- The Daily Brief, by The Kenyan Wall Street

- Posts

- Sidian Bank's Astonishing Ascent

Sidian Bank's Astonishing Ascent

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, Sidian Bank and I&M Bank have posted their Q3 results, reflecting a profitable run that most Kenyan banks have continued to set

Sidian Bank’s Astonishing Ascent

By Harry Njuguna

Sidian Bank’s Q3 results read like a plot twist: a 470% profit surge to KSh 1.47 billion, driven not by a lending boom but by a windfall in non-interest income that nearly tripled and pushed operating income sharply higher.

Financial Snapshot

🟢 Operating income nearly doubled, rising 92.8% to KSh 5.63 billion, powered by a spectacular 146% jump in non-interest income.

🟢 Holdings in government securities skyrocketed 157% to KSh 40.06 billion, now dwarfing a loan book that has barely moved in a year.

🔴 Operating expenses rose 37.5% and loan-loss provisions climbed 126%.

🟢 Customer deposits surged 79% to KSh 77.96 billion, giving Sidian the liquidity to chase the safer end of the yield curve.

🟢 Total assets expanded 66% to KSh 95.06 billion.

Read the full analysis here >>>>>

Brothers in Steel

By Fred Obura

Presidents William Ruto and Yoweri Museveni spent the weekend in Tororo, but the real story wasn’t the ribbon-cutting; it was the quiet admission that the region still imports more steel than it can afford. By celebrating a new integrated plant on the Ugandan side of the border, Kenya and Uganda were telegraphing a larger ambition: to finally build a shared heavy-industry backbone instead of competing for scraps of investment. The speeches dwelt on integration and “collective strength,” but underneath was a more practical concern of volatile steel prices that have been distorting everything from roads to housing costs. For Nairobi, the promise is that regional capacity might soften those shocks; for Kampala, it’s a chance to anchor itself in the coming AfCFTA value chains. Either way, the Tororo plant stands less as a factory than as a signal that East Africa is trying, at last, to make something big together.

Read the full article here >>>>>

G20 South Africa: Flipping the Script

By Brian Nzomo

African finance ministers at the first-ever African-hosted G20 summit in South Africa are proposing a “Borrowers’ Club” to give the continent’s indebted nations more leverage and a platform for technical collaboration. The initiative aims to complement existing frameworks while pushing for faster, more transparent, and inclusive sovereign debt restructuring, including automatic standstills and broader creditor participation. Beyond debt, leaders flagged the need for investment in infrastructure, regional trade, and climate resilience, framing the plan as both a lifeline and a growth strategy. Yet the summit’s ambitions face friction: U.S. President Donald Trump boycotted over perceived bias and rejected climate and financial reform agendas, casting a shadow on enforcement.

Read the article here »»»»»

Visit our new website here to get updated on this story and others…

I&M Bank’s Q3 Profits Soar by 29%

By Harry Njuguna

I&M Bank Group closed the third quarter with a decidedly confident stride. Profit after tax rose 28.7% to KSh 11.8 billion, extending a year of steady expansion.

Financial Snapshot

🟢 Operating income climbed 20.3%, landing at KSh 43 billion.

🟢 Net interest income did most of the heavy lifting, rising by 21%.

🟢 Non-interest income rose 18%, underscoring the Group’s slow pivot toward more predictable revenue lines.

🔴 Expenses rose 15.6% with loan-loss reserves ticking up by 8%.

🟢 Assets are up 12.8% and deposits up 10%.

Read the full financial analysis here >>>>>

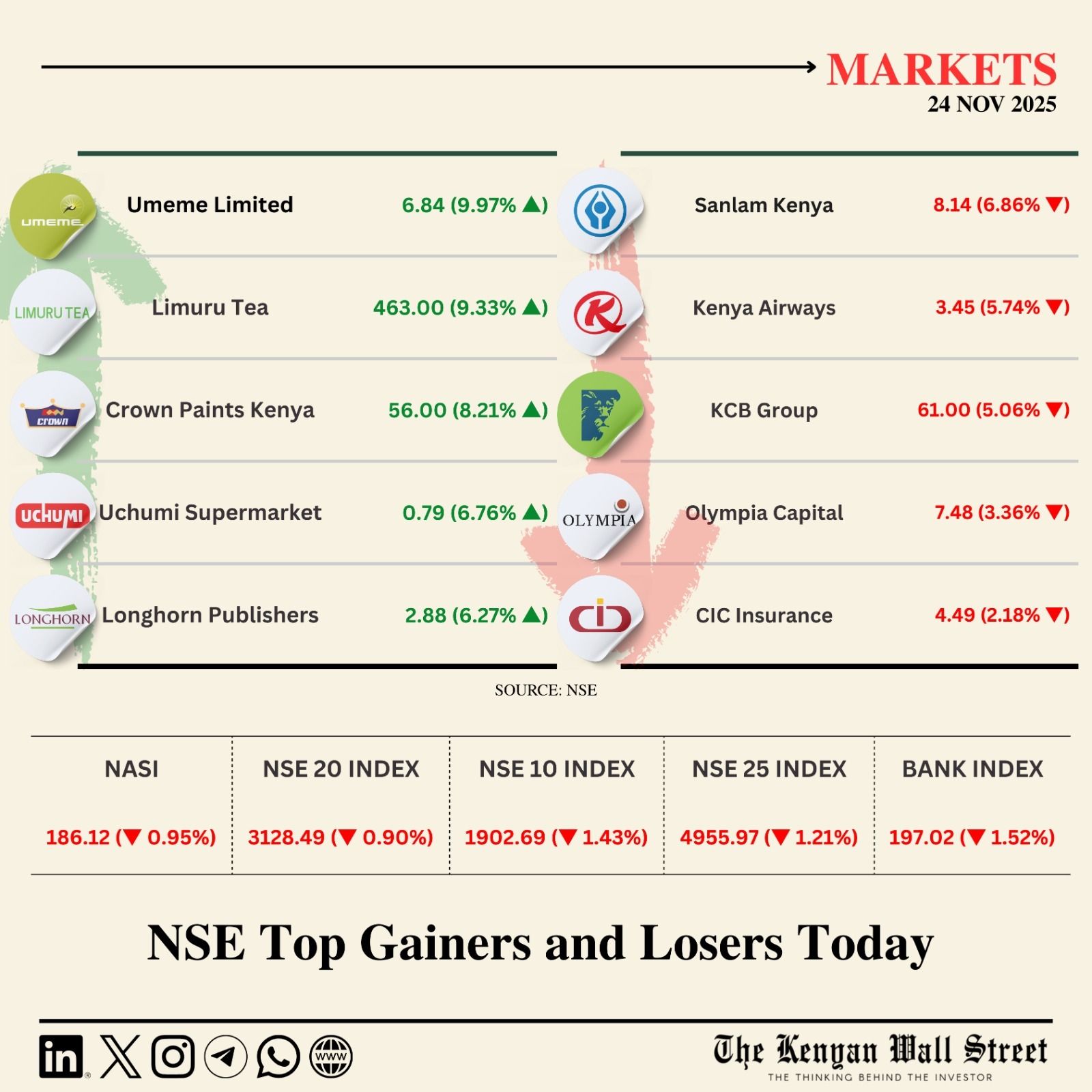

Capital Markets

More Stories

On Your Watchlist

Do feel-good office vibes matter when fair pay and job security are on the line in the workplace?

In the fifth episode of the Just Money Podcast, our host Just Ivy Africa sits down with Seasoned HR expert Daisy Cherono (Master in International Human Resources Management) and seasoned Office and Operations Manager Michelle Ndonye.

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»