- The Daily Brief, by The Kenyan Wall Street

- Posts

- Shortening the Leash

Shortening the Leash

Kenya's #1 newsletter among business leaders & policy makers

I am Brian from The Kenyan Wall Street…

In today's newsletter edition, we look at the new law that wants shorter terms for directors in Kenyan road agencies and why there is concern that roles are overlapping.

ABSA Bank has posted its half-year financial performance and we sat down with a VC partner who told us why African startup funding is on the lag.

Shortening the Leash : Road Agencies and Overlapping Roles

A new law cuts agency heads’ terms as fierce battles over control of Kenya’s roads intensify.

By Fred Obura

Kenya’s road agencies are caught in the eye of a political storm as a new law slashes the terms of their director generals from five years down to just three, renewable once. But this is more than a simple administrative change…

It’s part of a broader power play between national authorities and county governments, each eager to control the billions flowing through the Roads Maintenance Levy Fund. Long-standing agencies like KURA and KURRA, once champions of infrastructure, now face calls for disbandment amid claims they’ve outlived their usefulness in a devolved government system.

High-profile leaders have weighed in, igniting a fierce debate over who truly owns Kenyan roads. As the dust settles, the future of the country’s transport backbone hangs in the balance. Read more here >>>>>

Banking & Credit

Absa Bank Reports 9% Profit Rise in H1

By Chelsy Maina

Absa Bank posted a 9.05% increase in half-year profit, helped by better asset quality and stronger non-interest income. While net interest income faced slight margin pressure, growth in payments, forex, and advisory fees bolstered the bottom line.

Here is how the bank performed…

🟢 Profit after tax rose 9.05% to KSh 11.68 billion in H1 2025.

🟢 Net interest income dipped 1.76% to KSh 22.34 billion.

🟢 Non-interest income jumped 13.72% to KSh 9.12 billion.

🟢 Loan loss provisions fell sharply by 37.9% to KSh 3.2 billion.

🟢 Total assets grew 10.42% to KSh 531.6 billion, with customer deposits up 2.27% to KSh 361.3 billion.

Absa’s focus on digital transformation and cost control sets the stage for steady growth despite a competitive market. Read the full financial analysis »»»»»

Consolidated Bank : A Return to Profit Territory

By Chelsy Maina

Consolidated Bank of Kenya has flipped its script, posting a modest profit after years in the red, but the celebration is tempered by a yawning capital deficit that refuses to shrink. Improved interest income and tighter cost control suggest operational strides, yet the bank still struggles to meet regulatory capital thresholds; casting a long shadow over its future. Liquidity is strong and customer deposits are inching upward, but the weight of non-performing loans threatens to stall growth. Behind the numbers lies a story of cautious optimism balanced precariously against structural weaknesses. The government’s promised capital injections may be the lifeline, but whether it will be enough to sustain the bank’s revival remains to be seen. Read more here »»»»»

Capital Markets

Silent Shifts: AIB-AXYS Spotlights Kenya’s Quiet Market Movers

By Harry Njuguna

As Nairobi’s stock market shows signs of renewed vigor, AIB-AXYS Africa sees some companies quietly positioning themselves for bigger gains. Liberty Kenya Holdings is poised for an 18.9% jump, backed by steady performance and a reliable dividend. Not far behind, British American Tobacco (BAT) Kenya benefits from growing consumer demand and easing cost pressures. KCB Group and Equity Group also look set to ride regional growth and strategic acquisitions. Meanwhile, NCBA Group and Safaricom face tougher terrain, grappling with rising costs and stiff competition, signaling a more cautious outlook. Read more here »»»»»

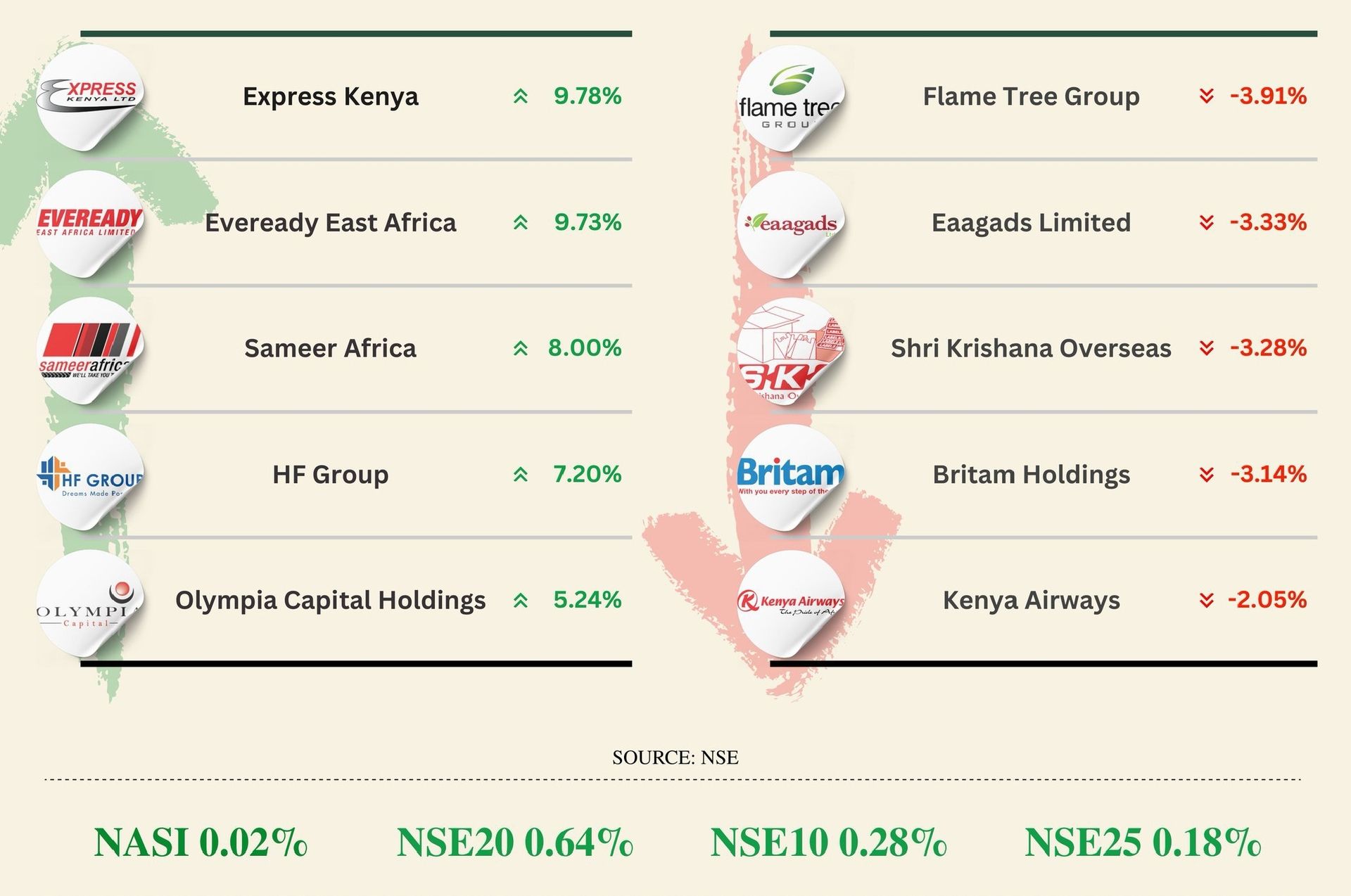

NSE Gainers & Losers

Source: NSE

Tech Frontier

INTERVIEWS : The Heartbeat of African Innovation — Why Founders Must Stay Rooted

By TKWS Staff Writer

Kristin H. Wilson - Managing Partner at Innovate Africa Fund

Startups in Africa are raking in record funding, yet many still struggle to solve the continent’s toughest problems. Kristin H. Wilson, Managing Partner at Innovate Africa Fund argues that proximity to the problem, not just chasing investor dollars is the real secret to lasting impact. In this candid interview with The Kenyan Wall Street, she reveals why the brightest founders stay deeply connected to their communities while navigating the tricky balance between purpose and pragmatism. From the pitfalls of fleeting hype to the need for patient capital, Wilson lays bare the gaps that still hold Africa’s tech ecosystem back. Read this interview here >>>>>

HoneyCoin’s US$4.9Mn to Revolutionize Africa’s Cross-Border Payments

By Brian Nzomo

Nairobi-based HoneyCoin has secured a US$4.9 million seed round led by Flourish Ventures and Visa Ventures. Since 2020, founder David Nandwa has built a blockchain-powered platform already processing over US$150 million monthly across 45 countries. By blending traditional fiat with stablecoins, HoneyCoin offers instant settlement solutions that could redefine financial infrastructure on the continent. With strong regulatory licenses and partnerships with MoneyGram and Stripe, the startup is poised to accelerate growth and deepen compliance. Read more here »»»»»

MTN Uganda Posts 13% revenue growth But Profit Dips in H1

By Harry Njuguna

MTN Uganda grew top-line revenue by 13.1% to UShs 1.722 trillion in H1 2025, fueled by a 31.3% surge in data revenue and an 18.6% rise in fintech income.

🟢 Profit after tax dipped 9.7% to UShs 267.0 billion.

🟢 EBITDA climbed 17.8% to UShs 924.2 billion.

🟢 Subscriber base expanded 10.2% to 22.8 million customers.

🟢 Data traffic increased 42.6%, while fibre coverage grew 52.9% to 18,510 km.

🟢 The board declared an interim dividend of Shs 10 per share.

Read the full financial analysis here »»»»»

Also Read

Stories you missed

♦️ Illegal Trade. A Kenyan national, Elisha Odhiambo Asumo, has been indicted in the United States for conspiring to supply military-grade weapons to Mexico’s infamous Cartel de Jalisco Nueva Generación (CJNG).

♦️Banking. The Central Bank of Kenya (CBK) has proposed new regulations that would impose different fee levels and compliance requirements on non-deposit-taking credit providers.

♦️ Infrastructure. As CHAN matches roll on, it is clear that the real game is not just on the pitch but also on the country's capacity to deliver on what it promised, but at what cost.

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.