- The Daily Brief, by The Kenyan Wall Street

- Posts

- Summoning the bulls...

Summoning the bulls...

Kenya's #1 newsletter among business leaders & policy makers

Welcome to today's newsletter edition. We have compiled the most insightful business stories to kickstart your weekend… I am Brian from The Kenyan Wall Street.

MARKETS

SUMMONING THE BULLS : How Safaricom Ignited NSE’s Market Rally

NSE All Share Index (NASI) price action from 1st January 2022 to 15 May 2025

Safaricom's latest earnings revealed that the Telco has crossed US$3 billion in revenue and this has sparked a KSh 113 billion rally in the Nairobi Securities Exchange. The NSE All Share Index (NASI) is now strutting just shy of its 52-week high, after leaping 5.7% in just five days. Blue-chip stocks are basking in the spotlight, with foreign investors flipping from a KSh 160 million exit to a KSh 139 million return within a week. Safaricom’s stock hit a 52-week high of KSh 20.25 before settling at KSh 19.90. With NASI now +8% year-to-date, the bulls may just be warming up. Read our full analysis here »»»»»

ARMING THE REGULATOR: Capital Markets Authority Signs Global Watchdog Pact

CMA Chief Executive Officer Wyckliffe Shamiah(second-left) Doha, Qatar. Photo: CMA

At the 50th IOSCO summit in Doha, Kenya’s CMA joined a high-stakes global club by signing the Enhanced Multilateral Memorandum of Understanding—becoming only the 28th regulator worldwide to do so. This upgraded pact, known as the EMMoU, arms securities watchdogs with sharper tools against cross-border financial mischief, from ISP records to freezing offshore assets. It's a step up from the 2002 original, now with powers bundled under the acronym ACFIT. Read more here »»»»»

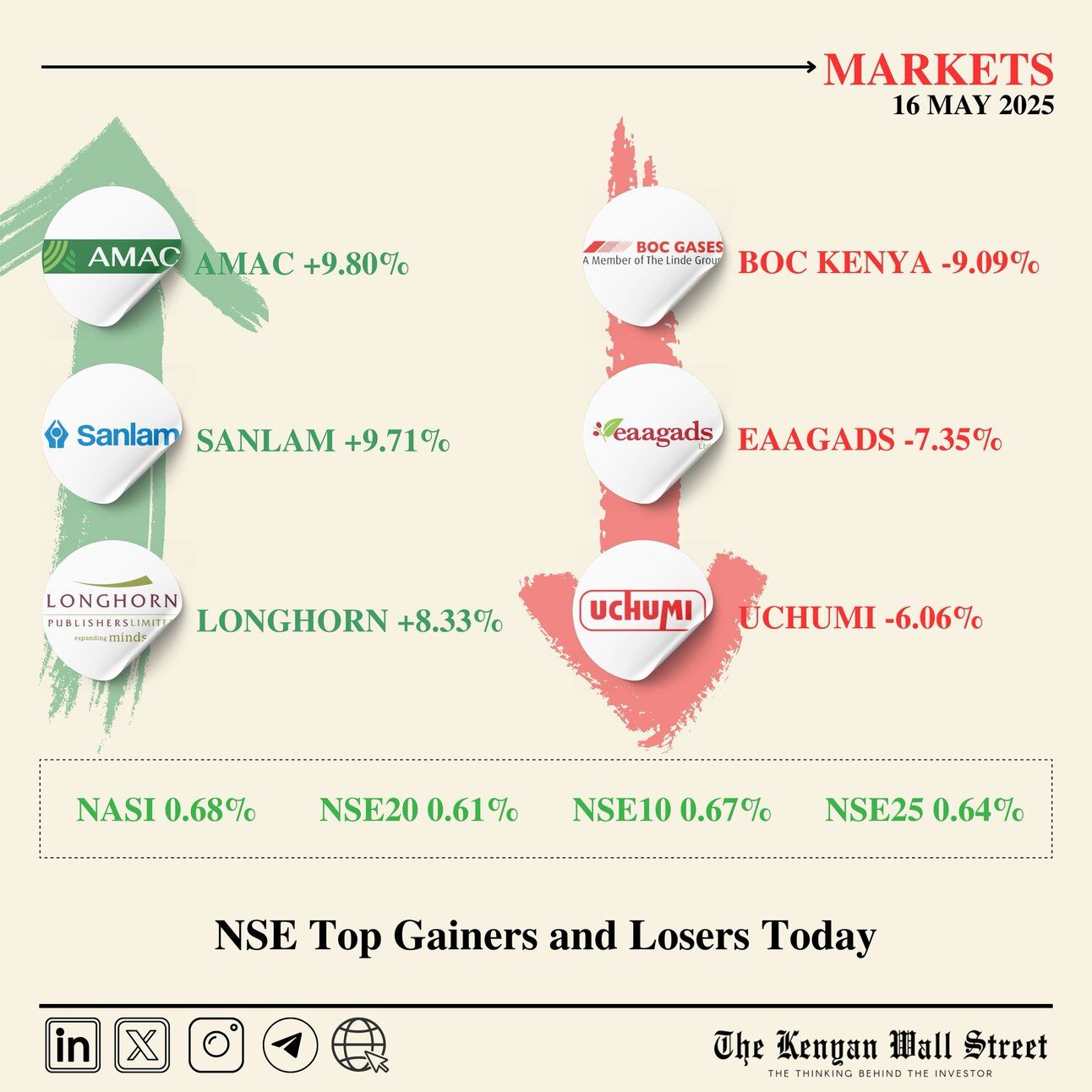

NSE Gainers And Losers

Source : NSE

HOSPITALITY

A COME-BACK : Is Kenyan Hospitality Sector Seeing A Rebound?

A Hotel Room

The Kenyan hospitality sector is bouncing back, with hotel bed nights rising to 10.2 million in 2024—its highest since the pandemic—driven by both domestic and international guests, notably a 37% surge in American stays. Coastal destinations led the charge, though shifts within the region saw gains in the North Coast offset by declines in Malindi, Kilifi, and the South Coast. Nairobi’s high-end hotels also flourished, with a nearly 21% rise in occupancy, reflecting growing urban tourism and business travel. Despite these gains, rising operational costs continue to squeeze profits, tempering the sector’s otherwise optimistic recovery narrative. Continue reading »»»»»

Today's Poll

How do you think the Hospitality Sector will perform this year? |

INVESTMENT

SHIFTING WINDS : Why Wealthy Kenyans Are Less Hungry for Real Estate Investments

Wealth Investment

Kenya’s wealthy are retreating from traditional real estate investments, favoring liquid assets like treasury bonds and REITs amid economic headwinds and high construction costs. The 2025 Kenya Wealth Report reveals a dramatic drop in residential property investment—just 22%, down from over 50% last year—as affluent investors seek stability and flexibility. While confidence in the local economy is rising, with 66% still preferring to buy homes domestically, diversification into technology, agriculture, and art is reshaping wealth strategies. Passion investments, once niche, are on the rise—art tops the list, signaling a cultural shift as Kenya’s elite align with global lifestyle trends. Here is the full analysis »»»»»

Briefs

On your watchlist

While it is well enough to leave footprints on the sands of time, it is even more important to make sure they point in a commendable direction

Yesterday's Poll Results

Do you think the 5% tax on remittances proposed by the U.S is fair?

🟨⬜️⬜️⬜️⬜️⬜️ Yes (24%)

🟩🟩🟩🟩🟩🟩 No (76%)

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.