- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Debt Horizon Still Looms...

The Debt Horizon Still Looms...

Kenya's #1 newsletter among business leaders & policy makers

In today’s newsletter : Kenya’s public debt has swelled to a record KSh 11.5 trillion amid surging short-term borrowing, while the Kenya Broadcasting Corporation (KBC) quietly faces a London arbitration that could cost taxpayers over KSh 300 billion.

I am Brian from The Kenyan Wall Street and this is today's edition of our daily newsletter…

The Debt Horizon Still Looms…

Fitch holds Kenya at ‘B-’ as growth peeks through a fog of obligations.

By Harry Njuguna

Kenya’s economy is breathing a little easier, but the air is still thin. Fitch Ratings has left the country’s credit score at a precarious ‘B-,’ nodding to flickers of growth even as debt and deficits crowd the horizon.

Interest payments now swallow a third of government revenue, a figure that feels like a slow constriction. The government has padded its foreign reserves, but they still lag behind its peers, like a swimmer clinging to the shallow end. Read more >>>>>

Meanwhile, political fragility and revenue shortfalls are the shadows following every bright headline. For now, Kenya survives on momentum and faith, suspended between the optimism of markets and the arithmetic of its obligations.

Public debt now sits at a record KSh 11.5 trillion, a mountain built by the steady drizzle of Treasury Bills and bonds. The government has leaned harder on its own banks, rolling over short-term paper desperately.

The Mess at the State Broadcaster

A decades‑old KBC partnership threatens to saddle taxpayers with an astronomical bill.

By Brian Nzomo

In a London arbitration court, the national broadcaster — KBC — is fighting for its financial life. A terminated media partnership from the 2000s has spiraled into an arbitration claim so large it dwarfs KBC’s entire balance sheet.

The numbers whisper of a taxpayer‑backed disaster, with hundreds of billions in potential liability for a station already drowning in debt. Conflicts of interest, secret settlements, and boardroom intrigue give the saga the flavor of a political thriller. Click to read more >>>>>>

Also Read

NSE Gainers & Losers

Source : NSE

Opinion

The Best African Investment No One Is Talking About

By Kyle Schutter

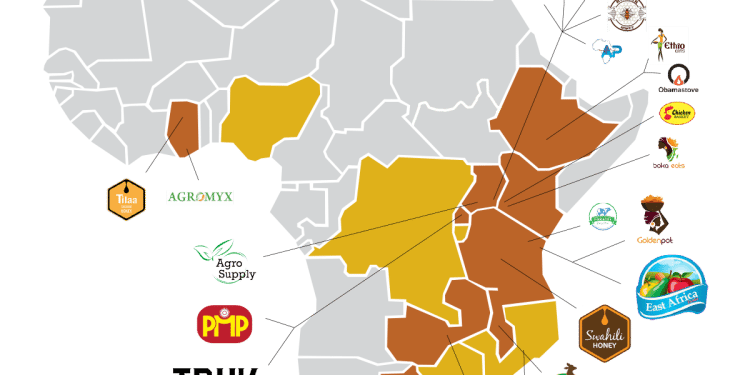

While flashy startups collapse and foreign VCs circle conferences, one African company quietly grew 125x by betting on food and not apps. Africa Eats skipped the hype and built a portfolio of gritty, profitable businesses feeding millions and enriching local founders. They didn’t just rethink investment, they rewrote the rules of the stock exchange. If you care about real returns and real impact, read this opinion piece »»»»»

Stories you missed

♦️ Companies. Sameer Africa PLC has undertaken a significant pivot over the last decade, shifting from tyre manufacturing and distribution to becoming a key player in the industrial real estate sector.

♦️Narcotics. Kenya has become a major player in the continent’s illicit drug trafficking economy, with industrial-scale methamphetamine production, widespread cannabis cultivation, and an emerging threat of synthetic opioids, even as cocaine floods in from Latin America.

♦️ Capital Markets.The Nairobi Securities Exchange (NSE) has eliminated the long-standing minimum board lot of 100 shares, allowing securities to trade in multiples of just one share.

On your watchlist

Yesterday's Poll Results

Do you think NACADA's policy seeking to restrict alcohol consumption will be fruitful?

🟨⬜️⬜️⬜️⬜️⬜️ Yes (24%)

🟩🟩🟩🟩🟩🟩 No (76%)

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.