- The Daily Brief, by The Kenyan Wall Street

- Posts

- Selling the Brewery

Selling the Brewery

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, the biggest shareholder of EABL has decided to offload its stake to a Japanese company. What's up?

Also, a new report by the Controller of Budget shows that counties are still allocating insignificant portions of their revenues to development.

Selling the Brewery

By Harry Njuguna

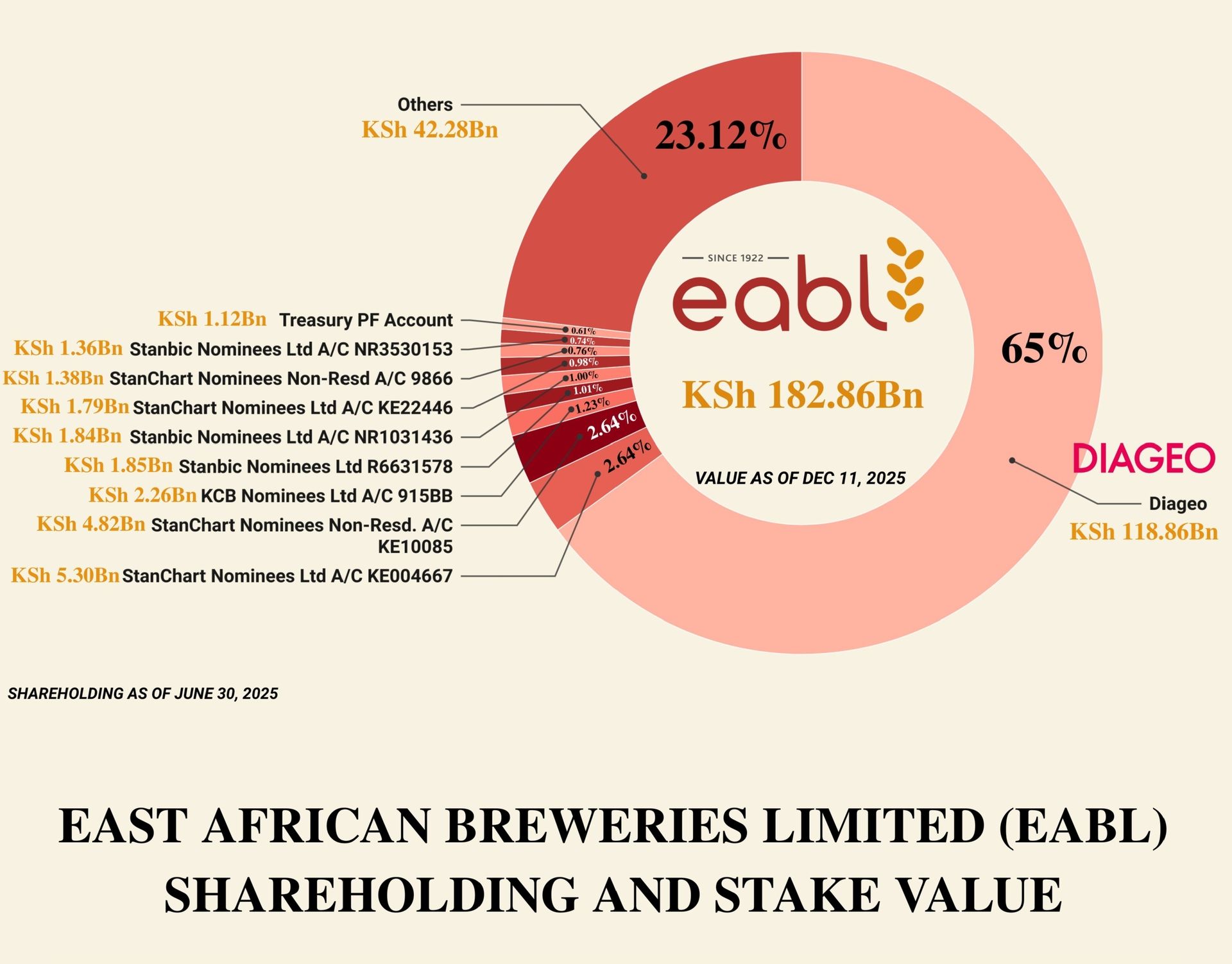

Diageo’s decision to sell its controlling stake in East African Breweries to Japan’s Asahi Group Holdings marks a quiet but consequential shift in the ownership of one of East Africa’s most culturally embedded companies. The transaction values EABL at an implied US$4.8 billion, a price that reflects not just market dominance but the long-held belief that the region’s young, urban population will keep drinking more.

For Diageo, the sale is a balance-sheet exercise, yielding about US$2.3 billion in net proceeds and trimming leverage. For Asahi, it is something rarer: a decisive entry into Africa through a market leader rather than a tentative experiment.

Snapshot

The deal transfers Diageo’s entire holding in Diageo Kenya Limited, which controls 65% of EABL, along with its direct stake in UDV Kenya. Yet Diageo is not fully departing. Through long-term licensing and transitional agreements, Guinness and selected Diageo spirits will continue to be produced and distributed locally, while Tusker and other homegrown brands remain under EABL ownership. Regulatory approvals are still pending, with completion expected in the second half of 2026.

Spending nothing on development

By Brian Nzomo

County governments opened the 2025/26 financial year with a theatrical pause on development, spending just KSh 3.69 billion on capital projects in the first quarter, a mere 2% of their annual development budget.

Twenty counties did not spend a single shilling on development at all, effectively freezing new projects while budgets on paper continued to promise roads, clinics, and markets. The result was a familiar early-year ritual in Kenya’s devolved system: projects deferred, timelines compressed, and the seeds of inefficiency quietly planted for later in the fiscal year.

What moved instead were salaries. Recurrent expenditure reached KSh 51.47 billion in the quarter, accounting for 93% of total spending, with employee compensation alone swallowing nearly four out of every five shillings. Counties, once envisioned as engines of local development, increasingly resemble payroll administrators, keeping bureaucracies running while capital investment waits on procurement processes, cash flow, or unresolved pending bills.

The imbalance was compounded by weak own-source revenue collection. Counties raised just KSh 13.94 billion against an annual target of KSh 93.89 billion, leaving little room to maneuver as arrears and pending bills climbed to KSh 156.23 billion and KSh 177.46 billion respectively.

Briefs

🤝Airtel Money has integrated with Showmax, allowing customers to pay for streaming subscriptions directly from their mobile wallets. The service lets users subscribe, renew, or activate Showmax packages without leaving the platform. Airtel Money said the integration offers a faster and simpler payment option for customers seeking direct access to digital entertainment services during the festive season.

📡 Airtel Africa has partnered with SpaceX to deploy Starlink’s direct to cell satellite technology across its 14 African markets. The company said the satellite to mobile service will begin in 2026, starting with text messaging and data for selected applications. Airtel Africa said customers with compatible smartphones in areas without terrestrial network coverage will connect directly through Starlink satellites.

📱🪙 Financial technology firm Tala plans to issue US$50M (KSh 6.47Bn) in credit through USDC, a dollar backed stablecoin, to support blockchain based lending. The company said the facility will fund permissionless lending for millions of customers globally. The tokenized platform targets underbanked borrowers and will operate on the Solana blockchain with liquidity support facilitated through Huma Protocol.

Exiting KQ Group MD Allan Kilavuka

✈️ Kenya Airways said Group MD and CEO Allan Kilavuka has exited after proceeding on terminal leave, about a month after the airline issued a profit warning. The board appointed COO Captain George Kamal as acting CEO with effect from 16 December 2025. Kenya Airways said the turnaround plan remains on track as the board starts a search for a substantive CEO.

OPINION : Trump’s 50-Year Mortgage Idea, A Kenyan Analyst Weighs In

By Ken Tobiko Oidamae

President Donald Trump’s pitch for a 50-year mortgage promises cheaper monthly payments, but it risks making homeownership far more expensive over a lifetime. While stretched repayments lower monthly strain, total interest costs explode, doubling the burden for borrowers who may be paying well into old age. For lenders, the ultra-long tenor introduces massive credit, interest-rate, and asset-liability mismatch risks that few institutions can comfortably absorb. For Kenya, where similar debates about long-tenor mortgages are emerging, the real solution likely lies in fixing land, supply, and approval bottlenecks; not in stretching repayment timelines to the breaking point.

Read this article here >>>>>

On your watchlist

Visit our new website here to get updated on this story and others…

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

The ‘Daily Brief’ breaks for the festivities. We appreciate your valued readership over the year. When we resume next year, we shall continue to beam your evenings with insightful business news and groundbreaking analysis.

From the team at the Kenyan Wall Street and Wall Street Africa, we wish you a Merry Christmas and a Happy New Year 2026.