- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Long Night At Posta

The Long Night At Posta

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter edition, we take a look at one of the country's oldest but collapsing parastatals. Also, October's inflation figures are out and we analyze the financial results for KenGen and Carbacid.

The Long Night At Posta

By Brian Nzomo

Once the proud custodian of Kenya’s letters and parcels, Posta now staggers beneath months of unpaid wages and years of bureaucratic decay.

Its workers, unpaid and unmoved by new promises, march in a nationwide strike for survival. The court has intervened, drawing a faint line between duty and desperation, demanding salaries before silence.

Parliament, ever the optimist, imagines a rebirth of a corporation that has been laughably outpaced in the e-commerce and logistics market, which is ground for better digital titans.

The figures tell a bleaker story: billions lost, assets unaccounted for, and faith long spent. In the corridors of reform, talk of modernization sounds less like vision and more like denial.

Read the full article here >>>>>

Finally, KenGen Financial Results are here…

By Harry Njuguna

KenGen has delivered a stunning performance for the year ended June 2025, posting its third-highest profit since listing on the NSE. The state-owned utility’s robust results were driven by operational efficiency, improved power generation, and strategic diversification into regional projects.

Financial Snapshot:

🟢 Profit After Tax rose to KSh 10.48 Bn, up 54%.

🟢 An Operating Profit worth KSh 13.62 Bn, a 43% increase YoY.

🟢 Revenue stood at KSh 56.10 Bn, with growth in diversified income streams offsetting lower geothermal and steam sales.

🟢 A dividend of KSh 0.90 per share, matching the 2008 record payout.

🟢 Total assets rose 3% to KSh 505.6 Bn and equity increased 2.3%.

Read the full financial analysis here >>>>>

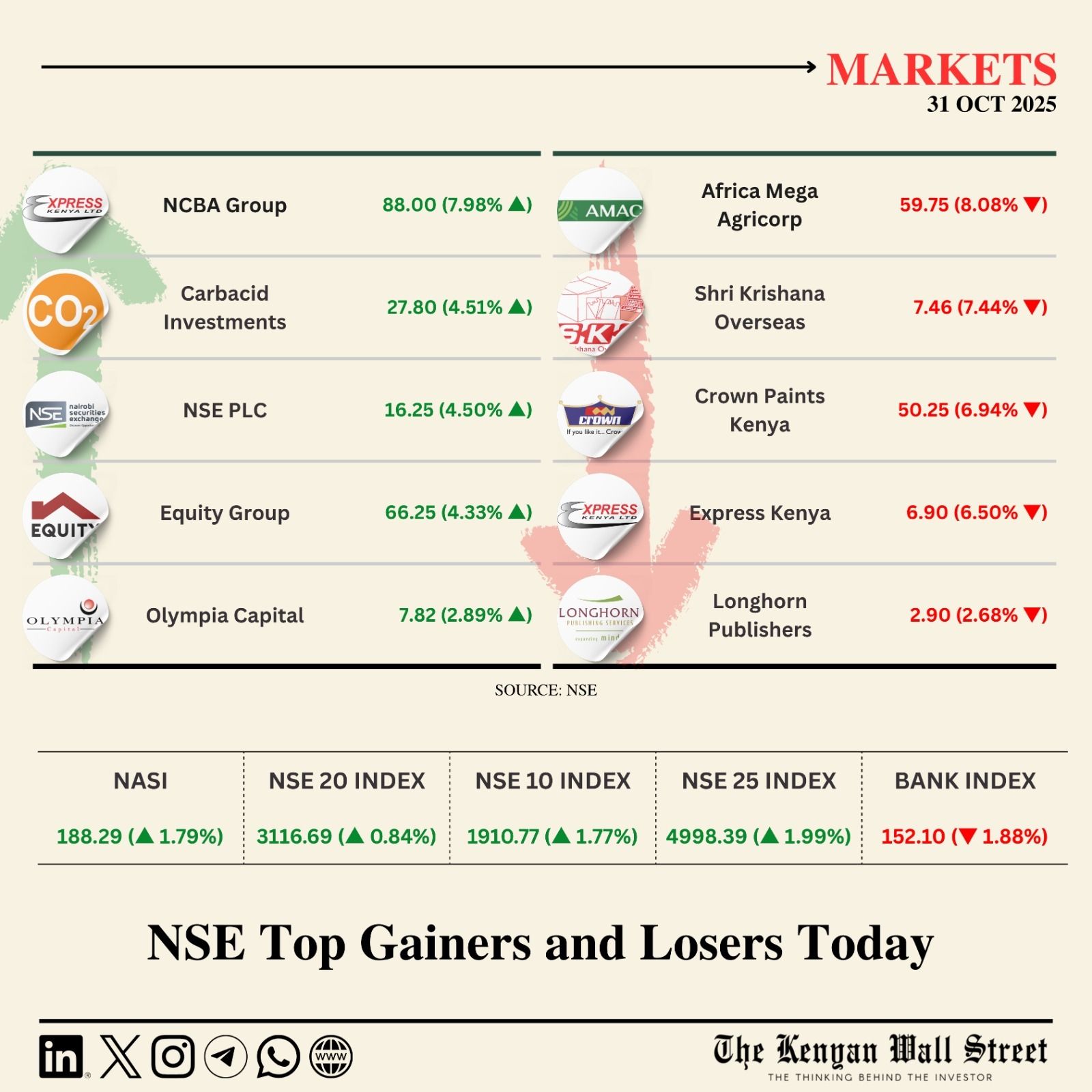

More in Capital Markets

NSE Gainers & Losers

The October Inflation

By Fred Obura

October nudged Kenya’s cost of living slightly higher, as the bite of fresh produce and electricity bills outweighed modest relief from staple foods. Tomatoes surged 37% year-on-year, while oranges and mangoes climbed steadily, reminding households that fruits can sting. Core inflation, stripped of volatile food and energy, eased to 2.7%, suggesting underlying pressures remain contained. Power bills rose sharply, with 200 kWh now costing KSh 5,764, even as LPG offered a fleeting reprieve. Transport and housing costs added their own weight, leaving Kenyan wallets stretched but resilient.

Read the full article here >>>>>

Also Read…

Your Weekend Watchlist

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.