- The Daily Brief, by The Kenyan Wall Street

- Posts

- South Africa's Nedbank to Acquire NCBA

South Africa's Nedbank to Acquire NCBA

Kenya's #1 newsletter among business leaders & policy makers

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, Nedbank makes a move for NCBA, we explain how devolution is lifting county revenue in arid regions but unpaid bills and weak spending discipline threaten to erase those gains.

Also…the government wants to reform the tea sector. Where best to begin than by tackling nefarious debt practices…

This and more in today's newsletter edition…

Nedbank to Acquire NCBA

By TKWS Desk

South Africa’s Nedbank Group Ltd intends to acquire a majority stake in NCBA, the two lenders said in disclousres on Wednesday evening.

According to the disclosures, the offer is structured as a partial pro rata offer to acquire approximately 1, 097,362,891 NCBA shares, comprising 66% of the lender’s total issued shares.

NCBA shareholders will be paid 20% in cash and 80% in Nedbank ordinary shares listed on the Johannesburg Stock Exchange, while Nedbank will become NCBA’s majority shareholder, with the rest of the lender’s shareholding remaining listed on the Nairobi Securities Exchange.

The disclosures follow years of industry rumors that South African banking giants including Nedbank and Standard Bank had been seeking a Tier-1 acquisition in Kenya.

“Nedbank is an ideal partner for our growth in the East Africa region.” John Gachora, NCBA Group Managing Director.

The two banks said the transaction is expected to close within six to nine months.

Is Devolution Changing Kenya’s Revenue Map?

By Fred Obura

Kenya’s arid and semi-arid counties are quietly rewriting the revenue story, posting rapid gains in own-source collections as long-ignored tax bases are finally brought into view. Digitisation, fee standardisation, and tighter enforcement have allowed regions like Turkana and Wajir to grow faster than their urban counterparts, even as Nairobi continues to dominate in absolute terms. Yet beneath this progress lies a structural weakness: county pending bills have swollen to nearly a third of approved budgets, threatening to drain the credibility of the revenue rebound. Without resolving the culture of delayed settlement, today’s revenue gains risk becoming tomorrow’s arrears crisis.

Read the full article here >>>>>

Untangling Debt From the Tea Farmer

By Brian Nzomo

A tea plantation in Kenya

For decades, Kenyan tea farmers unknowingly stood as guarantors for debts they did not negotiate, approve, or fully understand. This week, the government finally severed that quiet arrangement, banning the use of farmers’ tea proceeds as collateral for factory and KTDA borrowing. The move is a belated acknowledgment of how institutional opacity can turn cooperative structures into debt traps. By forcing factories to borrow transparently, in their own names, the state is testing whether financial discipline can restore trust in a sector that feeds both export earnings and rural livelihoods.

Read the full article here »»»»»

What fuels the tax man's coffers?

By Fred Obura

KRA headquarters at the Times Towers in Nairobi

December 2025 gave Kenya Revenue Authority (KRA) reason to pat itself on the back. Collections surged past targets, largely buoyed by fuel taxes, a reminder of how energy policy silently shapes public coffers. Behind the headline numbers lies a subtle tension: reliance on volatile oil prices leaves the Treasury exposed to swings beyond its control. Non-oil taxes chipped in, but the narrative is clear: Kenya’s fiscal health is increasingly tethered to the pumps at the roadside. In a way, every litre sold carries a story not just of consumption, but of government dependence.

Read the full article here >>>>>

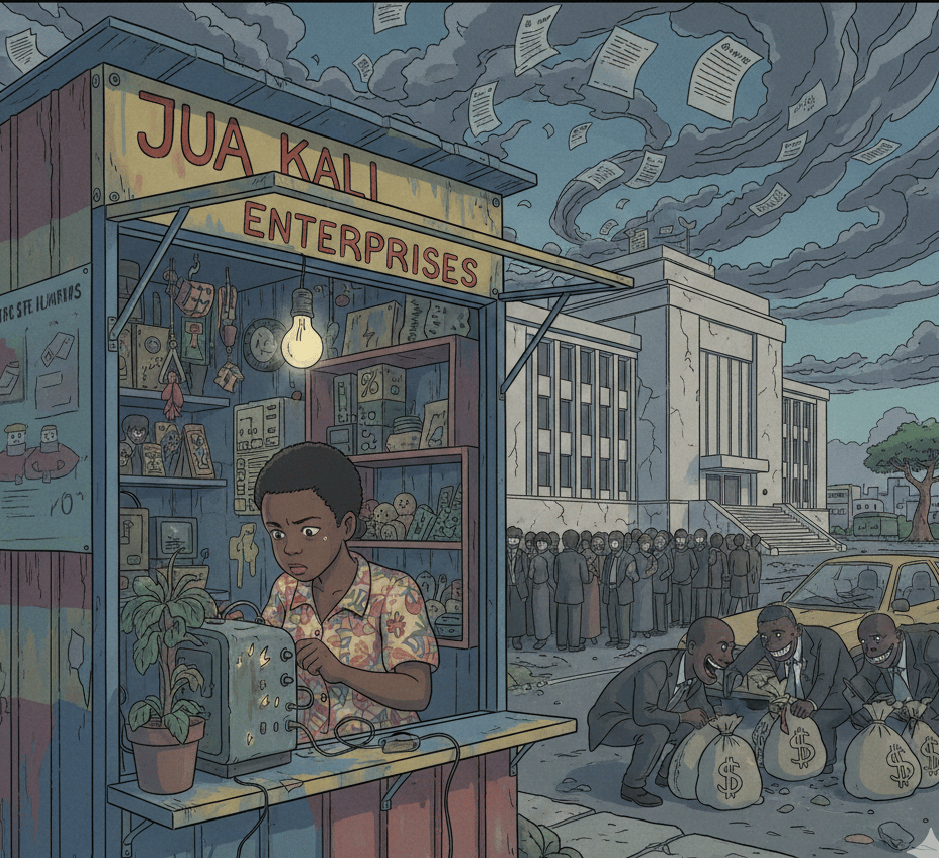

OPINION : Kenya's Political Economy is Killing its Businesses

By Phares Kariuki

Kenyan businesses often fail not because they lack ingenuity, but because they operate in an economic ecosystem that quietly exhausts them. The state demands meticulous compliance while offering little protection where it matters most, leaving entrepreneurs to self-insure against everything from power outages to contract breaches. Over time, this imbalance poisons the commercial environment, rewarding those who learn to profit from dysfunction rather than those who try to build durable firms. Capital accumulation becomes less a function of talent than of endurance, luck, and proximity to informal workarounds.

Read this opinion piece here >>>>>

Heads Up

Briefs

🏦 Paystack has launched ‘The Stack Group’ as a parent holding company to consolidate its expanding portfolio of technology businesses.

🌱 Kenya Tea Development Agency (KTDA) Holdings has begun the recruitment process for a new Group Chief Executive Officer following the exit of Wilson Muthaura.

🇪🇹 Africa’s largest carrier, Ethiopian Airlines, has ordered nine Boeing 787-9 Dreamliner aircraft as it positions for rising long-haul travel demand.

🇺🇬 Uganda’s gold exports rose 75.8% in 2025 to US$5.8Bn, up from US$3.3Bn in 2024, driven by record global prices and new entrants into the sector.

Partner Content

A Glimpse of Bitcoin's Safe-Haven Potential?

Bitcoin has hit a new all-time high of over US$ 126,000 in October, and this time, with less hype than in previous cycles. So, is Bitcoin a safe haven from market turmoil? There's no definitive answer — not yet. Sometimes it acts like one; most of the time, it doesn’t.

Read more details here »»»»»

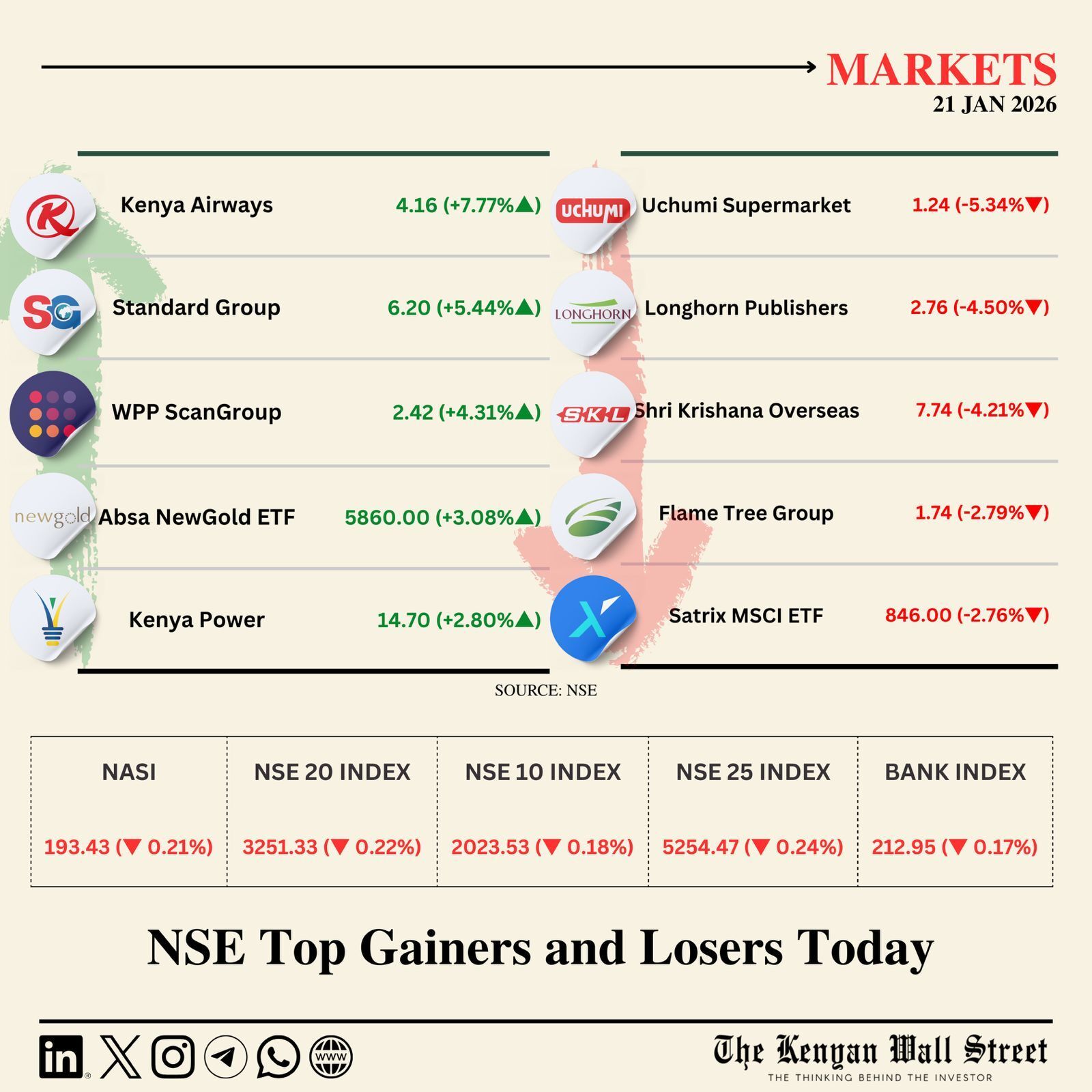

On your Watchlist

Today in History

South Africa’s Coalbrook mine collapsed, killing 435 workers in the deadliest mining disaster in the country’s history.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.

1