- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Shape of Tomorrow's Debt

The Shape of Tomorrow's Debt

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

Howdy!

It's Brian from The Kenyan Wall Street…

Here are some top stories we lined up for you today. The Treasury has released its borrowing plans for the fiscal year, with external lenders still holding the line. Meanwhile, development spending on both levels of government remains a mirage as salaries stubbornly outpace legal limits.

The Shape of Tomorrow's Debt

By Harry Njuguna

Kenya will turn once more to the great multilateral lenders to finance its ambitious fiscal weight, according to the Treasury. The numbers, laid out in neat tables and targets, seem straightforward enough, but behind them lies a quieter dance of loans tied to hefty conditions including reforms that add more friction between the state and its taxpayers.

The loans arrive wrapped in the promise of sustainability, yet they carry the reminder of past indulgences, of debt already towering above the economy that sustains it. The World Bank, the AfDB, unnamed bilateral partners — each a different face of the same compromise, extending relief while tightening the web of oversight.

The Trajectory of Kenya's debt

The government speaks of strategies such as buybacks, swaps, restructuring schemes that hint at ingenuity…but the subtext is one of endurance, of surviving this fiscal year in the hope that the next might be kinder. It is the story of a country borrowing against tomorrow, hoping that tomorrow, too, will keep borrowing from itself.

Read more here >>>>>

Also Read : Kenya’s domestic debt burden has deepened sharply, with servicing costs crossing the KSh 1 trillion mark for the first time in FY 2024/25.

The Surging Bureaucracy that tilts the fiscal balance

By Brian Nzomo

The wage bill has become an intolerable weight bending Kenya’s public finances, crowding out the very investments meant to justify government itself.

Counties, meant to embody devolution’s promise, now spend more feeding payrolls than building clinics or roads, their revenues too fickle to keep up with the fixed appetite of salaries. At the national level, the picture is steadier but hardly cleaner, the cap on wages breached almost as a matter of routine.

What was meant as a safeguard against bloat has, instead, turned into a number the government learns to step over with impunity. And beneath it all, a million-strong bureaucracy whose growth, once celebrated, now stalks every budget like a shadow.

Read more here >>>>>

Risk Barometer: Kenyan Banks on the Edge…

By Harry Njuguna

Kenyan banks are juggling too many risks at once. Non-performing loans are still rising, capital rules are tightening, and some lenders remain too thinly capitalized to weather even mild shocks. But the most unnerving threat may not come from the books at all. It lurks in the form of cyber-attacks, where a single breach could wipe out billions and leave already fragile banks scrambling for survival.

Stress tests now factor in these digital dangers, showing how quickly a routine risk can spiral into a systemic one. Bigger lenders still have cushions, but smaller banks are skating close to the edge. And with cybercriminals growing bolder and more skillful, the sector’s stability may depend less on spreadsheets than on its servers.

Read more here >>>>>

Gazing into the African future of AI

By Fred Obura

Uganda is preparing to host Africa’s first artificial intelligence factory at the Karuma Hydropower Plant, a 100MW hyperscale project known as the Aeonian Project. Backed by European investors and development partners, the facility will run entirely on renewable energy and house a sovereign supercomputer named USIO, built with NVIDIA’s latest Blackwell GPUs. Supporters say the factory will keep Africa’s data on the continent, enabling local researchers to train models in African languages and apply AI in healthcare, education, and science.

Read more here »»»»»

Insight

A courtroom sketch of Abdiaziz Farah, a Minnesota businessman who was imprisoned for 28 years for being the mastermind of the largest pandemic fraud in the USA

The Kenyan, Somali Ring At the Center Of America’s Largest Pandemic Fraud

By Brian Nzomo

In the pandemic’s fog of emergency spending, a Somali-American businessman who once fled war and hunger helped orchestrate a fraud that siphoned off hundreds of millions of U.S. taxpayer dollars.

The scheme that involved phantom meal sites, invoices padded with children’s names that never existed — stretched from Minnesota’s parking lots to Nairobi property market, tracing a trail of money that was less about feeding the vulnerable than about feeding appetites for property, cars, and status.

Family members, friends, even supposed community leaders joined in, laundering the proceeds through shell companies and cross-border networks that have long thrived in the gray zones of finance. The fallout has been severe…lengthy prison terms, indictments, and Kenya again on the uncomfortable lists of places where illicit cash finds easy refuge.

Yet what lingers is not only the brazenness of the theft but also the uneasy recognition of how porous the walls remain between survival, ambition, and fraud.

Read this article here »»»»»

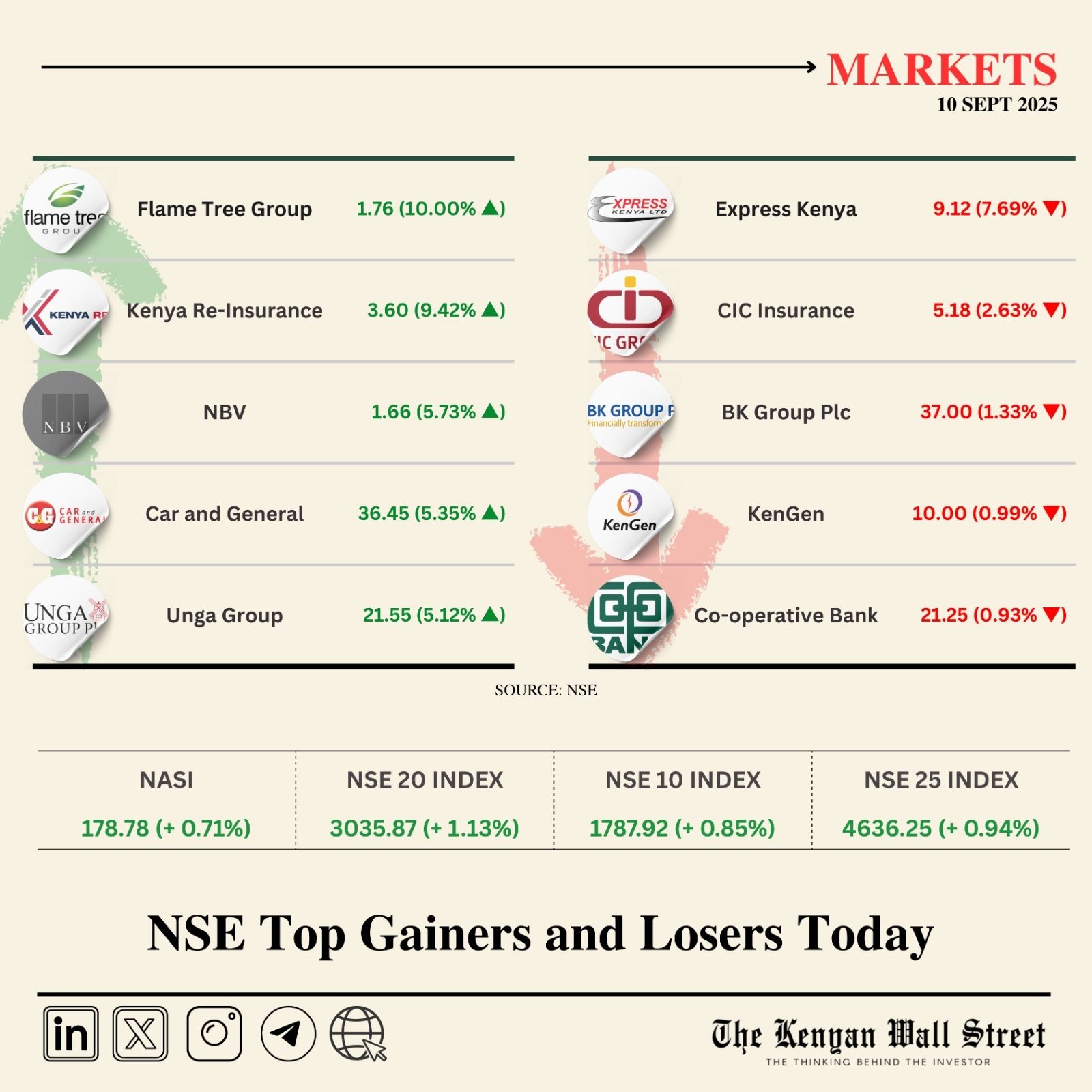

NSE Gainers & Losers

Source : NSE

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

Also Read

On Your Watchlist

Stories you missed

♦️ Banking. Kenya’s 14 microfinance banks (MFBs) have endured one of the toughest decades in the financial sector.

♦️ Public Finance. The High Court has suspended the Treasury’s directive requiring all government entities to adopt electronic procurement.

♦️ Investment. Kenyans are saving more money in Saccos than ever before, pushing the movement’s assets past KSh1 trillion by the end of 2024.

♦️Sustainability. African leaders and the United Nations have urged the world to unlock investment and reforms that would allow the continent to drive global climate action.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.