- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Eight-Percent Club

The Eight-Percent Club

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street.

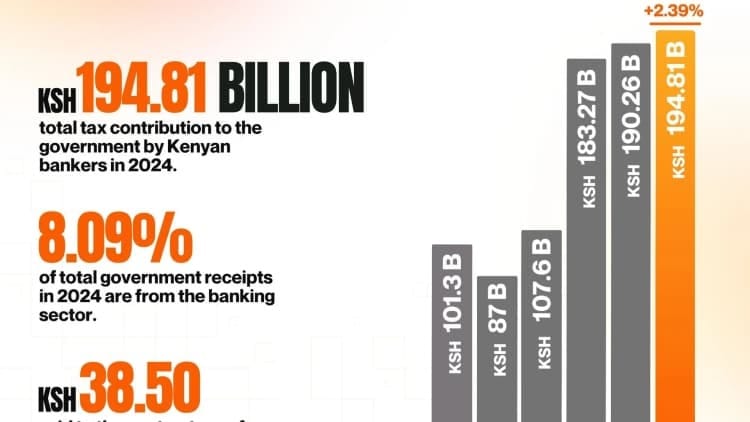

In today's newsletter edition, banks in Kenya contribute to 8% of the the taxes the gov't gets. We break down the figures.

Also, we highlight why terror investigators are nabbing individuals suspected of financing extremist elements using cryptocurrency platforms.

The Eight-Percent Club

By TKWS Desk

Kenyan banks, long the Treasury’s most reliable patrons, delivered nearly KSh 195 billion in taxes last year, according to a new industry report. The study, compiled by the Kenya Bankers Association (KBA) and PwC, shows the sector accounted for just over 8% of the country’s tax haul; an outsized contribution from only 36 institutions. Profitability rose, softening the effective tax rate, but the state still took the lion’s share of the value banks created, well ahead of employees and shareholders. A surge in people-related taxes, powered by the full-year impact of the Affordable Housing Levy, hinted at where future burdens may gather. And yet, even with the weight of compliance, the industry continues to play the dependable taxpayer in a fiscal system built on the few who always pay.

Read this article here >>>>>

Privatizing a wilted flower

By Fred Obura

Kenya’s long-fading pyrethrum industry is now leaning on an old remedy: handing the problem to the private sector. The Agriculture Ministry says the state-run Pyrethrum Processing Company of Kenya is too indebted, too underfunded, and too hollowed out to revive on its own, despite years of budgetary drip-feeding. Leasing it out, after cleaning up its swollen balance sheet, has emerged as the only workable lifeline for a firm that once anchored one of the country’s marquee export crops. The government insists that seedlings, partnerships and new regulations are beginning to restore confidence, though farmers still wait for overdue payments and production continues to drift. For now, the future of the sector rests on a familiar Kenyan calculation: when the state cannot fix a broken industry, perhaps someone else can.

Read the article here >>>>>

Visit our new website here to get updated on this story and others…

Terror Investigators Eye Crypto Links

By Brian Nzomo

Kenyan investigators are widening a national counter-terror sweep that has increasingly turned its attention to cryptocurrency trails, detaining suspects across five counties as they probe whether digital assets are quietly moving extremist funds. A Mombasa-based lawyer, Andrew Chacha Mwita, is being held for two weeks as detectives sift through financial activity they believe may link him to a broader network under investigation. In Marsabit, a businessman was transferred to Nairobi after tensions flared outside the local station, part of a 22-person dragnet stretching from Moyale to Kapseret. The crackdown lands just as Kenya’s new Virtual Asset Service Providers Act takes effect, arming regulators with tools to scrutinize crypto flows that once moved beyond easy supervision.

Read the full story here >>>>>

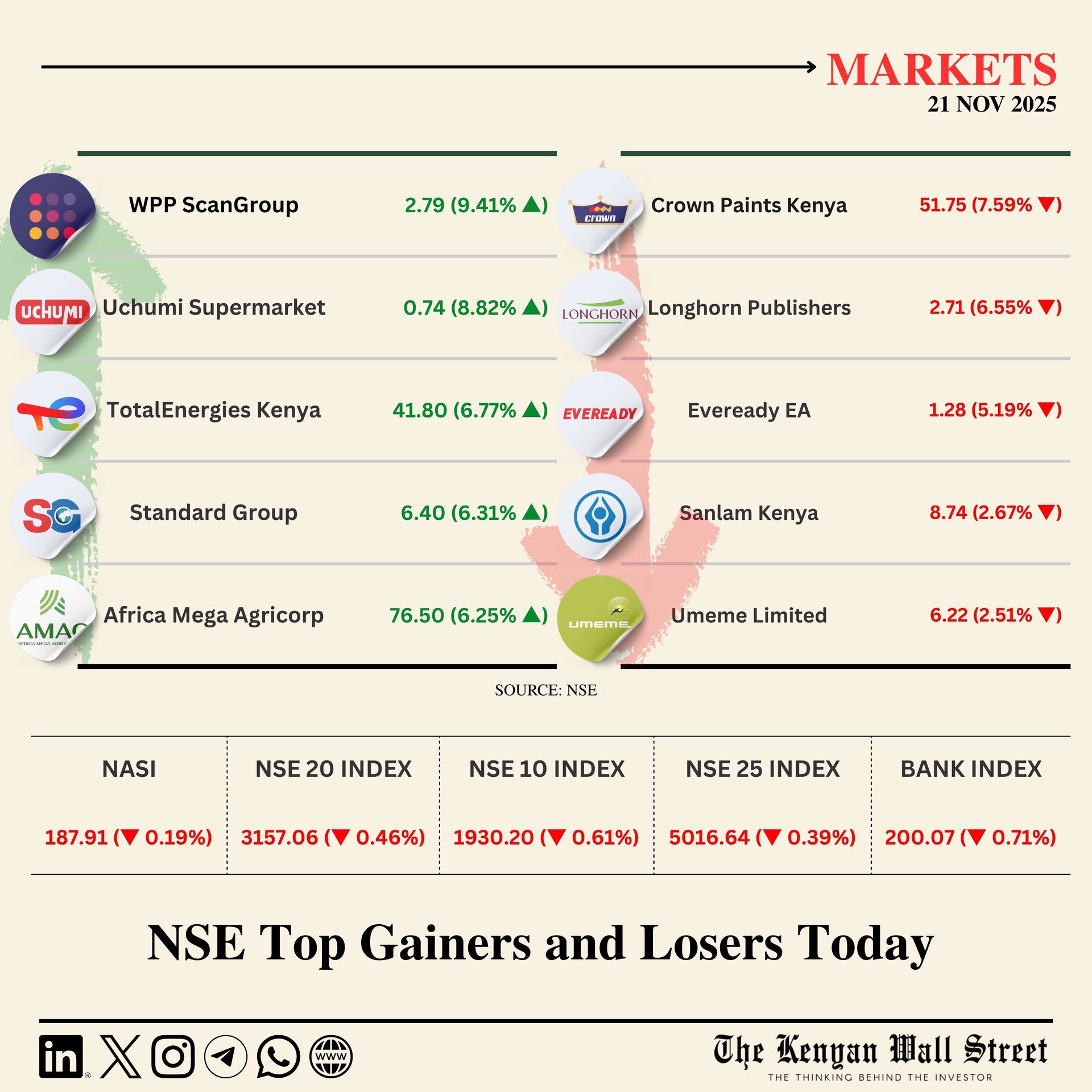

Capital Markets

More Stories

On Your Watchlist

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»