- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Pipeline that became a budget fix

The Pipeline that became a budget fix

Kenya's #1 newsletter among business leaders & policy makers

A Happy New Year 😀

It's Brian from The Kenyan Wall Street.

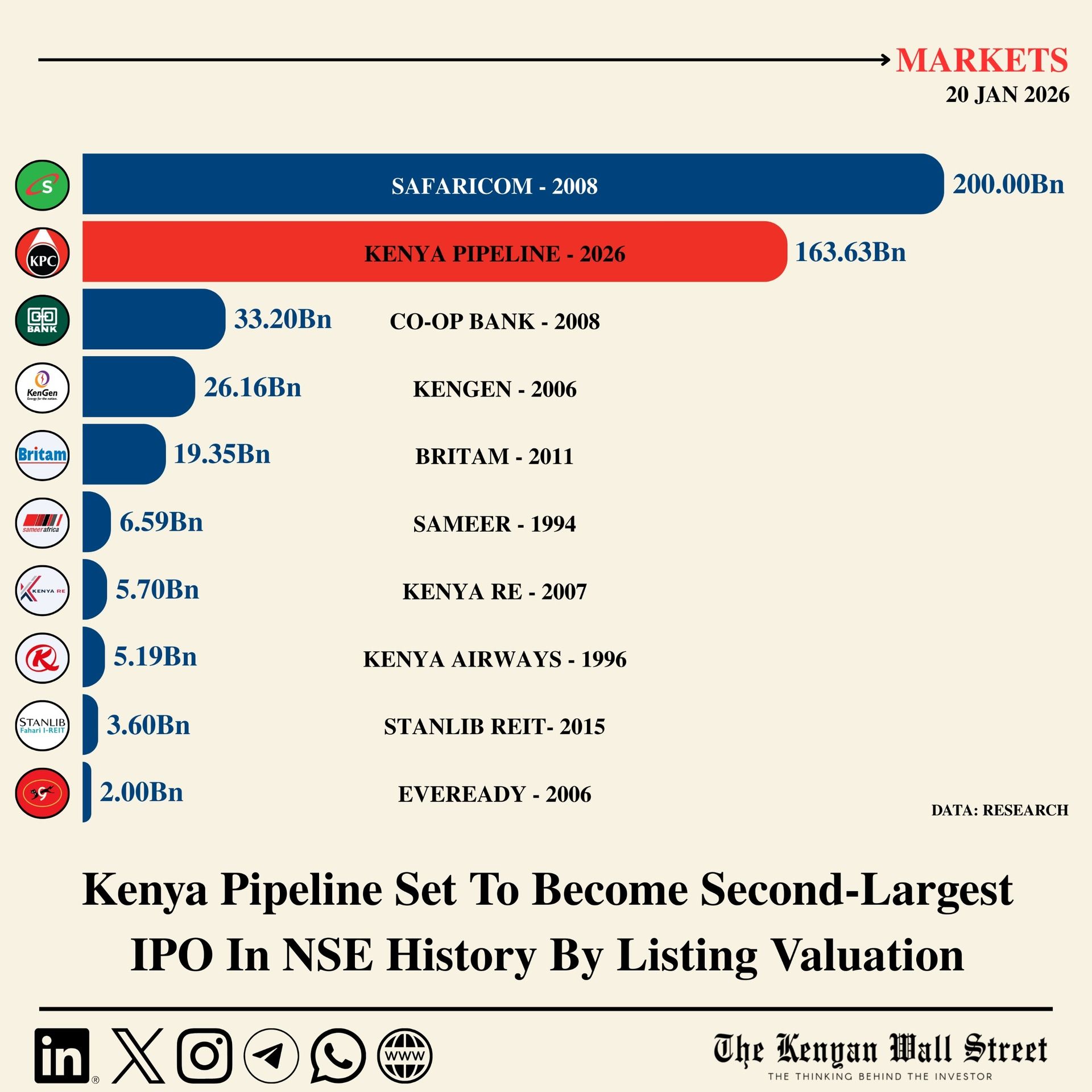

In today's newsletter, we explain why the IPO of Kenya Pipeline will plug budgetary gaps for the government but expose the asset to colder market scrutiny.

Also…the government is still convinced it will empower millions using informal credit even when there is little resolve to alleviate default risks.

This and more stories…

The Pipeline that became a budget fix

By Harry Njuguna

Treasury Cabinet Secretary John Mbadi at the Kenya Pipeline IPO event held at the Exchange on Monday

Kenya’s plan to sell a majority stake in its fuel pipeline is being marketed as a budget fix, but it reads more like a change in temperament. Faced with exhausted lenders and an IMF-shaped silence, the State is choosing to liquidate certainty rather than borrow against it. The transaction does not build a pipeline, modernize it, or expand capacity; it simply converts ownership into cash and calls it fiscal prudence. Once listed, Kenya Pipeline will slip out of the shelled universe of State corporations and into the colder discipline of markets, where patriotism carries no voting rights. What looks like privatization is the government learning to live with less control of assets that have been regarded as ‘strategic’.

Read the full article here >>>>>

When the State Backs Informal Credit

By Fred Obura

Kenya’s expanding Hustler Fund and credit guarantees are framed as empowerment, but they also function as a slow migration of risk onto the public balance sheet. By encouraging banks to lend while promising to absorb part of the losses, the State is underwriting informality without fully accounting for its costs. The borrowers are millions, their incomes volatile, and their repayment histories thin, yet the policy documents speak more confidently about inclusion than default. What looks like market-friendly intervention is, in practice, the government standing behind loans the market itself remains wary of. The real test of these programmes will not be how much credit is disbursed, but how much political appetite remains when repayment falters.

Read the full article here >>>>>

Kicking the Can Down the Road

By Harry Njuguna

Kenya used a bond switch to push KSh 25 billion of debt repayments into 2037 without raising new cash. The Treasury offered investors the chance to exchange maturing August 2026 bonds for longer-dated paper, effectively deferring repayment. Participation was voluntary, and no liquidity entered government coffers…the country simply bought more time. The move reflects a growing reliance on liability-management tools to smooth redemptions and reduce rollover pressure. In short, the switch reshapes the debt calendar without shrinking the debt itself.

Read more details here »»»»»

INSIGHT : After Senegal’s Turbulent Triumph, East Africa Prepares for AFCON 2027

By Chelsy Maina

Senegal's football team ‘The Lions of Teranga’ celebrating their trophy win after defeating the hosts Morocco in a controversial final match of AFCON

Senegal’s 2026 AFCON win was overshadowed by disputed officiating and concerns over unequal treatment of visiting teams. Complaints over security, training access, racism, and ticket allocations highlighted lingering credibility gaps in African football governance. As Kenya, Uganda, and Tanzania prepare to co-host AFCON 2027, these issues cast a long shadow over the region’s readiness. Success will hinge on fair officiating, secure venues, and transparent management to ensure all teams compete on equal terms. The tournament offers East Africa a chance to turn hosting into a test of professionalism and trust.

Read the full article here >>>>>

Heads Up

Partner Content

Is Bitcoin Calming Down as it Matures?

In recent years, Bitcoin has occasionally shown lower volatility than some leading technology stocks, challenging the long-standing narrative of unpredictability. This reputation, while once accurate, largely stems from Bitcoin’s early years, when the market was small and dominated by retail traders and speculative flows. Read more here »»»»»

Snapshot

Source : TKWS

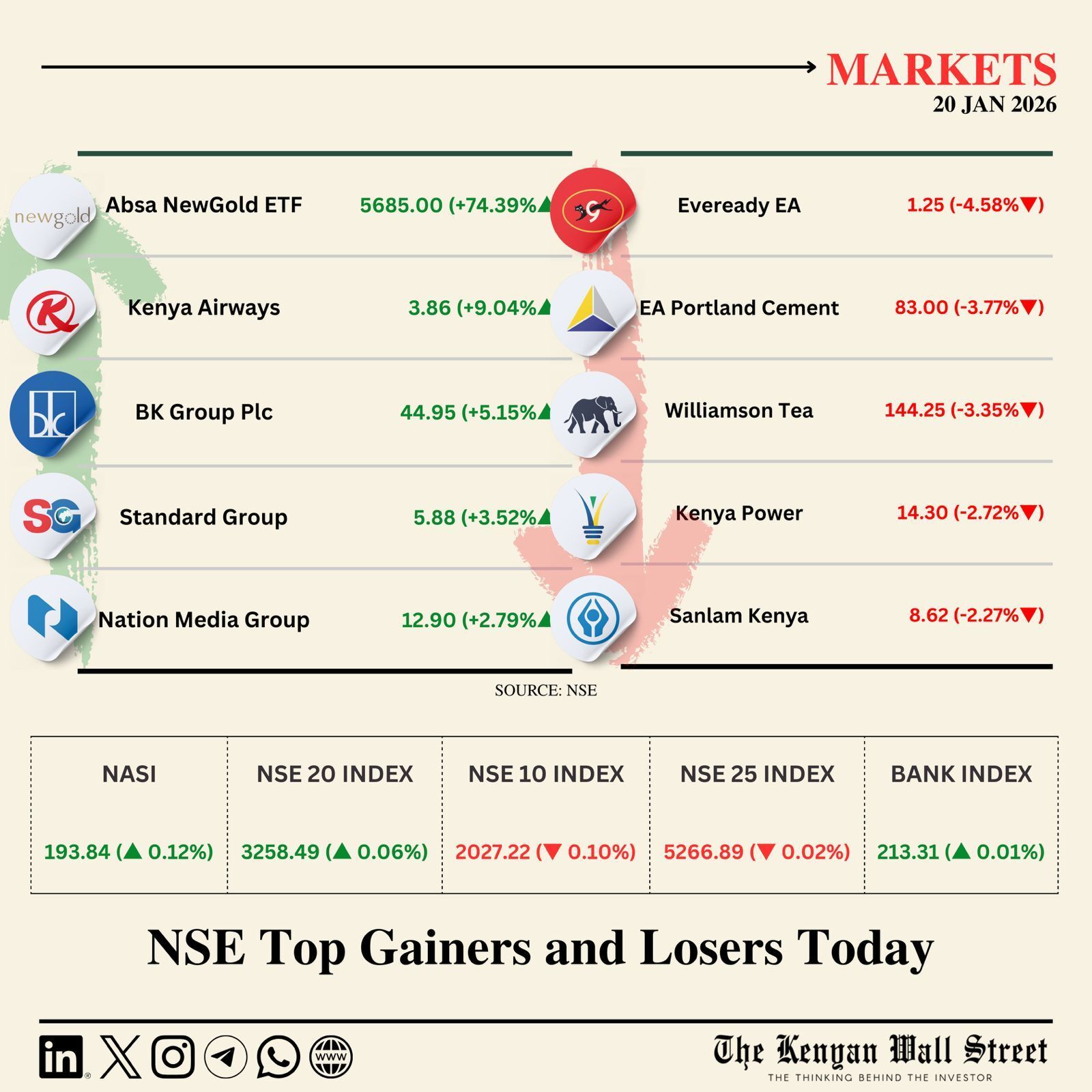

Source : NSE

Visit our new website here to get updated on this story and others…

On your watchlist

Are you paying too much to invest? Most Kenyan investors look at the annual returns (15%, 18%, 20%) but completely ignore the hidden fees that quietly destroy generational wealth.

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Today in History

Jaramogi Oginga Odinga, Kenya’s first vice president and the country’s most consequential opposition figure, died, ending a political career defined by defiance of centralized power and one-party rule.