- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Interest Trap

The Interest Trap

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Hi 👋🏽 It's Brian from The Kenyan Wall Street

In today's newsletter edition, MPs are considering measures to tame the explosion of interest payments that outpace the actual loans borrowers receive.

We also trace the declining path of Umeme Ltd. share price on the NSE. And we look at why a more innovative healthcare system will ensure the country is on a stable footing amid donor cutbacks…

The Kenyan parliament

The Interest Trap

By Brian Nzomo

Borrowing in Kenya has long carried a paradox: the promise of quick cash that too often swells into a debt far larger than the loan itself.

A fresh petition before Parliament now seeks to anchor the ‘in duplum’ rule into consumer law, ensuring that interest never surpasses the original principal. The rule exists already in statute, but its enforcement has been uneven, leaving room for lenders to layer on penalties that spiral borrowers into distress.

The petition argues that a clear line would restore public trust and curb exploitation in a sector where oversight is patchy at best. Yet the move arrives as lawmakers weigh competing pressures: to protect borrowers without choking off credit in an economy where informal lending thrives.

Read more here >>>>>

Dim Lights At Umeme’s Stocks

By Harry Njuguna

A stock that once lit up Kenya’s stock exchange has gone almost dark. Umeme Ltd., Uganda’s power distributor, soared on a dividend frenzy in July only to plunge more than 70% once the payout passed.

Its twenty-year concession to run Uganda’s grid has expired, leaving investors betting less on electricity and more on how much compensation Kampala will eventually pay.

The trajectory of Umeme's stock price

Nairobi traders have fled, while the same shares in Kampala remain curiously steady, a mirror showing two very different markets. Arbitration in London now holds the key, with hundreds of millions of dollars in dispute. Until then, Umeme is less a utility than a gamble on bureaucracy’s clock.

Read more here >>>>>

Dr. Stella Kivila - Director of Health Tech Strategy and Impact at Salient Advisory.

Why Innovation must Replace Donor Dependency In the Health Sector

By Fred Obura

Kenya’s health system is wobbling under donor cutbacks, and Dr. Stella Kivila, a physician-turned–health-tech strategist, says the shortages are no accident but symptoms of dependence.

In an interview, she described how aid freezes have left clinics with empty shelves, interrupting treatments for HIV, malaria, and maternal health. Yet she framed the crisis as a chance to rethink the system: not just gadgets, but innovations that build resilience.

Her own advocacy began after losing her father to complications that better tools might have caught, making the mission personal. For Dr. Kivila, the path forward is clear, Kenya must replace aid reliance with homegrown health-tech solutions that can scale, endure, and save lives.

Read more here >>>>>

A Bitter Season For Tea Farmers

By Harry Njuguna

Kenya’s tea basket is lighter this year, with production tumbling 12% as the skies withheld their rains. Smallholder farmers took the steepest fall, their leaf count dropping 16%, while estates and Nyayo zones also withered. Independent growers fared slightly better, though still in decline. At the Mombasa auction, volumes held up but prices eased, and exports slipped 9% as buyers from London to Cairo trimmed orders. Even local sales sagged, suggesting the country’s most dependable crop is brewing weaker returns.

Read more here »»»»»

Happening Tomorrow…

The Kenyan Wall Street is set to host the Inaugural Bullish Kenya event on the Sidelines of the UN General Assembly in New York City.

The event will be held on Thursday, 25th September 2025. It will be a highly-exclusive gathering of 80 top decision makers in the business and banking sectors from both Kenya and the United States. This invite-only event will support Kenya’s mission to be Africa’s leading investment and business destination.

To learn more about this event, read here »»»»»

Insight

Stablecoins

How Stablecoins Are Transforming Remittances and Trade Settlements

By Chelsy Maina

For years, sending money across Africa has been a slow, expensive, and bureaucratic ordeal, leaving small businesses and migrant workers frustrated with fees and delays. Now, dollar-backed stablecoins are quietly rewriting the rules, settling transactions in minutes and cutting costs to a fraction of traditional banking. Nairobi traders can lock in exchange rates with near-instant certainty, while platforms like YoguPay stitch these rails into full treasury systems, letting SMEs pay staff and suppliers across multiple countries without chasing foreign exchange dealers. What was once a patchwork of intermediaries and paper trails is becoming a lean, auditable, real-time financial stack, capable of handling payrolls, hedges, and cross-border trades at a click.

Read more about it here »»»»»

More Stories

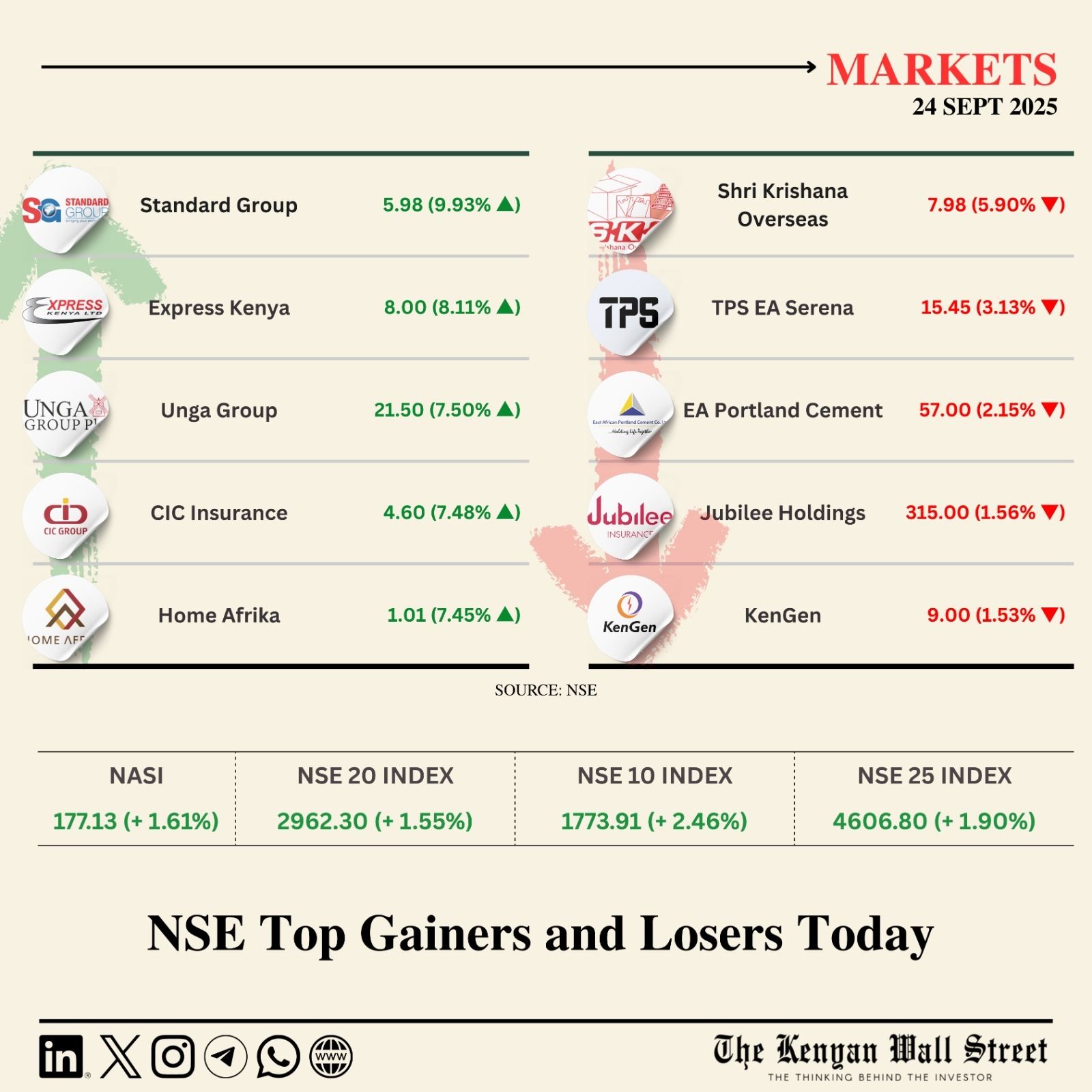

NSE Gainers & Losers

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

On Your Watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.