- The Daily Brief, by The Kenyan Wall Street

- Posts

- How Stolen Meals Became the Architecture of Fraud

How Stolen Meals Became the Architecture of Fraud

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Howdy!

It's Brian from The Kenyan Wall Street…

A new week begins! Here are some top stories we lined up for you today. From a U.S fraud case with Nairobi accomplices to a new ruling from the tax tribunal that could change how you run your business…

Diana E. Murphy federal courthouse is shown in Minneapolis Friday, May 17, 2024.

How Stolen Meals Became the Architecture of Fraud

By Brian Nzomo

A young Kenyan, twenty-eight years old, has found himself at the center of what U.S. prosecutors describe as the largest pandemic-era fraud ever unearthed, a case that has already toppled reputations in Minnesota and now spills into Nairobi’s real estate corridors.

The indictment paints a portrait of a man who allegedly received bags of cash and wire transfers from his elder brother. These funds meant for hungry American children but were swiftly recast into bricks, land, and polished apartments in Kenya’s capital.

The Nairobi property market, with its opaque transactions and weak oversight, emerges in this telling as both sanctuary and accomplice, a convenient clearinghouse for wealth that could not withstand scrutiny at home.

What began as a U.S. domestic scandal has therefore taken on a distinctly international complexion, a reminder of how swiftly illicit money searches out borders porous enough to slip through. Kenya, already under the glare of global watchdogs for its shortcomings in curbing money laundering, now finds itself cast in an unwanted supporting role in America’s most notorious Covid-era theft.

Read more details here >>>>>

When Every Deposit is Taxable Income, unless…

By Brian Nzomo

When millions move through corporate bank accounts in Kenya, the taxman will assume they are income until proven otherwise. That was the lesson for Kirin Pipes, which failed to persuade the Tribunal that shareholder funds, loans, and customer pre-payments were anything more than taxable revenue. The judges said evidence must be more than schedules and unsigned agreements… and without verifiable documents, the deposits stood exposed. For other firms accustomed to informal financing and loose paperwork, the ruling signals a harsher climate where every shilling left unexplained may soon carry a tax bill. Read more here >>>>>

Less Fraud, More Fortune For Insurers

By Fred Obura

Fraud in Kenya’s insurance sector appears to be easing, even as profits surge to record highs. In the last quarter of 2024, reported scams fell sharply, suggesting that tighter oversight and new verification tools are starting to bite. At the same time, insurers pocketed a windfall from government securities, with earnings multiplying almost fourfold. The contrast between fewer fraudulent claims and swelling balance sheets points to a sector finally finding its footing after years of costly leakages. Yet the industry’s reliance on bond-driven income raises its own questions about how sustainable this golden moment will be. Read more here »»»»»

Homeboyz Entertainment: Edging Closer to a Turnaround

By Harry Njuguna

Homeboyz Entertainment trimmed its half-year losses as events rebounded, pushing revenues and gross profit sharply higher while turning equity positive.

Financial snapshot:

🔴Net loss narrowed to KSh 11.5 million, from KSh 24.5 million a year earlier.

🟢 Revenue surged 54% YoY to KSh 149.3 million.

🟢 Gross profit jumped 55% to KSh 54.3 million.

🟢 Operating deficit cut by more than half to KSh 10.4 million.

🟢Net finance costs fell to KSh 1 million from KSh 2.1M.

🟢Equity turned positive at KSh 16.1 million.

Read full financial analysis here »»»»»

PARTNERSHIP : Capital Club East Africa, The Kenyan Wall Street Sign Deal to Drive Conversations on Economics and Finance

L-R: Mebs Tejpar, Managing Director Capital Club East Africa; Andrew W. Barden, CEO, The Kenyan Wall Street

The Capital Club East Africa (CCEA), East Africa’s premier private Member’s club, and The Kenyan Wall Street (TKWS), Kenya’s fastest-growing news media brand for business and finance, have signed a strategic partnership to table the conversations that inform the decisions necessary to enhance Kenya’s economy. The two institutions will leverage their synergies in support of each other’s missions. This will include co-branded events such as closed-door roundtables and themed networking sessions. Read about it here »»»»»

This partnership with The Kenyan Wall Street underscores our role as a trusted convening hub for decision-makers—creating curated platforms where leaders engage, ideas take root, and translate into the policies, investments, and innovations that will define Kenya’s economic future and sustained prosperity.

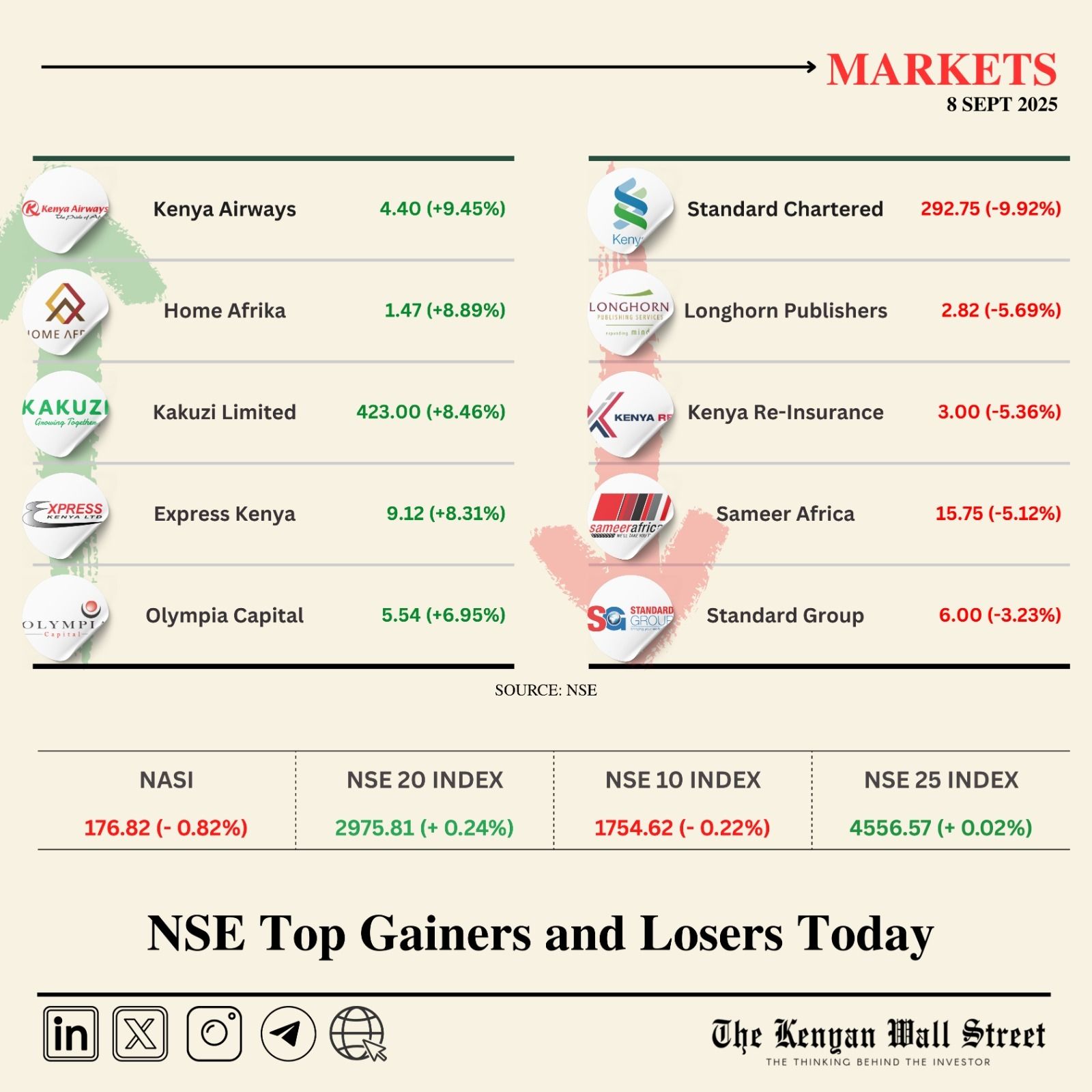

NSE Gainers & Losers

Source : NSE

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Insight

Why is Africa’s Private Equity Market Capturing Less than 1% of GDP in Deal Volumes?

By Chelsy Maina

Private equity in Africa is still diminutive, even as the continent brims with startups and restless capital. While Europe’s deal volumes soar, Africa’s barely register against its GDP weight. The reasons are familiar : thin capital markets, shaky exits, politics that rattle nerves… but they don’t fully explain the stubborn gap. Experiments like Boost Africa show what catalytic money can do, nudging risk-averse investors into markets they once ignored. The question is whether those sparks can ignite fast enough to match the scale of Africa’s demographic tide. Read more here »»»»»

Also Read

On Your Watchlist

Stories you missed

♦️ Economy. Kenya’s domestic debt burden has deepened sharply, with servicing costs crossing the KSh 1 trillion mark for the first time.

♦️Insurance. Listed reinsurance company Kenya Reinsurance Corporation Ltd (Kenya Re) has suspended its managing director, Dr. Hillary Maina Wachinga, for 21 days.

♦️Graft. The Office of the Director of Public Prosecutions (ODPP) intends to withdraw corruption charges against former Migori governor Okoth Obado after securing the forfeiture of assets valued at KSh 235 million.

♦️Startups. Tanzanian fintech, NALA, is leaning on Equity Bank and Pesalink to speed up its entry into Kenya.

♦️Labour. The Supreme Court has dismissed Standard Chartered Bank Kenya’s appeal in a pension dispute with 629 former employees.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.