- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Great Pipeline Sell-Off

The Great Pipeline Sell-Off

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street

In today's newsletter edition, Parliament has signed off on a deal that could reshape both the state’s balance sheet and the country’s capital markets: the partial sell-off of Kenya Pipeline Company (KPC).

Harry Njuguna writes…

For the Treasury, it is a chance to raise badly needed cash, about a hundred billion shillings, without piling on new loans.

For the Nairobi Securities Exchange (NSE), long starved of big names, it promises a marquee listing not seen in decades.

The plan, though, arrives entangled in the politics of privatization: lawsuits, contingent liabilities, and a lingering suspicion that the process has moved too fast. Lawmakers insisted on safeguards, from caps on insider holdings to priority slots for ordinary Kenyans, but doubts remain about how much of that spirit will survive in practice.

Meanwhile, investors are weighing a different question: whether a strategic monopoly in petroleum transport can deliver growth without raising costs for consumers. What is clear is that the KPC offering, whenever it lands, will serve as a test of confidence in Kenya’s market experiment.

Read the full article here >>>>>

Your Opinion

Do you think the planned privatization and listing of Kenya Pipeline is a beneficial move? |

KQ On Parliament’s Grilling Spot

By Brian Nzomo

Kenya Airways is once again under pressure, this time from Parliament, to explain how it plans to repay billions in state bailouts.

Lawmakers have grown wary of the endless cycle of support, noting that the Treasury has poured billions into the airline in recent years with little to show for it.

The Auditor-General has flagged the absence of proper repayment frameworks, while KQ’s own books remain mired in losses, its 13th in 14 half-year periods. Fleet shortages, falling revenue, and the long shadow of Project Mawingu’s failure continue to weigh on performance.

As MPs float privatization and tighter repayment terms, the national carrier finds itself caught between political impatience and financial fragility.

Read the full story here >>>>>

The Construction Rebound

By Fred Obura

The construction sector has staged a strong rebound, lifted by cheaper credit and a surge in developer financing.

The industry grew 5.7% in the second quarter of 2025, reversing last year’s contraction, as imports of cement, steel, and bitumen soared alongside a 21.7% jump in lending to builders.

The Central Bank’s rate cuts have filtered through to lower commercial lending costs, unlocking liquidity for housing and infrastructure projects. Property prices have followed, with detached homes in Nairobi recording their fastest quarterly rise in nearly a decade, even as rental markets softened under tenant price sensitivity.

Read more here »»»»»

The Trade Gap Widens

By Harry Njuguna

Kenya’s trade balance with the outside world is slipping again, the deficit in trade widening even as oil prices soften and foreign reserves climb. Exports have stumbled, imports have proven resilient, and the gap between what leaves and what enters the country has grown harder to ignore.

Remittances continue to prop up the accounts, but even that familiar cushion feels insufficient against rising debt and shifting global demand. Policymakers are left pointing to stronger reserves as proof of stability, though the underlying story is one of persistence rather than resolution.

Read more here »»»»»

More Stories

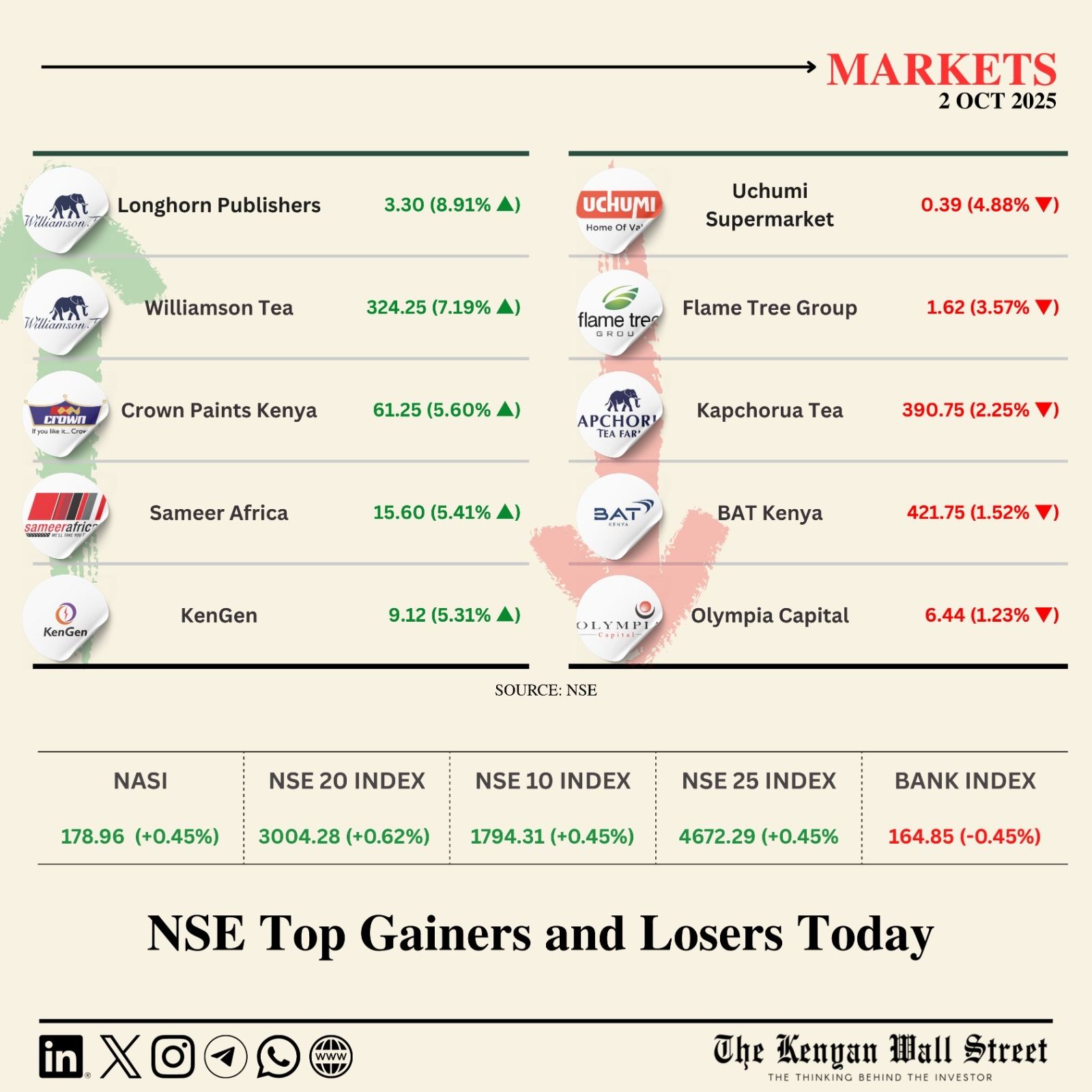

NSE Gainers & Losers

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

In a market where traditional banks often shy away from risk, CIB Kenya CEO Abhinav Nehra is doing the opposite. He sits down to discuss the bank's bold new approach to SME lending and its plans to change the financial landscape in Kenya and beyond.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.