- The Daily Brief, by The Kenyan Wall Street

- Posts

- The 4% Solution

The 4% Solution

Kenya's #1 newsletter among business leaders & policy makers

In today’s newsletter: A new sugar levy lands on millers and importers, while African airlines warn that profit-driven airport deals risk putting infrastructure before safety.

I am Brian from The Kenyan Wall Street and this is today's edition of our daily newsletter…

The 4% Solution to a Decades-old Problem

Kenya’s Sugar Industry Gets a New Price Tag. Will it work?

By Fred Obura

A 4% Sugar Development Levy quietly took effect on July 1, marking a financial turning point for Kenya’s struggling sugar sector.

Millers are now required to remit 4% of the ex-factory price for all local sugar sold, while importers will pay the same rate based on the Cost, Insurance, and Freight value of each shipment.

The Kenya Revenue Authority is the designated collection agent, with payments due by the 10th of the month following sale or import.

Though modest in percentage, the levy carries outsized ambition: to restore a sector long corroded by debt, neglect, and political inertia.

The levy is the fiscal engine of the Sugar Act of 2022, a law designed not just to regulate, but to resuscitate. Nearly half the collected revenue is earmarked for increasing cane productivity, while the rest is split among factory upgrades, infrastructure, research, and administrative oversight.

Whether the levy is felt as a burden or a lifeline depends on where one stands in the value chain. For producers and traders, it adds an immediate cost.

Follow our website for more updates…

ENERGY

⛽ Pain At the Pump: Kenyans to Pay more for Fuels

By Fred Obura

In its latest pricing cycle, EPRA has announced sharp fuel price hikes, pushing Super Petrol to KShs. 186.31 per litre in Nairobi. Diesel and Kerosene follow suit, rising by KShs. 8.67 and KShs. 9.65 respectively, straining households already bracing against a high-cost environment.

The surge is blamed on a near 7% jump in the global landed cost of fuel imports between May and June, now compounded by local tax and inflation-linked levies.

While the national inflation rate held steady at 3.8% in June, transport costs rose 3.2%, hinting at broader ripple effects still to come. These hikes, EPRA says, are meant to reflect global realities and protect the domestic market from supply shocks. For most Kenyans, however, the result is yet another uphill drive.

CAPITAL MARKETS

🧾 Sanlam, ALA, VCG Lead New Wave of Regulated Investment Schemes

By Harry Njuguna

The Capital Markets Authority (CMA) has greenlit a series of new collective investment schemes (CIS) and sub-funds, a move poised to deepen Kenya’s capital markets and offer investors a broader array of financial products. The approvals, announced 14th July, underscore the growing appetite for diversified investment vehicles, with assets under management (AUM) in Kenya’s CIS sector now exceeding Ksh. 500 billion. Read more here »»»»»

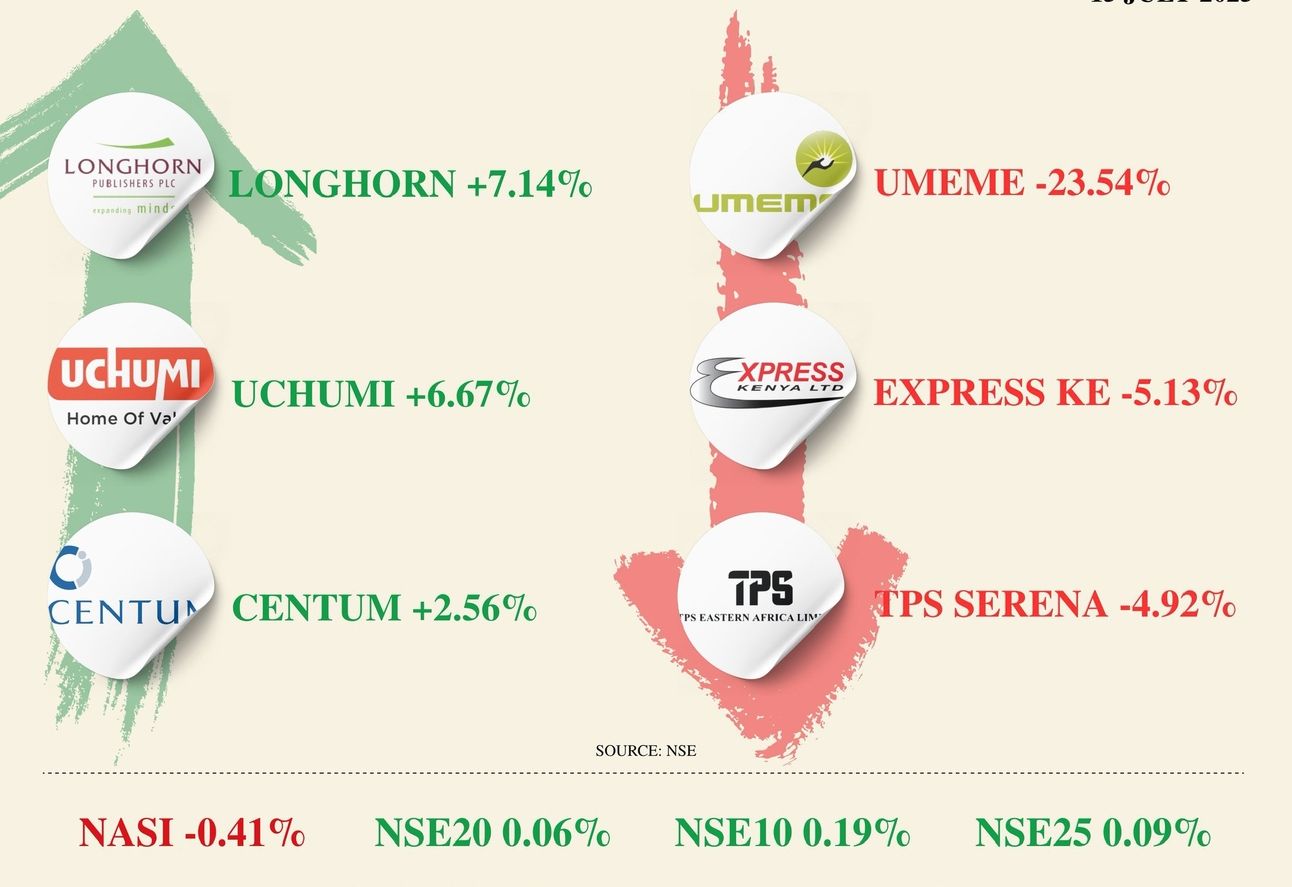

NSE Gainers & Losers

Source: NSE

Privatizing the Skies : Why Africa must be Cautious

Private capital is wooing at African airports, but there are warnings about rising costs and vanishing oversight.

By Fred Obura

In the turbulent skies of African aviation, a storm brews over airport privatization. The African Airlines Association (AFRAA) is sounding alarms over concession deals that risk turning runways into cash registers. Their warning, fresh on the heels of Kenya’s scrapped Adani-JKIA deal, underscores a deeper disquiet: profit-seeking may be eroding safety, service, and affordability.

Across the continent, rising taxes and user fees meant to fund infrastructure are quietly grounding growth. A recent AFRAA study lays bare the cost burden throttling African air travel, as global fiscal pressures and climate levies stack higher. Read more »»»»»

What you missed…

Geopolitical Watch : The Middle East

By Chelsy Maina

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.