- The Daily Brief, by The Kenyan Wall Street

- Posts

- Kenya’s Loan Rates Get a Makeover

Kenya’s Loan Rates Get a Makeover

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, the new credit pricing model begins today. We highlight what it means for the banking sector.

This and more stories in today's edition…

Kenya’s Loan Rates Get a Makeover, But Will Borrowers Benefit?

By Chelsy Maina

Today marks the rollout of Kenya’s revamped Risk-Based Credit Pricing Model, tying loan costs directly to KESONIA, the nation’s overnight interbank rate. By separating the reference rate from individual bank premiums, the system promises clearer pricing and a faster response to monetary policy moves, like the potential CBR cut next week. Banks must now publish full loan costs online, aiming for transparency that investors and borrowers have long demanded. While existing loans will only adjust from February, the new framework signals a shift toward global-standard lending practices and disciplined credit markets. Yet, whether this reform truly unlocks affordable credit or simply reshuffles the numbers remains an open question.

Read the article here >>>>>

French Dermo-Cosmetics Set Sights on Nairobi

By Fred Obura

France’s Pierre Fabre has officially stepped into Kenya’s skincare scene, signaling that the country’s dermatology-led market is no longer a niche, but a battleground for global and local brands alike. With Nairobi emerging as East Africa’s dermatology hub, multinationals see an opening among health-conscious consumers seeking clinically validated, science-backed solutions. Established players like Nivea and La Roche-Posay, along with minimalist ingredient-led brands, provide both competition and a glimpse into evolving consumer tastes. Fabre’s arrival is less about mere beauty products than about staking a claim in the region’s rapidly lucrative skincare landscape.

Read the article here »»»»»

NBV Narrows H1 Losses

By Harry Njuguna

Nairobi Business Ventures (NBV) has narrowed its half-year loss, relying on aviation to offset pressure from sluggish trading and margin compression.

Financial Snapshot:

🔴 Sales fell sharply to KSh 137.5 million from KSh 280.5 million.

🔴 Loss after tax narrowed to KSh 78.3 million from KSh 99.0 million as management cut operating costs and paused underperforming trading lines.

🟢 Aviation, led by Air Direct Connect, remained the only growth pillar.

🟢 Total assets rose modestly to KSh 3.33 billion, while total equity stood at KSh 1.82 billion.

🟢 Management plans a gradual scale-up of trading and is exploring real estate opportunities on Delta Cement’s 28-acre parcel to diversify revenue streams.

Read the full financial analysis here >>>>>

Speaker Wetangula's Defamation Suit Paused

By Brian Nzomo

A decade-long defamation saga involving National Assembly Speaker Moses Wetangula and the BBC has been paused by the Court of Appeal. At the heart of the dispute lies a 2015 documentary alleging Wetangula received bribes from British American Tobacco (BAT), a claim he vehemently denies. The BBC’s attempt to secure foreign evidence has now been recognized as raising real legal questions under Kenyan law. Judges ruled that proceeding without resolving access to this material could unfairly tip the scales, effectively freezing the trial.

Read the full story here »»»»»

Happening this week

Visit our new website here to get updated on this story and others…

OPINION: Tanzania's Excise Duties on Imports Risk EAC Trade Integration

By Dr. Kirimi Wanjagi

Tanzania’s recent excise duties on imports from fellow East African states have stirred a familiar unease along the region’s borders, as trucks idled for hours while commerce caught in the crossfire. What looks like a routine fiscal tweak may test the very promise of East African integration, highlighting how fragile the ideal of a seamless single market can be. Legal precedent from Kenya shows that the East African Court of Justice is willing to step in when national policies threaten regional trade, though politics often complicate swift resolution. The coming weeks may reveal whether the region’s legal mechanisms can uphold the common market, or whether protectionist instincts will quietly chip away at the EAC’s long-standing vision.

Read the full article here >>>>>

Is Bitcoin a safe haven from market turmoil? There's no definitive answer- not yet. Sometimes it acts like one; most of the time, it doesn’t.

~ Apollo Sande, Country Manager for Luno Kenya.

Read more here »»»»»

On December 4–5, Latitude59 Kenya brings together founders, investors, operators and ecosystem builders for two days of real insight not hype. Expect candid discussions on what it truly takes to build sustainable, revenue-driven companies, practical workshops led by top experts, and masterclasses you can apply immediately.

Plus, the Top 10 startups selected from 222 applicants will pitch live on stage for the 2025 title. If you’re building, investing, or shaping the future of tech in Africa, you cannot afford to miss this.

Grab your ticket here »»»»»

More Stories

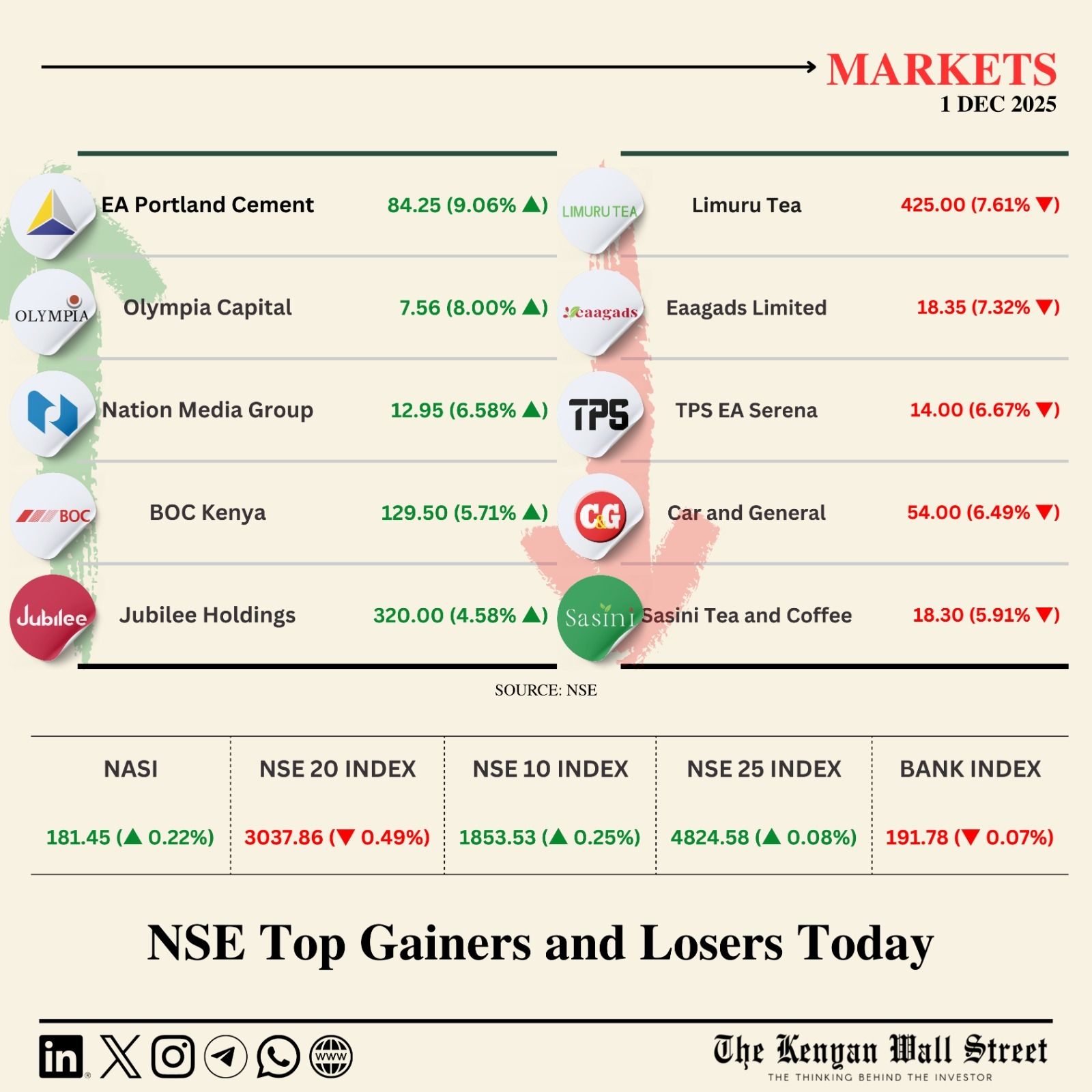

On Your Watchlist

Scared money doesn't make money!

In the sixth episode of the Just Money Podcast, our host Just Ivy Africa, sits down with John Collins Mbugua, Senior Analyst at Faida Investment Bank, and Ronny Chokaa, Senior Research Analyst at Capital A Investment Bank, to dispel the myth that investing is only for the wealthy.

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»