- The Daily Brief, by The Kenyan Wall Street

- Posts

- KCB Group to Make KSh 14.16bn from National Bank Sale

KCB Group to Make KSh 14.16bn from National Bank Sale

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Access Bank Budgets US$109.6bn to Complete National Bank of Kenya Deal

Access Bank will pay KCB Group US$109.6 million (~KSh 14.16bn) to complete the acquisition of National Bank of Kenya (NBK) PLC, its Q2 report shows.

Access Bank stated in March 2024 that it would buy National Bank of Kenya (NBK) from KCB Group for about $100 million, which is 1.25 times NBK’s book value.

Access Bank is Africa’s largest lender by customer base, serving over 60 million customers across 24 markets on three continents throughout more than 700 branches and service outlets.

Its operations span Nigeria, Ghana, Rwanda, Zambia, Mozambique, Botswana, and the DRC, and it has branches in the UK and UAE, as well as representative offices in China, Lebanon, India, Paris, and Hong Kong.

Access Bank already has a presence in Kenya after it acquired Transnational Bank. The Nigerian lender plans to integrate NBK gradually. It will align systems, harmonize products, and unify teams to enhance the customer experience.

With the acquisition of 100% of NBK, its second after acquiring and rebranding Transnational Bank, Access Bank strengthens its footprint in Kenya, and moves it to Tier II status. The deal had stalled after the Central Bank of Nigeria raised concerns about Access Bank’s exposure in other markets, particularly the DRC, where the bank’s subsidiary was not in compliance with local laws.

The deal is guaranteed by the African Export-Import Bank (Afreximbank) to a maximum guarantee amount of US$ 89.5 million.

Property Developers Chart the Future of Kenya's Real Estate Sector

By Lulu Kiritu

A few weeks ago, different players in the real estate industry gathered in Westlands to discuss and dissect issues related to sustainable design, decentralized infrastructure management, and the institutionalization of developers to unlock affordable capital.

The ensuing discourse swirled around domestic macroeconomic pressures and global dynamics affecting investment into East Africa, structural weaknesses in planning, approvals, and corporate governance. It also included practical technologies and high-quality material standards crucial for modern construction, capital mobilization, and the preferred development model for managing Kenya’s rapid urbanization.

Read the story here »»»»»

Opinion

Formal Foundations Would Unlock New Capital for Africa's Universities

By Nicasio Karani Migwi

Kenya’s public universities are grappling with a combined debt burden of KShs 72.37 billion as of March 2025, according to the Controller of Budget.

Proposed remedies include taxpayer bailouts, university infrastructure bonds, donor and DFI loans, commercialization of research, and revived income-generating programs. However, one of the most sustainable and globally proven solutions lies in strengthening university foundations, vehicles that mobilize resources and manage endowment funds with transparency and strategic foresight.

Read the article here »»»»»

More Stories

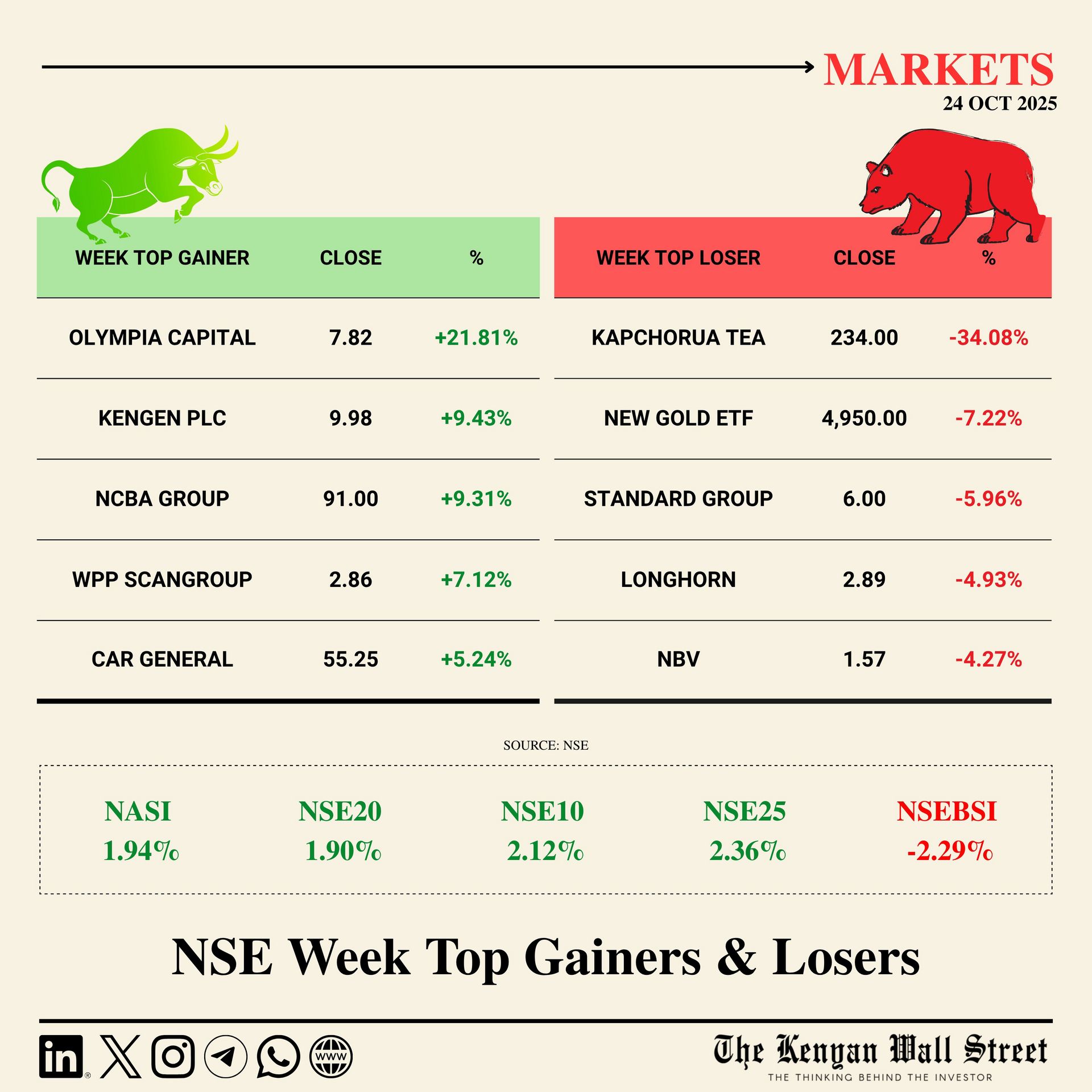

Last Week in Markets

More News to Kickstart Your Week

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.