- The Daily Brief, by The Kenyan Wall Street

- Posts

- Kenya Pipeline Listing : Shares go for Nine Shillings

Kenya Pipeline Listing : Shares go for Nine Shillings

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, the government has decided to list over 11 billion shares in the NSE this March. Here is how it plans to do that…

Also…Kenyan forex buffers are looking better than they did in early 2024. Is this a sigh of relief, or a mirage of stability?

This and more in today's newsletter edition…

By Harry Njuguna

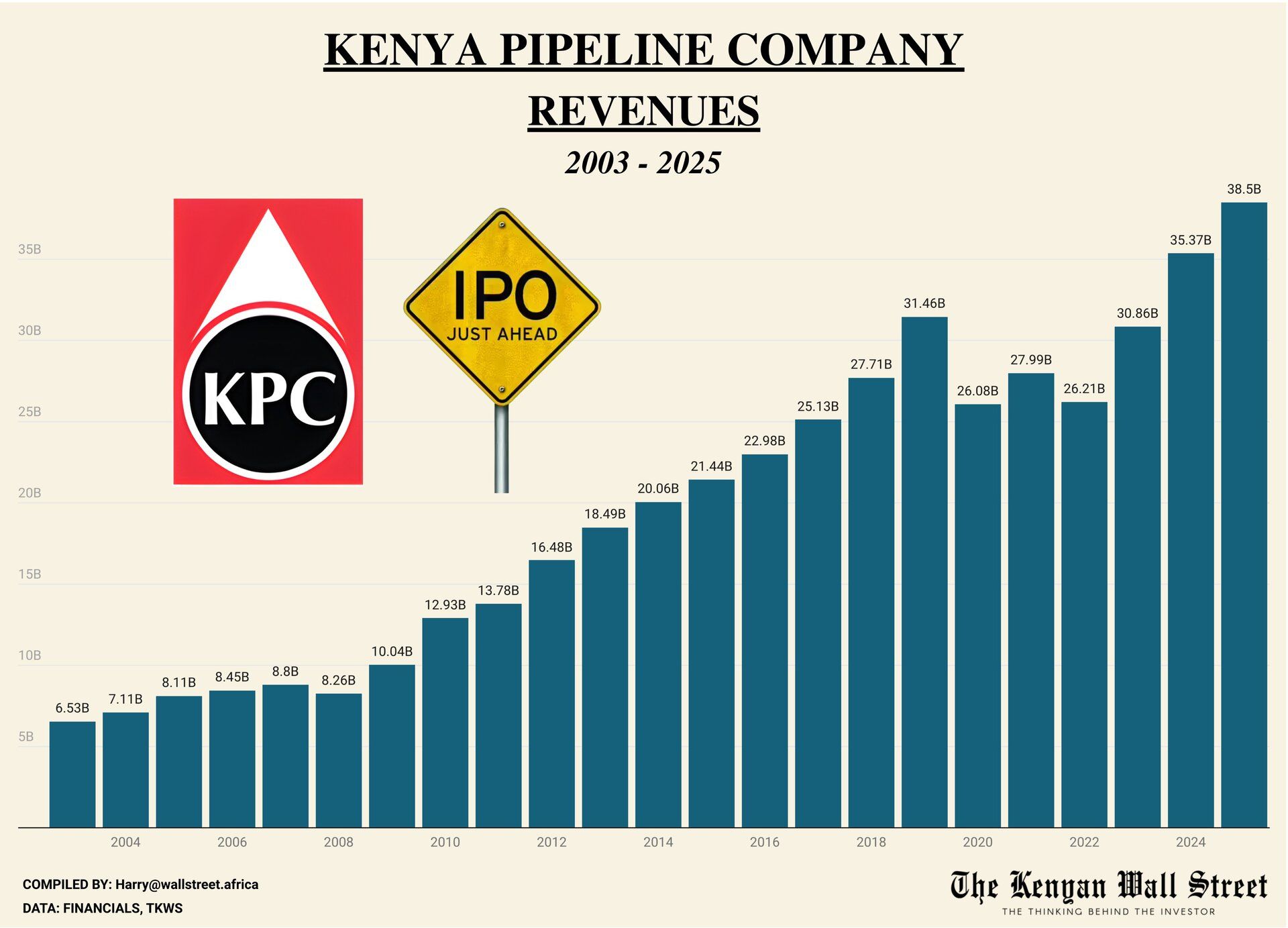

Revenues posted by Kenya Pipeline over the years | SOURCE : KPC Financial Results

Kenya is about to offer its citizens a rare chance to own a slice of its most strategic energy artery, the Kenya Pipeline Company, through a KSh 163.6 billion initial public offering. At KSh 9 per share, the government is divesting 65% of its stake, yet retains a controlling 35%.

The IPO has been pitched as a gateway for ordinary Kenyans to participate in a blue-chip infrastructure asset, but the true appeal is to institutional investors who can stomach an EV/EBITDA multiple of 8.1.

Meanwhile, KPC’s balance sheet is fronted as immaculate; debt-free, cash-generative, and a consistent dividend payer but the broader market’s appetite will test whether fiscal strength translates into retail enthusiasm.

Meanwhile, the NSE prepares to host what may be its largest IPO in recent years. Trading of shares at the exchange is expected to begin in March.

Read the full article here >>>>>

The Monetary Breathing Room

By Harry Njuguna

Kenya’s foreign-exchange reserves have swelled to a record KSh 1.61 trillion, a figure that signals not exuberance but a carefully rebuilt sense of monetary self-control. After flirting with scarcity in early 2024, the CBK has methodically stockpiled dollars, buying time and credibility in a region where both are often in short supply. Much of the hard currency has arrived through remittances, tourism receipts, and fewer urgent debt payments rather than from any dramatic export renaissance. The result is a currency market that looks calmer not because risks have vanished, but because they have been deferred.

Read the full article here >>>>>

Where Banks have no money

By Brian Nzomo

Equity Bank

Equity Bank’s standoff in Juba, South Sudan reveals what happens when banking continues after money has effectively disappeared. A threatened lawsuit over inaccessible deposits shows how commercial banks are being forced to manage political failure at the teller’s window. With cash rationed to symbolic amounts, banks are left holding liabilities that cannot be honoured, while the state deflects blame. The dispute is not about customer service or compliance, but about whether a functioning banking contract can survive without liquidity. In South Sudan, even the region’s strongest banks now operate inside an economy where trust has outpaced cash.

Read the full article here >>>>>

OPINION : Why the Global Payments Race Is Pushing Banks Toward PayTech Acquisitions

By Nicasio Karani Migwi

Payments have become the main arena of financial power, not a supporting function. Banks are acquiring paytechs because whoever controls transaction flows controls liquidity, data, and customer behavior. Mobile money platforms, super apps, and big tech have forced banks into a defensive war they can no longer fight with legacy systems. Buying payments infrastructure is now the fastest way to secure systemic relevance and protect low-cost funding. Those that hesitate will not merely lose market share, but they will lose their place in the financial system.

Read the opinion piece here »»»»»

Heads Up

Briefs

💡 The Energy and Petroleum Regulatory Authority (EPRA) has announced new electricity tariff adjustments for January 2026, adding a fuel energy cost charge of 326 Kenya cents per kWh, a foreign exchange adjustment of 178.53 cents per kWh, and a WARMA levy of 1.38 cents per kWh.

📬 The Postal Corporation of Kenya (POSTA) has applied to the Communications Authority of Kenya (CA) for approval to revise private letter box and bag rental fees, citing higher service delivery costs.

💸 The transaction volumes on the Kenya Electronic Payment and Settlement System (KEPSS) rose to 9.8 million messages valued at KSh 46.6Trn in FY2024/25, up from 8.2 million messages worth KSh 43.1Trn in FY2023/24.

🌐 The World Bank has committed US$ 43Mn, equivalent to KSh 5.5Bn, to support a Green Investment Fund aimed at expanding financing for Kenyan small and medium-sized enterprises.

🇺🇲 OpenAI said it will begin testing advertisements on the free version of ChatGPT for logged-in adult users in the United States.

Partner Content

Is Crypto Uniquely Positioned as an Alternative Investment?

Wealthy investors are increasingly looking beyond traditional assets to diversify their portfolios. Among the expanding universe of alternative investments, cryptocurrency stands out for offering advantages that few others can match. Read more here

On your Watchlist

Snapshot

CBK Usable foreign reserves from 2014 to 2026 | SOURCE : CBK

Source : NSE

Today in History

Former Kenya Vice-President Moody Awori, Energy Minister Kiraitu Murungi, and former Finance Minister David Mwiraria were formally cleared of any wrongdoing in the Anglo Leasing scandal, ending a high-profile probe into one of the country’s largest government procurement controversies.

Last Friday’s Poll Results

Do you believe that some companies in Kenya are strategic assets that cannot be privatized or listed in exchanges?

🟩🟩🟩🟩🟩🟩 Yes (78%)

🟨⬜️⬜️⬜️⬜️⬜️ No (22%)

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.