- The Daily Brief, by The Kenyan Wall Street

- Posts

- Tertiary Education : On the Edge Of Collapse

Tertiary Education : On the Edge Of Collapse

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Howdy!

It's Brian from The Kenyan Wall Street…

We analyze the state of tertiary education in Kenya, highlighting why the unfolding crisis will cost the country dearly.

We also take a look at Nairobi's trade position in Rwanda and a court decision that will impact an ailing company trying to ward off its lenders.

Tertiary Education : On the Edge Of Collapse

By Chelsy Maina

Kenyan universities are enrolling record numbers of students, but the rapid expansion is exposing cracks in a system that lacks the staff, infrastructure, and research funding to keep pace.

According to the Commission for University Education, enrolment jumped 12.4% in 2024 reflecting both rising demand and pressure on already stretched public institutions. The shift has widened the gap between public and private universities: while public campuses now carry nearly three-quarters of all students, their lecturer-to-student ratio worsened.

The strain is visible in research output, where faculty publications fell by 7.5% year-on-year, signaling that teaching loads are crowding out innovation. Infrastructure is also lagging, with outdated lecture halls and libraries making up less than 2% of total academic resources, raising questions about the long-term value of degrees produced under such conditions.

For policymakers and investors alike, the dilemma is whether Kenya’s higher education system can transform rising enrolment into a competitive workforce, or whether it risks becoming a factory for lower-quality graduates.

Read full article here >>>>>

Trade Shifts at Kigali’s Border

By Brian Nzomo

Kenya’s place in Rwanda’s import ledger has slipped, with shipments plunging by more than two-thirds in the last quarter.

Meanwhile, India has edged past Nairobi, joining Tanzania and China at the top of Kigali’s supplier list. The reshuffle comes as Rwanda’s overall imports contracted and domestic exports fell sharply, exposing the fragility of both demand and supply.

Even so, trade surpluses with blocs like COMESA and the Great Lakes region point to how cross-border ties with neighbors such as the DRC still cushion the balance.

Read more here >>>>>

Join us for an exclusive Live conversation on Thursday 18th September 2025 hosted by The Kenyan Wall Street in partnership with Tatu City.

Our panel of experts will unpack why more businesses are choosing Special Economic Zones (SEZs), the opportunities they create, and what this shift means for Kenya’s industrial future.

Click here to register for this insightful conversation

NCBA Gains Ground in Court Clash Over Multiple Hauliers’ Insolvency

By Brian Nzomo

The Court of Appeal has pressed pause on the High Court’s plan to hand a struggling haulier to the Official Receiver. The decision buys NCBA time to argue that its rights as a secured lender were ignored. For the company, it means the much-discussed Amava rescue deal is frozen mid-stream. Billions of shillings hang suspended between courtroom procedure and boardroom ambition. What was billed as a rescue has become a waiting game.

Read more here >>>>>

“Brace Up For Lower Profits!” - StanChart Kenya

By Harry Njuguna

Standard Chartered Bank Kenya has issued a profit warning for 2025, projecting earnings to fall at least 25% below last year’s level. The lender’s H1 profit after tax dropped 21.4%. A Retirement Benefits Appeals Tribunal ruling on a pension dispute involving 629 former employees is expected to add more than KSh 7 billion in liabilities, pushing up operating costs and ending a five-year run of rising profits.

Read more here »»»»»

More Stories

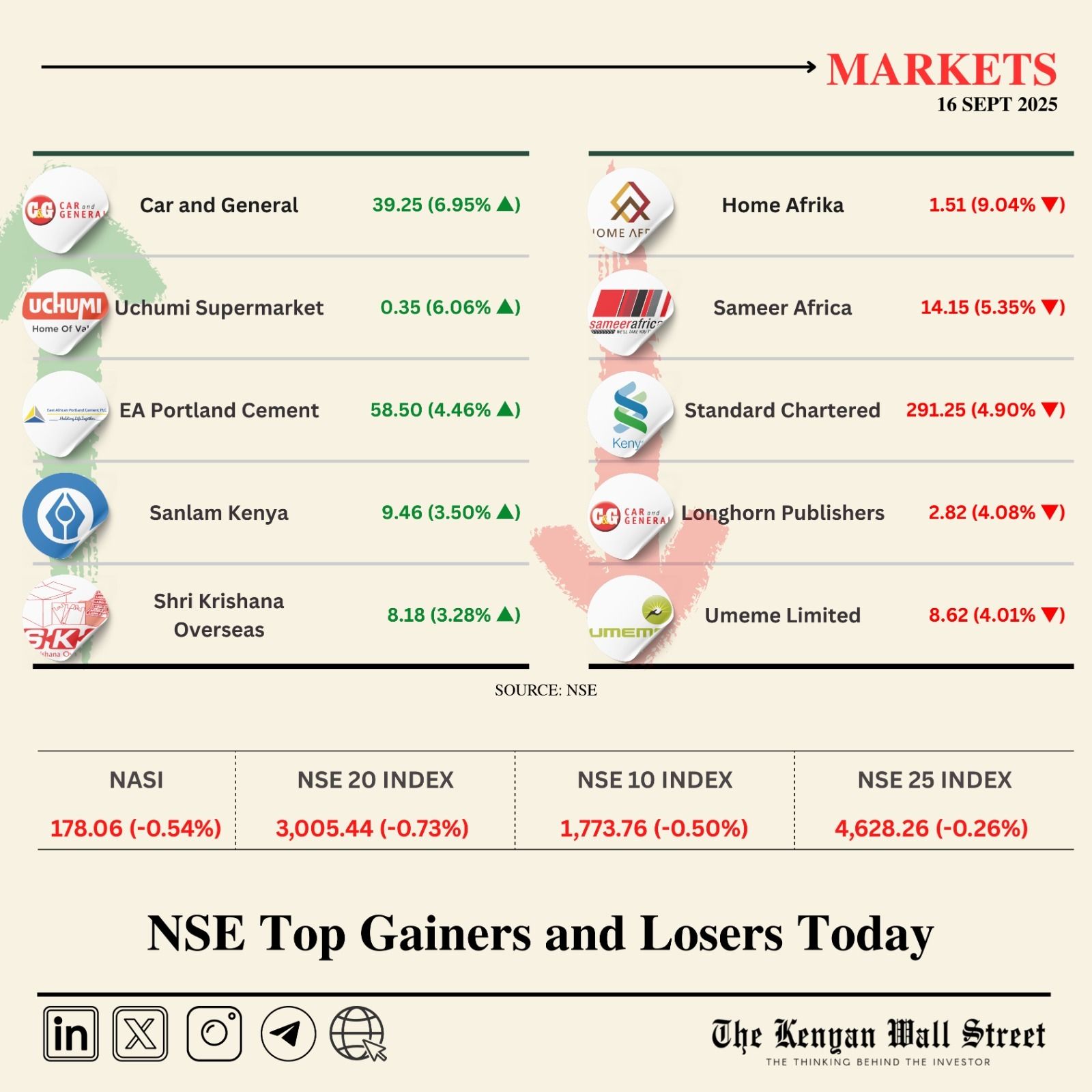

NSE Gainers & Losers

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Opinion

The Success of Africa’s Energy Ambitions will Depend on a Skilled Workforce

By Cobus Van Schalkwyk

Africa’s energy ambitions are vast, but the continent’s real shortage isn’t megawatts —it’s engineers. Factories can be financed, grids can be built, and turbines can be imported, yet without the human skill to sustain them, the promise flickers. The gulf is visible in classrooms that empty before graduation, in apprenticeships too few for the demand, in governments chasing technology without tending to talent. South Africa’s global recognition under the Washington Accord shows what’s possible, but most of the continent still trains its future on fragile scaffolding. Read more here »»»»»

On your watchlist

In this episode of the Her Leadership Series, we sit down with Nelly Gesare, the visionary founder of Green Thing, a pioneering social enterprise at the intersection of sustainability, business, and art.

Yesterday's Top Hits

♦️Capital Markets. Foreign investors accelerated their exit from the Nairobi Securities Exchange (NSE) in the second week of September even as the market delivered its strongest rally in more than a decade. (By Harry Njuguna)

♦️ Geopolitics. The U.S. Treasury Department has imposed sanctions on Sudan’s Finance Minister Dr. Gebreil Ibrahim Mohamed Fediel and an allied militia for their role in the country’s civil war and ties to Iran, even as African and Arab mediators rallied behind renewed diplomatic efforts to end the conflict. (By Fred Obura)

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.