- The Daily Brief, by The Kenyan Wall Street

- Posts

- SKL is now Listed, trading KSh 5.90 per share

SKL is now Listed, trading KSh 5.90 per share

Kenya's #1 newsletter among business leaders & policy makers

A long-awaited listing made its debut on the NSE today, in a bid to tap fresh capital and ride the continent’s growing manufacturing wave. At the same time, state-run textile firm, Rivatex, is sinking under the weight of billions in losses. Two manufacturers, two paths: one going public, the other going under.

I am Brian from The Kenyan Wall Street and this is today's edition of our daily newsletter…

SKL Officially Joins NSE with Bold Packaging Ambitions

By Fred Obura

SKL officially listed at the NSE, breaking a long dry spell of new company listings

Shri Krishana Overseas (SKL) has made its public market debut on the Nairobi Securities Exchange, listing at KSh 5.90 per share with plans to scale aggressively in Kenya’s packaging industry. The firm, founded by Dr. Sonvir Singh and Nirmal Chaudhary, has grown its revenues by 138% in just four years, but its latest numbers hint at stalled momentum.

With just 1.2% revenue growth in 2024, SKL appears to be pushing against the limits of its current production capabilities. That’s set to change: the company is nearing completion of a massive new plant in Kajiado County that will boost output from 2,400 to 24,000 tonnes annually. While capital raised through the listing will help fund the expansion, the IPO also serves to sharpen its governance and attract investor confidence.

Kenya’s packaging market, valued at over US$ 585 million, remains underserved, and SKL hopes to claim a larger share through automation and scale. But can this SME darling sustain growth amid growing competition and market saturation? Read More »»»»»

More on Capital Markets

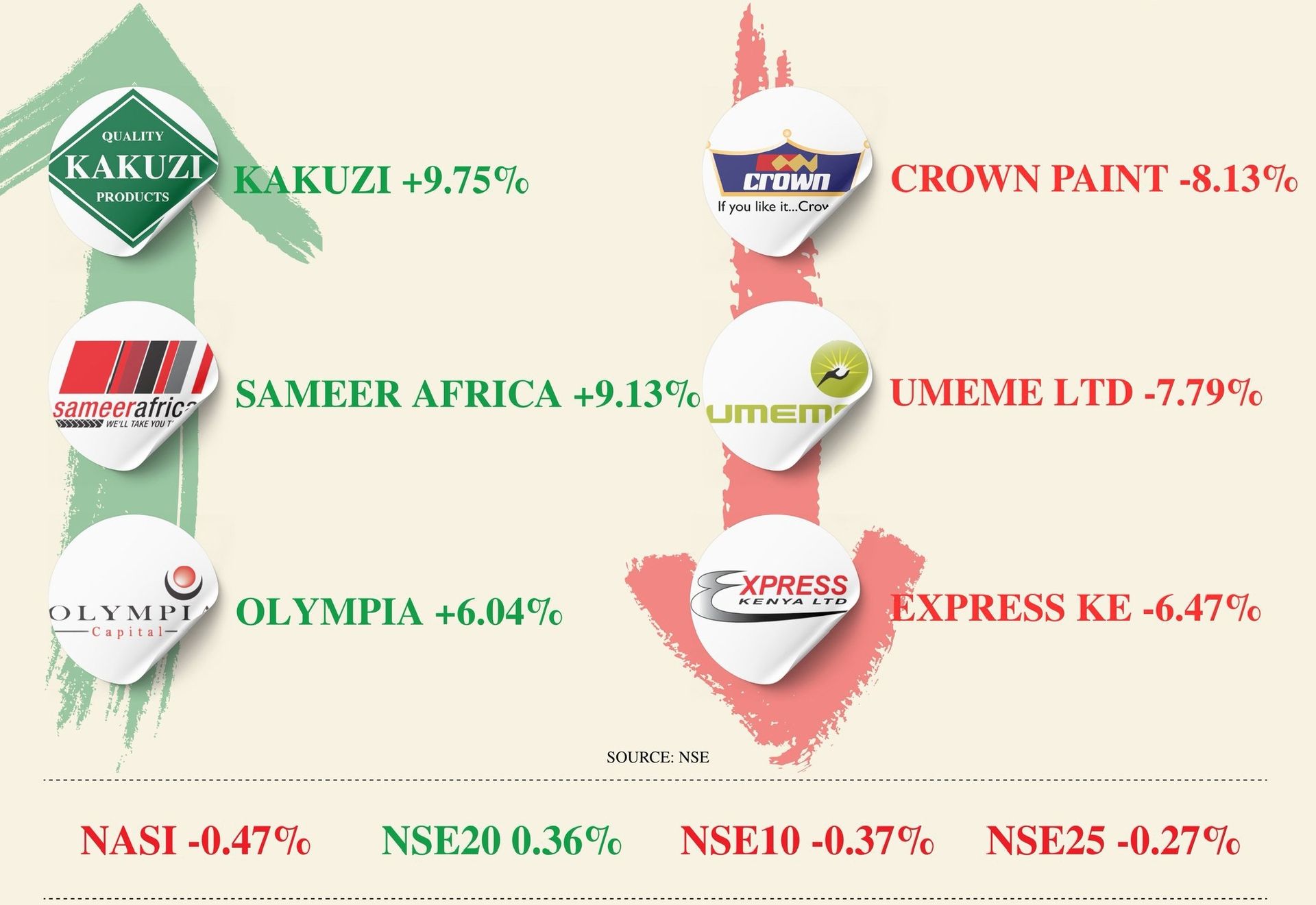

NSE Gainers & Losers

Source : NSE

Inside the Deepening Crisis at Rivatex

A broken sales system, vanishing millions, and AGOA’s ticking clock expose the cracks in Kenya’s state-backed textile manufacturer.

By Brian Nzomo

Rivatex, once a symbol of Kenya’s industrial resurgence, is now drowning in losses and systemic failure. At the heart of the collapse is a retail sales system so dysfunctional that auditors couldn’t verify a single figure from its KSh 332 million in reported sales.

The company has overspent by over 50% of its income, failed to remit staff pensions, and is nursing losses that have ballooned to KSh 3.4 billion. A ghost ERP system sits idle while spreadsheets continue to track half a billion shillings’ worth of inventory.

As the preferential U.S. trade window under AGOA closes later this year, Rivatex’s inability to scale up or export meaningfully leaves a bitter aftertaste. What happened to one of Kenya’s most ambitious manufacturing revivals? Read More »»»»»

Your Opinion

Do you think it is possible for Rivatex to recover financially and become a manufacturing icon? |

Tech Frontier

📡 Sub-Saharan Africa Has the Most Expensive Internet

By Fred Obura

Sub-Saharan Africa now ranks as the most expensive region globally for mobile data, with users paying up to 5% of their monthly income for just 1GB. The World Bank’s latest Findex report paints a bleak picture: steep prices are locking millions out of the digital economy and stalling everything from remote education to access to basic services. This cost pattern reflects more than just market inefficiencies; it's a major structural barrier to meaningful digital participation. If nothing changes, the continent’s celebrated mobile money revolution could be overshadowed by a deepening digital divide. Read More »»»»»

Safaricom Celebrates Subscriber Growth Ahead of 25th Birthday

By Harry Njuguna

Safaricom has crossed the 50-million customer mark in Kenya, a major milestone ahead of its 25th anniversary this October. From just 17,000 subscribers in 2000, the telecom titan now commands over 63% of the market, though that dominance is under quiet pressure. Airtel is steadily gaining ground, particularly in mobile money, where M-PESA’s once-unshakeable grip has slipped for six straight quarters. As Safaricom expands into Ethiopia and celebrates past successes, it must also confront the future. Read more »»»»»

Stories you missed

♦️ Energy. Utility firm, Kenya Power, spent KSh 73.7 billion purchasing electricity from Independent Power Producers (IPPs) that delivered significantly less energy than the state-owned generator, KenGen.

♦️Mobility. Ride-hailing platform Bolt has introduced a new Family Profile feature that allows one person to manage and pay rides for up to nine other people from a single Bolt account.

♦️ Capital Markets. President William Ruto has announced the impending Initial Public Offering (IPO) of the Kenya Pipeline Company (KPC) in September 2025, which will kickstart a long-awaited privatization program.

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.