- The Daily Brief, by The Kenyan Wall Street

- Posts

- Is WPP Scangroup On its Death Throes?

Is WPP Scangroup On its Death Throes?

Kenya's #1 newsletter among business leaders & policy makers

In today’s newsletter : WPP Scangroup’s slow-motion collapse exposes cracks in Kenya’s creative economy, while Energy CS Davis Chirchir turns to fuel levy securitization to cover mounting government bills.

I am Brian from The Kenyan Wall Street and this is today's edition of our daily newsletter…

WPP Scangroup : Inside the Slow Collapse of an Ad Powerhouse

Kenya’s biggest ad firm is bleeding talent, losing clients, and betting its future on a fresh CEO search.

By TKWS Team

Kenya’s top advertising firm is in turmoil. WPP Scangroup has lost its CEO, its biggest clients, and much of its creative and tech talent in just over a year.

Insiders blame a series of costly missteps, from botched mergers to leadership mismatches and abrupt restructuring. The company’s pivot away from digital tools like Optimus, once a rising star, has left it trailing competitors. At least seven new agencies now run by ex-Scangroup staff have seized market share, including former long-term accounts like KCB and Airtel.

Legal battles, a leadership vacuum, and shareholder anxiety have deepened the crisis. Its stock has plunged from KSh 70 a decade ago to just KSh 1.80. The search for a new CEO is on, but many are asking whether there's still a business left to save. Full story here »»»»»

“It is True! We Securitized the Fuel Levy.” - Roads Minister

How a portion of your pump price was turned into instant cash, no debt recorded, no Parliament vote, just another day in public finance

By Brian Nzomo

Roads And Transport CS, Davis Chirchir

The government has confirmed it raised KSh175 billion by securitizing part of the fuel levy, specifically KSh 7 out of every litre you pay at the pump.

No new loan on the books, no vote in Parliament, just a Special Purpose Vehicle quietly turning future taxes into fast cash. Roads CS Davis Chirchir insists it was done by the book, while Treasury CS John Mbadi says it’s old news, though most Kenyans only found out last week.

Fuel prices, meanwhile, jumped nearly KSh 9 per litre, sparking fresh questions about how much of the cost is tax versus global trends. Officials deny any link, but with over KSh80 of every litre going to levies, the numbers speak loudly. Click to read full article »»»»»

Editor's Picks

🛣️ Back on Track : The Rironi-Mau Summit Highway

By Brian Nzomo

Two Chinese firms step up for Kenya’s delayed toll highway, angling to replace a cancelled French deal that cost taxpayers billions. But they are not alone. A third company, Multiplex Partners, awaits approval of its bid. The Rironi–Mau Summit road project, once derailed by unsustainable terms, is back on track, with a toll model that could pinch motorists. Construction begins in August. Read more »»»»»

🍚 The Awaited Reforms : The Sugar Levy Takes Flight

By Fred Obura

Sugar prices are set to rise as a 4% levy quietly took effect on July 1, reshaping the cost structure for both millers and importers. The revived Kenya Sugar Board is back in the driver’s seat, promising reform, oversight, and research, but not without new bureaucracy. Consumers may end up footing the bill as factories pass along the pain. Meanwhile, the Kenya Revenue Authority sharpens its pencil ahead of the first levy deadline. Read more »»»»»

Capital Markets

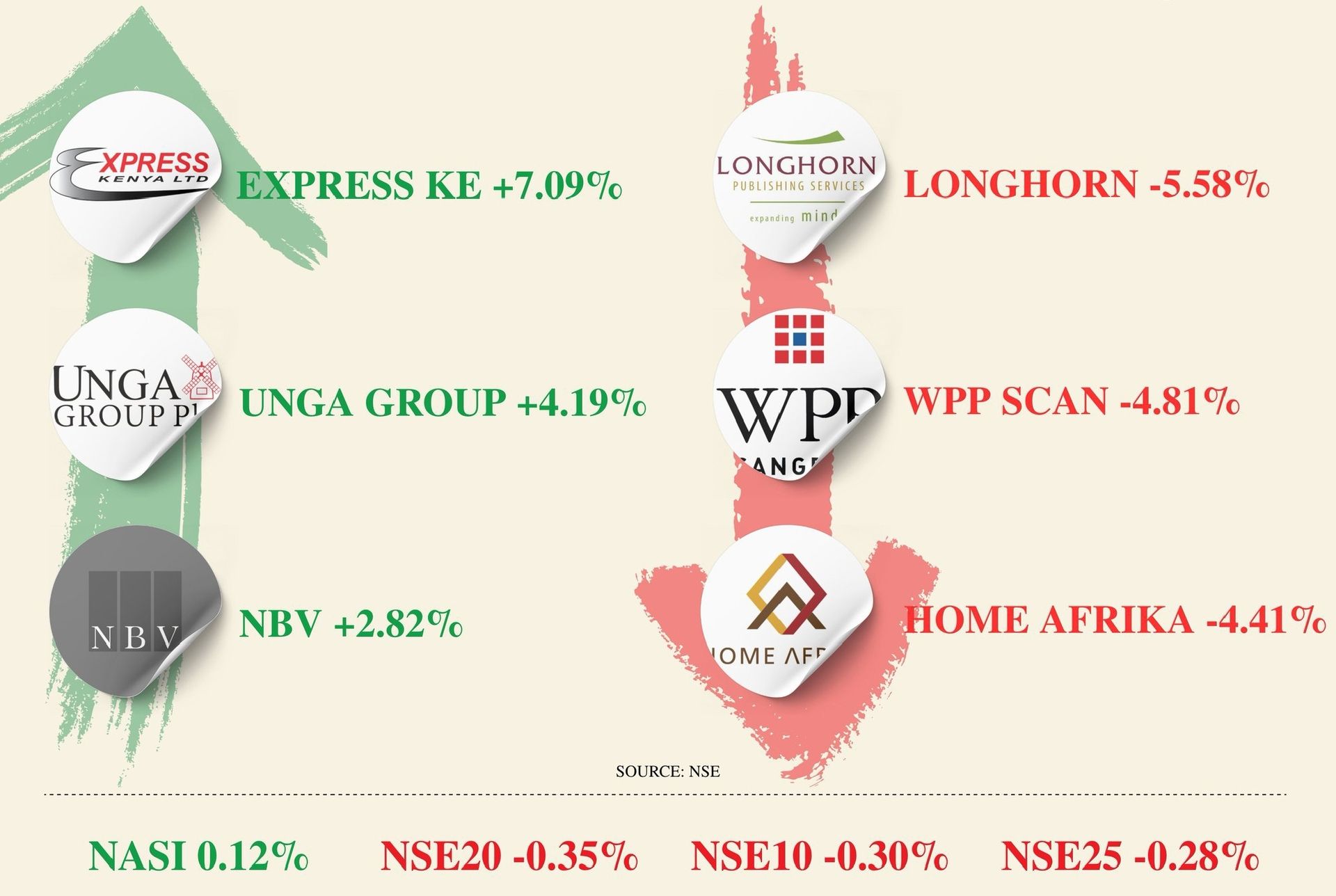

📉 The NSE Rally Takes a Pause

By Harry Njuguna

The Nairobi Securities Exchange (NSE) took a measured step back after months of heady gains, with profit-taking pulling the NASI from its recent peak. The index rose slightly on July 16, halting a five-day slide that investors saw less as panic and more as prudent exhalation.

Year-to-date, the bourse is still basking in a 27.6% gain, its strongest rally in over a decade, fueled by a sweep of broad-sector momentum and a clutch of out-performers like Kenya Power and Sameer Africa. But beneath the buoyant numbers, the question shifts to whether upcoming earnings will sustain this optimism or invite fresh caution. Read more here »»»»»

NSE Gainers & Losers

Source : NSE

Opinion

⛱️ 🧳 Zanzibar, Bali, and the Real Test of Tourism

By Henok Assefa

Zanzibar and Bali. Two islands, both blessed with beauty and history, yet only one has turned paradise into power. While Bali mastered the art of cultural branding and strategic tourism, Zanzibar still drifts in a sea of potential without a compass. The real question isn’t about tourist arrivals, but who owns the upside and who merely serves it. Can Zanzibar leapfrog the mistakes of others and craft a future that locals own? Read more »»»»»»

What you missed…

On your watchlist

This week, TKWS founder Erick Asuma sits down with Former WPP Scangroup veteran Sandeep Madan, Co-founder & CEO of The Partnership Africa

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.