- The Daily Brief, by The Kenyan Wall Street

- Posts

- The Taxman’s Digital Miscalculation

The Taxman’s Digital Miscalculation

Kenya's #1 newsletter among business leaders & policy makers

Newsletter sponsor

I am Brian from The Kenyan Wall Street…

In today's newsletter edition, Pesapal had a decisive win in a ruling that grounds digital money-moving as exempt from VAT. We also highlight the do’s and don’ts of buying land in Kenya…

The Taxman’s Digital Miscalculation

A High Court ruling on Pesapal shows that in the contest between old laws and new money, definitions matter more than labels.

By Brian Nzomo

Pesapal’s latest courtroom victory is less about one fintech dodging a tax bill and more about what happens when laws written for the age of paper slips collide with the architecture of digital payments.

At stake was whether moving money with an app is somehow a different technique from moving money with a bank, and the High Court decided, refreshingly, that money is money. The Kenya Revenue Authority (KRA) had hoped to shoehorn fintechs into the category of mere tech platforms, which would have made transactions more expensive for merchants and, eventually, for you and me.

Instead, Justice Rhoda Rutto reminded everyone that tax exemptions are about the nature of the service, not the label stamped on the provider. This ruling, in effect, blocks KRA from extending its reach by creative interpretation, a tactic regulators have long favored when legislation lags. For fintechs, it is a sigh of relief. Read more here >>>>>

Warehouses : The New Avenues For Investment

By Fred Obura

Prime industrial yields in Nairobi are hovering around 9.5%, among the best on the continent, and that simple number explains why global logistics giants are pouring money into Kenya’s warehouse boom. Investors aren’t just chasing returns; they’re following a wave of e-commerce demand that has turned once-sleepy industrial parks into contested real estate. Tax breaks and SEZ perks sweeten the deal, ensuring that warehouses, not malls, are the new temples of consumption. In Tatu City and Athi River, forklifts and chilled storage rooms now matter more than storefronts, as every online order ripples through these cavernous spaces. The geography of ambition has shifted: Nairobi’s most prized square metres are measured in steel and concrete, not glass and marble. Read more here »»»»»

Assembly Lines Revive With Electric Dreams

By Harry Njuguna

Kenya’s auto industry has rolled out of its slump with 6,723 units assembled in the first half of 2025, a 16 percent jump after two years of decline. The rebound owes as much to policy nudges including duty exemptions and Samurai financing from Japan as to renewed investor confidence. New models are back on the line: Toyota Fortuner in Mombasa, Volkswagens in Thika, and a clutch of electric startups promising green fleets. For an industry that once seemed stuck in reverse, the mood is suddenly expansionary. Installed capacity of 46,000 units means there’s still plenty of road ahead. Read more here >>>>>

INSIGHT : Step-by-Step Guide to Buying Land in Kenya

By Lulu Kiritu

Buying land in Kenya is never just a financial decision; it’s a gamble where caution makes all the difference. The boom has created real opportunities, but it has also unleashed fraudsters, disputes, and too-good-to-be-true offers. Due diligence including title searches, licensed surveyors, formal sale agreements, and traceable payments is not bureaucracy but survival. Too many buyers have discovered too late that their “dream plot” was already sold, encroached, or tied up in debt. The safest path is slow, deliberate, and legal, even when the deal is tempting. Done right, land ownership can be a foundation for the future; done wrong, it can be the most expensive mistake of your life. Read more here >>>>>

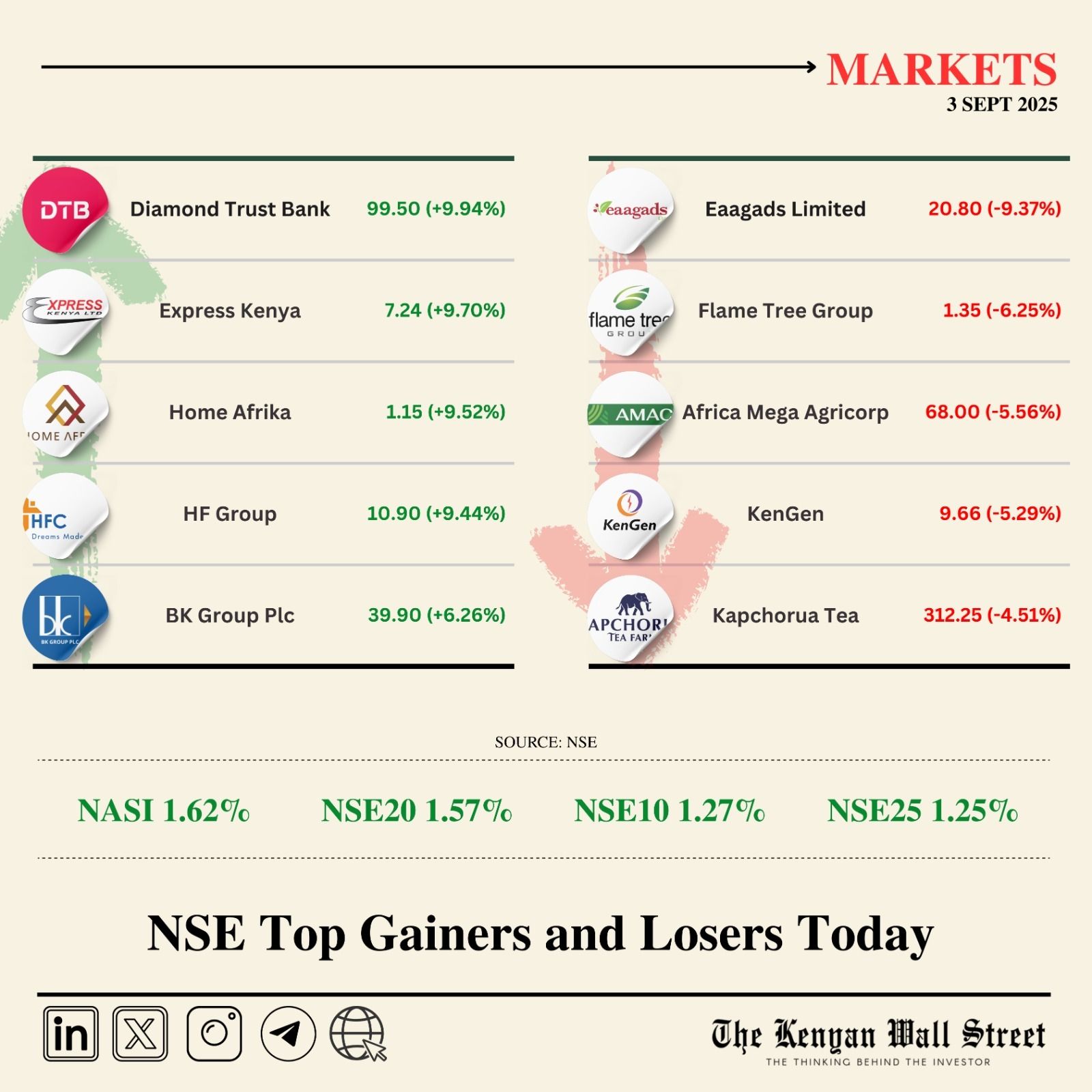

NSE Gainers & Losers

Source: NSE

The NSE Investment Challenge is a fun, interactive, and educational platform designed to teach you how to invest on the Kenyan Stock market using a real-time trading simulation.

✅ Virtual capital to trade

✅ Live market data

✅ Learn real investing skills

✅ Open to students & young professionals

💰 Cash prizes for the top performers

Click here to join this amazing opportunity 🎉

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»

OPINION: In the Game of Building Wealth, The Real Flex is Margin

By Alfred Gachaga

Kenyans love to parade assets: plots, apartments, cars…but too often these trophies are liabilities dressed in Sunday best. A rental that doesn’t rent, a plot you can’t sell, or a car draining your account isn’t wealth; it’s theatre. Real wealth is liquidity, the margin that lets you withstand a late salary, a medical bill, or half a year without income. Without that buffer, the “soft life” collapses with shocking speed, exposing Fuliza balances and postponed Netflix accounts. The arithmetic is brutal but liberating: assets must pay you, liabilities must be named for what they are, and net worth — not income — tells the truth. In the end, the real flex isn’t the property you show off, but the margin that keeps you standing when the tide goes out. Read this piece here »»»»»

Also Read

Stories you missed

♦️ Finance. Kenya’s pension industry closed 2024 on a high, with retirement savings hitting Ksh 2.23 trillion from KSh 1.84 trillion in 2023.

♦️ Taxation. The High Court has rejected the taxman’s effort to reclassify two high-dose vitamin E products as food supplements.

♦️ Investment. Kenya’s annual inflation rate held steady at 4.5% in August, offering relief from fears of runaway prices.

♦️ Startups. Global insurtech firm, Bolttech, is extending its African footprint by entering the Kenyan market through a partnership with LOOP.

♦️Tourism. Kenya’s tourism and transport sectors are showing a strong, intertwined recovery, with new data revealing a significant surge in both visitor arrivals and Standard Gauge Railway (SGR) activity.

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.