- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Mirage of a Pension Boom...

The Mirage of a Pension Boom...

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

I am Brian from The Kenyan Wall Street…

In today's newsletter edition, we take a look at the raging concerns about the pensions sector in Kenya. We also analyze HF Group's return as a Tier 2 bank, tracing the challenges it faced before this turnaround…

The Mirage of a Pension Boom

What looks like a triumph of retirement savings in Kenya is a fragile edifice built on underfunded schemes and the quiet erosion of trust.

By Fred Obura

Pension funds in Kenya are swelling with cash, climbing past two trillion shillings and making retirement savings look like one of the country’s rare financial bright spots. But behind the glossy numbers lurk cracks…too much money parked in government paper, too little spread across riskier but potentially rewarding frontiers.

The industry is also lopsided, with a handful of giant schemes holding most of the assets while hundreds of smaller ones barely register. Worse, billions deducted from workers’ paychecks never make it into their accounts, a silent theft that has doubled in just a few years. Costs, too, are ballooning: staff, administrators, and service providers taking ever fatter slices of the pie. Regulators urge diversification, but that’s easier said than done in a market where the safe bet still seems safest. For now, savers are told their money is growing, even as the system that holds it creaks under its own weight. Read more here >>>>>

Inflation Rate : Where the Pockets Pinch?

By Chelsy Maina

Kenya’s inflation rate has stayed put at 4.5 percent, a figure that sounds reassuring on paper but feels far less so in the markets and kitchens of ordinary families. The statistic masks a split reality: energy bills are easing and fuel is slightly cheaper, yet the price of basic vegetables keeps climbing, leaving dinner tables more strained than before.

Tomatoes, cabbages, and sukuma wiki…once reliable staples…have seen prices rising with every shift in weather or glitch in transport. Meanwhile, the welcome dip in maize flour and beans is too modest to offer real comfort, more like a bandage than a cure. For many households, the disconnect between the government’s headline number and their own weekly shopping bills is widening into a source of quiet frustration. Inflation may be “under control” in statistical terms, but in lived terms, it is still controlling the choices of millions. Read more here >>>>>

INSIGHT : The Comeback story of HF Group

By Harry Njuguna

For years, Housing Finance stood as the country’s great promise of middle-class home ownership, only to be humbled by bad loans, unsold apartments, and the collapse of a property boom. By the end of the last decade, it was losing billions and had slipped into the ranks of the smallest lenders, a cautionary tale of what happens when a bank bets too heavily on mortgages.

The turnaround has not come quickly; it has taken new leadership, multiple rights issues, and the painful scaling back of its property arm to stabilize the balance sheet. In its place, HF has reinvented itself as a leaner institution, with digital banking, fee income, and partnerships filling the gaps once occupied by speculative housing projects. This pivot, together with fresh capital, has returned the bank to Tier 2 status after five years in the wilderness. Now the question that lingers: Can a lender born to build homes ever truly prosper by moving beyond them? Read here >>>>>

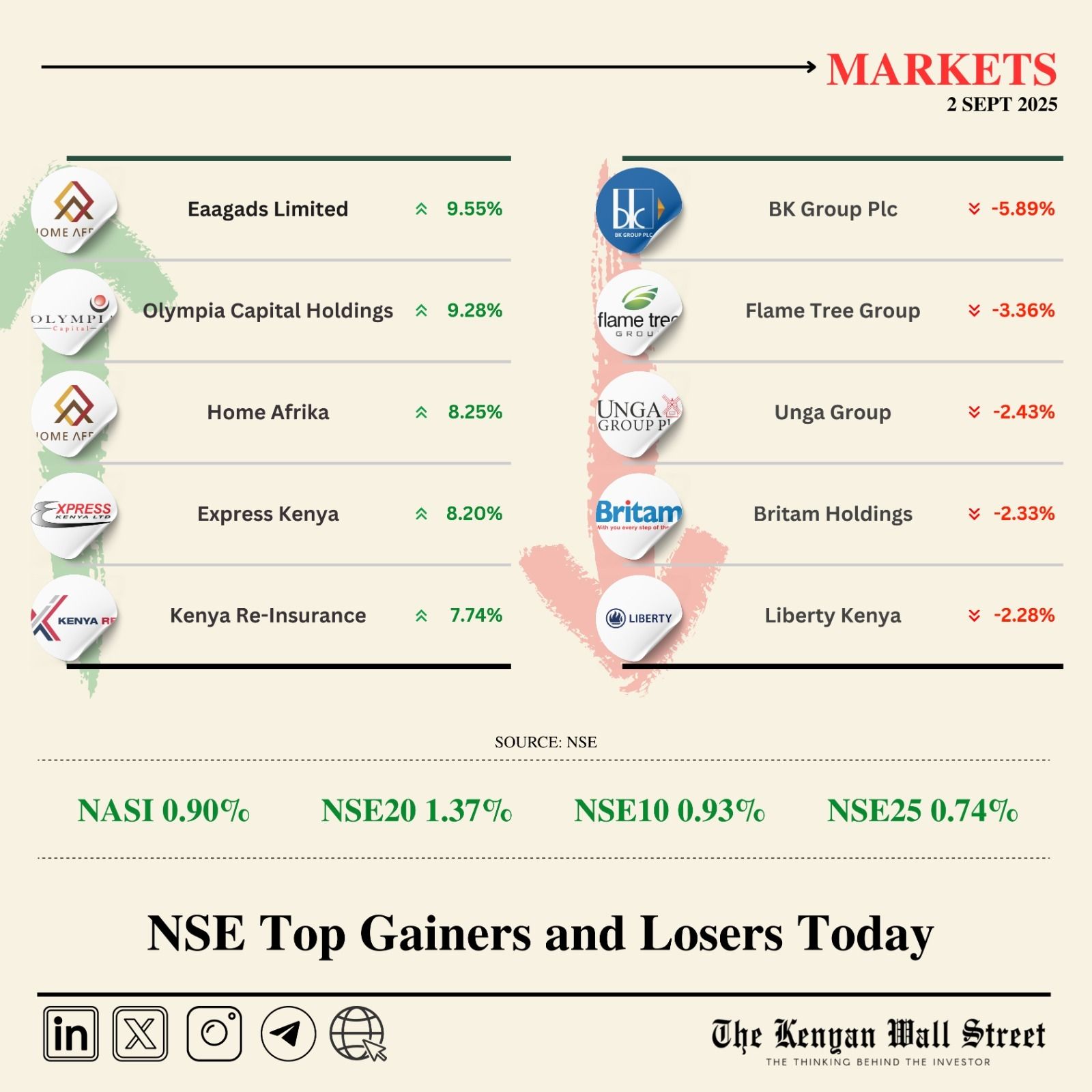

NSE Gainers & Losers

Source: NSE

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

OPINION: It’s Time to Restructure Kenya’s Public Debt

By Cuba Houghton

Kenya’s public debt has reached the point where restructuring is no longer a policy choice but a survival tactic. The government frames it as smart financial engineering, yet it looks more like buying time with borrowed air. Each rollover deepens the burden, pushing the costs onto citizens who already live with higher taxes and shrinking wages. Creditors may accept the shuffle, but the fundamental problem…too much borrowing, too little discipline…remains untouched. Restructuring may delay the reckoning, but it cannot erase it. Read this piece here »»»»»

More for you…

Stories you missed

♦️ Crime. A string of 1,678 suspicious M-Pesa deposits over four years have landed a 38 year old suspected drug trafficker in the crosshairs of Kenya’s anti-money laundering law.

♦️ Companies. Limuru Tea PLC has posted a deeper half-year loss despite modest revenue growth, as rising labour costs weighed heavily on margins.

♦️Energy. Kenya’s wind farms delivered a 46% jump in output that helped steady the country’s power grid in June.

♦️ Agriculture. Kenya’s crucial agricultural export sector is facing a significant slump as earnings from coffee, flowers, and vegetables decline in June.

♦️ Real Estate. Home Afrika Limited has posted a profit of KSh 192.4 million for the half year, a 14.6% increase from last year.

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.