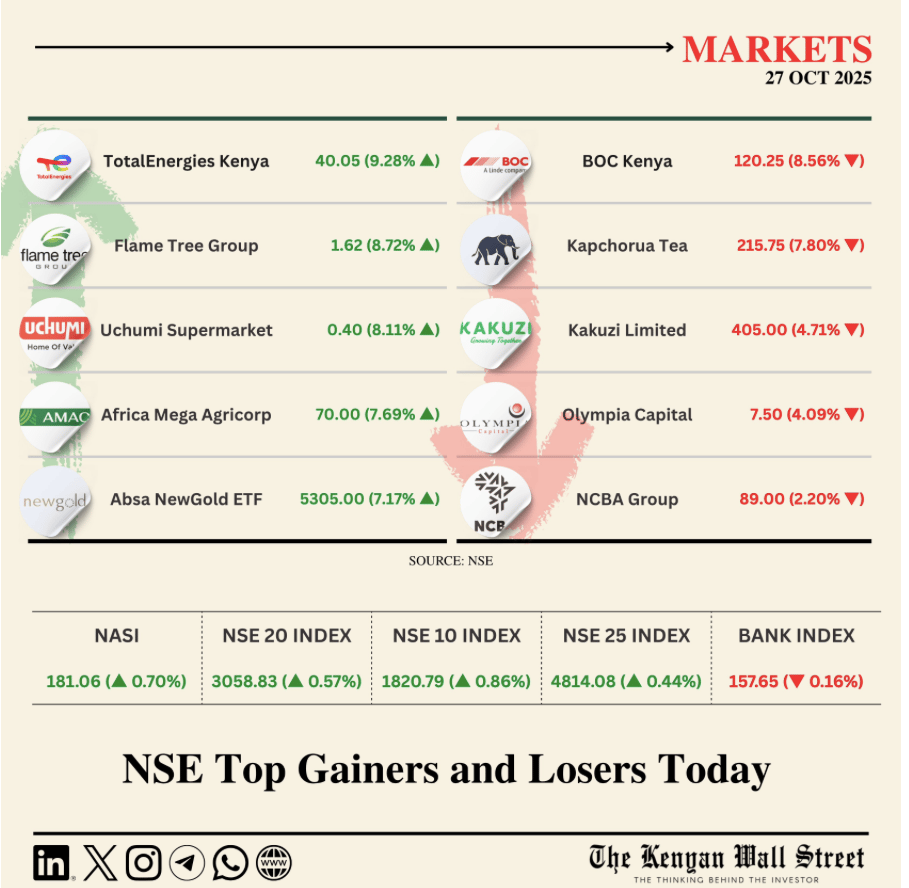

NSE Gainers & Losers

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

In the pilot episode of the Just Money Podcast, we're pulling back the curtain on the most pervasive myths in finance. Our host, Just Ivy Africa, challenges experts Bernard Nyaga (Head of Country,HFM) and Leah Wakarima (COO,HISA) on how the markets really work, who they truly benefit, and the biggest mistakes people make with their money.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.