- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Defective Fertiliser Subsidy

The Defective Fertiliser Subsidy

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter, the World Bank has pinpointed flaws in the acclaimed fertilizer subsidy program, noting that it has failed to cushion farmers’ costs. Meanwhile, Uchumi is on the regulator's spotlight after its odd, supersonic rally over the week.

We also analyze the Q3 financial results for Family Bank and StanChart.

The Defective Fertiliser Subsidy

By Fred Obura

The fertiliser subsidy is under fresh scrutiny as evidence mounts that the centralised NFSP-2 system is quietly shifting more costs onto farmers rather than reducing them. By sidelining private agro-dealers and funnelling distribution through NCPB depots, the programme has pushed farmers farther from access points, inflating transport expenses that wipe out much of the subsidy’s benefit. The model has also gutted rural supply chains by costing an estimated 200,000 jobs, even though NCPB’s landing costs remain nearly identical to those of private importers. Beyond logistics, the subsidy has distorted Kenya’s fertiliser mix by excluding DAP entirely, while pushing NPK 23:23:0 to levels that risk undermining yields in certain regions.

Read the full article here >>>>>

Uchumi’s Phantom Rally

By Harry Njuguna

Uchumi has found its way back into the headlines, not through a turnaround, but through the strange buoyancy of a stock that refuses to behave like the company behind it. In recent weeks the retailer’s long-tired shares have staged an improbable 365% rally, the kind of speculative flutter that tends to arrive just when the fundamentals are at their most threadbare. Regulators, sensing the dissonance, have reopened a governance review; another attempt to untangle the audits, disclosures, and stalled agreements that have trailed the supermarket chain for years. For investors, the rise has the shimmer of a mirage: visible, exciting, and uncomfortably detached from the ground beneath it.

Read the full article here >>>>>

StanChart Q3 Results Take a Hit From Pension Ruling

By Harry Njuguna

Standard Chartered Bank Kenya posted a 38% drop in third-quarter profit to KSh 9.79 billion, after absorbing a KSh 2.7 billion pension charge tied to September’s Supreme Court and RBAT decisions. The pension scheme has begun settling the ordered KSh 2.5 billion to 629 appellants, with KSh 1.9 billion paid to 499 individuals by 21 November

Financial Snapshot:

🔴 Operating income fell 17% to KSh 32.43 billion, as net interest income slid 10% and non-interest income dropped 29%.

🔴 Total expenses rose 19% to KSh 19.23 billion, almost entirely due to the pension charge.

🔴 Net loans dipped 3% to KSh 146.4 billion, while customer deposits fell 4% to KSh 283.4 billion.

🟢 Assets under management rose 23% to KSh 290 billion.

Read the full financial analysis here »»»»»

Family Bank Surges Ahead of NSE Debut

By Harry Njuguna

Family Bank has posted a profit after tax of KSh 3.597 billion for the nine months ended September 2025, a 55.7% jump from the prior year. As the lender gears up for a planned listing on the NSE in 2026, the results signal both scale and ambition.

Financial Snapshot

🟢 Core business income rose 43% to KSh 10.95 billion.

🟢 Total operating income climbed 34.4% to KSh 14.74 billion, with non-interest income up 14% to KSh 3.79 billion.

🔴 Total operating expenses increased 33% to KSh 10.24 billion, reflecting higher business activity and expanded loan-loss provisions.

🔴 Gross non-performing loans ended the quarter at KSh 15.60 billion, a 9.1% rise.

🟢 Total assets grew 24% to KSh 202.6 billion, fueled by a 15.3% increase in customer deposits to KSh 146.8 billion.

Read the full financial analysis here >>>>>

Happening this week

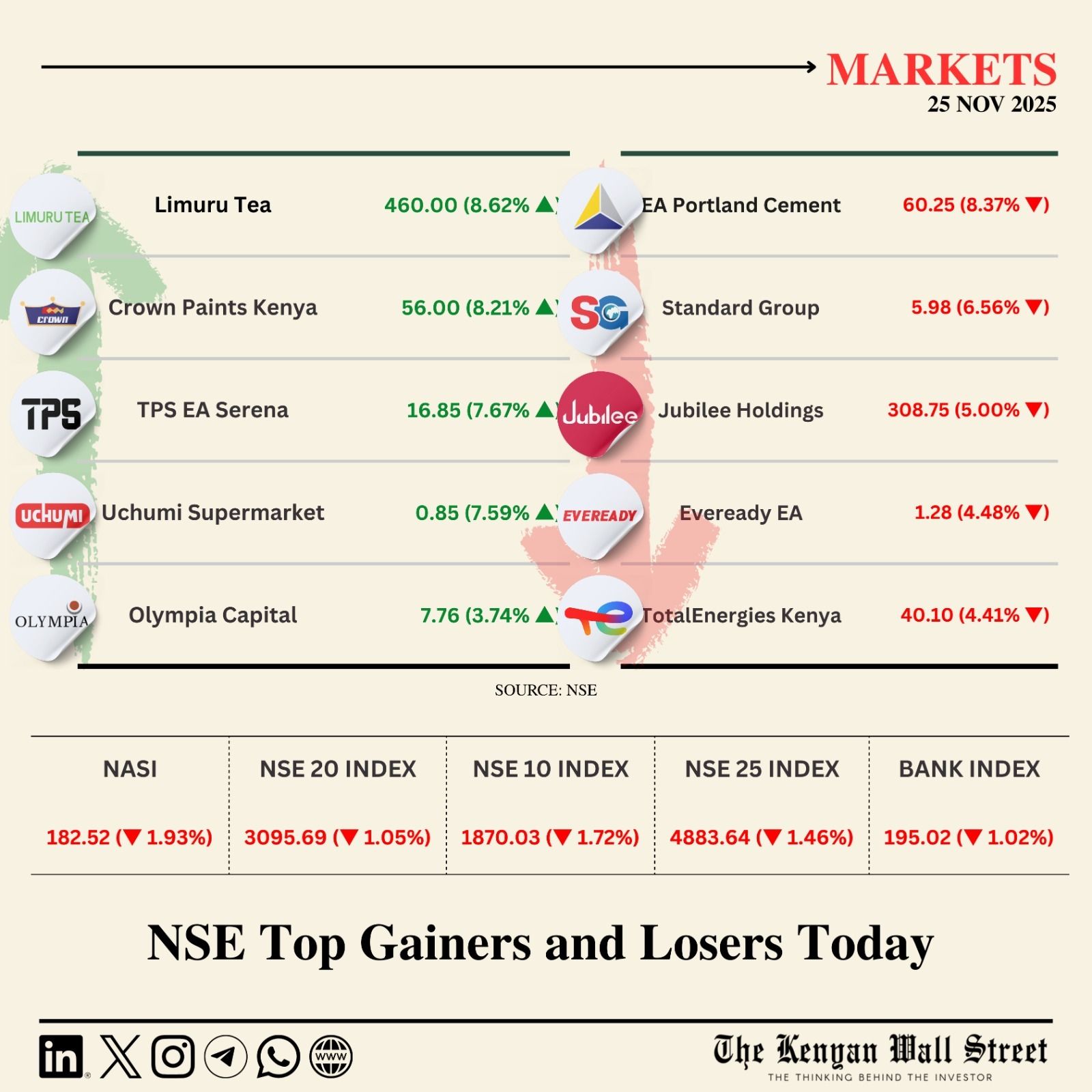

More in Markets

OPINION : Seamless User Experience and Technical Sophistication Don't Need to Compete

By Mario Nomso - Lead Product Designer at Kora.

Payments in Africa are getting more sophisticated, but users still expect everything to feel effortless. The real challenge for fintechs is hiding immense backend complexity behind a single tap while keeping trust intact. As payment options multiply, from USSD to QR to cross-border wallets, the winners will be the firms that design each channel to feel native rather than forced. Necessary friction, like authentication or confirmations, becomes tolerable when users understand it protects them, not slows them.

Read the article here >>>>>