- The Daily Brief, by The Kenyan Wall Street

- Posts

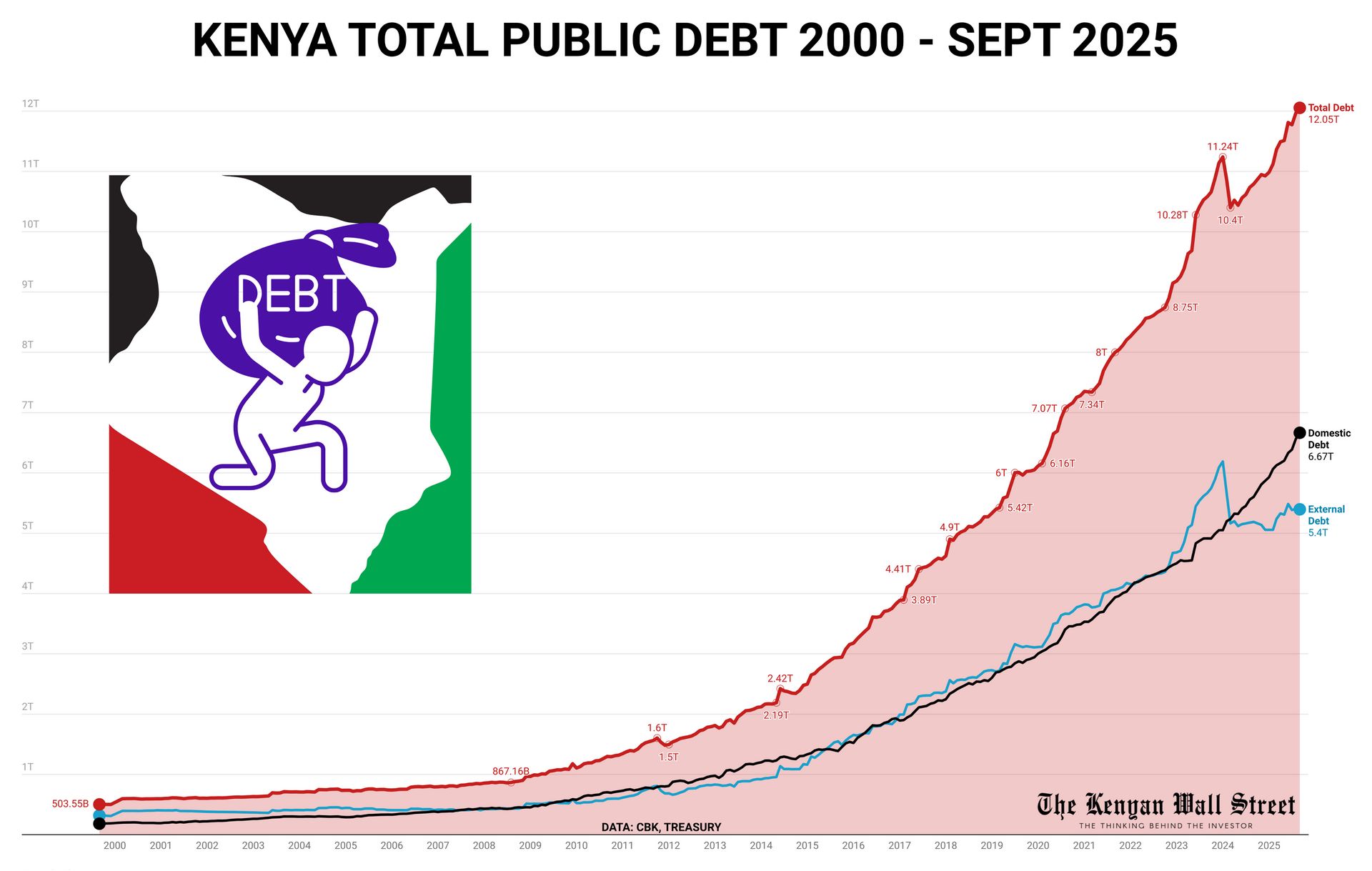

- The Weight On The National Ledger

The Weight On The National Ledger

Kenya's #1 newsletter among business leaders & policy makers

Newsletter Sponsor

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter edition, we analyze the rising tide of the national debt. Also, one of our columnists argues why de-risking initiatives should be at the pinnacle of startup investment.

The Weight On The National Ledger

By Harry Njuguna

The state of the Kenyan debt

Kenya has crossed an uneasy milestone, its public debt swelling past KSh 12 trillion.

The Treasury’s books reveal a subtle reshuffling: borrowing pulled inward, with domestic lenders now carrying most of the burden once shouldered by foreign creditors. This inward turn, buoyed by falling yields and restored market calm, signals both confidence and constraint.

Yet the relief is tempered by the arithmetic of obligation: even as dollar risk declines, repayments remain relentless, swallowing billions each month. Credit agencies have rewarded the discipline with cautious praise, but ratings don’t pay bills, and optimism does not refinance debt.

The question that hangs over Nairobi’s polished briefings is whether the nation is mastering its balance sheet or merely learning to live more comfortably with its debt.

Read the full article here >>>>>

Mental Health at the Fore of Investment

By Fred Obura

Africa’s mental health crisis has long existed in the shadow of its development agenda, but a new catalytic fund aims to bring it to the centre of investment conversations.

The Africa Venture Philanthropy Alliance (AVPA) and partners have launched a pooled financing vehicle to bridge one of the continent’s deepest health gaps, combining grants, concessional loans, and guarantees to draw private capital into mental health care.

With most countries spending less than US$1 per person annually and losing billions in productivity to untreated disorders, the fund reframes mental health as both a social and economic priority. Its focus on digital innovation, youth programmes, and community-based care signals a shift toward evidence-driven solutions backed by African and global institutions.

Read the full article here >>>>>

Is Bank Credit Softening?

By Harry Njuguna

Citibank Kenya has become the first lender in the country to cut its average lending rate to single digits, dropping to 9.6% in September 2025, amid falling sector-wide funding costs.

Over the same period, the banking industry saw deposit rates fall faster than lending rates, widening margins and strengthening liquidity across the system. While Citibank, ABSA, and M-Oriental led in lowering rates, thanks to their strong liquidity positions, banks serving SMEs and micro-lenders such as Credit Bank and Co-operative Bank maintained higher lending prices.

The spread between the cheapest and most expensive lenders widened further, with Access Bank and Credit Bank still charging twice as high as Citi Bank.

Read the full analysis here »»»»»

OPINION : De-risking Africa’s Growth by Building Investor Confidence

By Sylvester Omondi

Africa’s investment promise is no longer in doubt. It's in the structure that sustains it.

Across the continent, startups are solving real problems in energy, agriculture, and finance, but investor hesitation endures, rooted less in potential than in perception. De-risking Africa’s growth now depends on building trust through governance, transparency, and predictable regulation. Startup founders must professionalize, investors must partner beyond funding, and governments must harmonize rules that make cross-border investment less treacherous and more transparent.

Read the full article here >>>>>

More Stories

NSE Gainers & Losers

For up-to-date market insights and data from the NSE, join our Whatsapp channel here »»»»»