- The Daily Brief, by The Kenyan Wall Street

- Posts

- This is How September Ends, Why Banks Are Opening More Branches

This is How September Ends, Why Banks Are Opening More Branches

Here's what you need to know to start your week

Direct to your inbox every Monday at 9am (EAT)

What's Inside

This is How September Ends

It’s the last week of September, and so the end of Q3 looms.

In the first half of 2024, Kenya’s financial markets saw a significant surge with the shilling and Nairobi Securities Exchange (NSE), outpacing global peers.

Data compiled by The Kenyan Wall Street showed that the shilling surged 17.2%, becoming the best-performing currency worldwide, while bond market turnover doubled to KSh 781.8 billion. The NSE posted an impressive 50.4% growth in dollar returns, buoyed by a robust stock market rally and a significant increase in foreign investor participation, which rose to 65.6%.

This half of 2024 has presented a mix of escalated geopolitical tensions and simmering global risks, posing uncertainties in the broader economic landscape. With easing inflation across the board, interest rate cuts from both major and frontier economies might help things in Q4. Locally, the scrapped Finance Bill has led to budget cuts, increasing the risks of increased deficits and liquidity risks.

“Markets will take cues from fiscal developments, even as Parliament makes legislative amendments to the FY25 budget starting later this month,” Churchill Ogutu, an n Economist at IC Group, told The Kenyan Wall Street in August.

“For markets, revised domestic borrowing targets will be keenly monitored, as an indicator as to where rates should be. Further to this, inflation and currency performed favorably in the first half, and the focus this second half will be the start of the easing cycle. On the baseline, we think CBK will tread carefully with a first cut in October, although there is wiggle room to cut in August in the best-case scenario,” Ogutu added.

Stay updated on this and other stories on The Kenyan Wall Street.

“The function of economic forecasting is to make astrology look respectable.”

― John Kenneth Galbraith

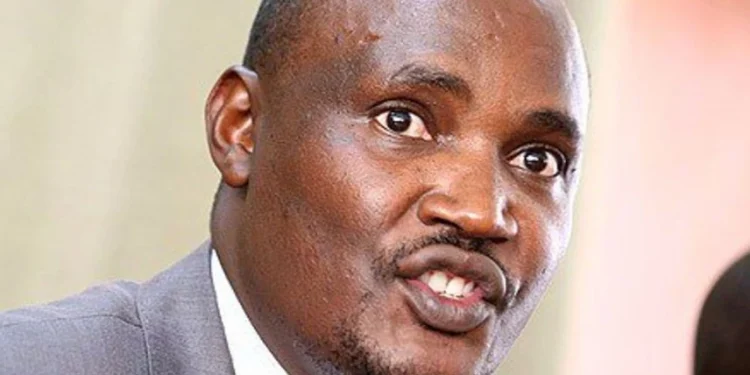

Why Banks Are Opening More Branches in the Digital Age- Interview with Dennis Musau, Stanbic CFO

Banks in Kenya have been expanding branch networks across the country and region despite being in the age of digitization where most transactions happen online.

On the sidelines of Stanbic Bank Kenya’s H1 results in August, The Kenyan Wall Street sat with Stanbic Bank Kenya’s Chief Finance and Value Officer Dennis Musau for a wide ranging interview to understand the listed lender’s numbers, and why it is also making a play for more physical presence.

The Kenyan Wall Street: We’ve seen a trend in the last year or two, banks and players in the sector are actively working to increase branch networks and sort of evolve the issues that they have been growing in despite the fact that for banks now, 90% plus of transactions take place online.

What are your thoughts on it generally as an industry practitioner, and what’s like is, is it the same strategy for standard going forward?

Dennis Musau: The view we get from our customers, especially SMEs, which drive more than 40% of the banking sector activity, is that they would like to find a place to deposit the cash. Despite a lot of digitization, we still have a largely cash economy, so the price, the physical presence, and points that you’ve seen coming up from different banks are in response to that. And it’s not an either or. It is an earned play to provide digital capabilities to make payments, to make finance, funds, transfers, to create convenience and shopping and all that. And then also create physical presence points where customers can go in and deposit the cash that they need.

We continue to see those two strands grow on our end and the CE did show this in a slide, we have increased our branch network from previously 28 now 30, and we’ll be looking for opportunities to increase that. We have increased our Agency Network significantly. Actually, we have increased our cash deposit machines, which are in demand, and we’ve continued to provide that.

We’ve continued to increase our ATM so all that sort of physical kind of arrangements continue to increase.

Alongside that, we continue to invest in our digital channels. So we just launched our new stanbic app, which authority had some glitches at the start, and is doing quite, quite well. In fact, we’ve seen more than 50% of the customers that we had in our previous version of the app already adopt the new app and increase digital activity. So it’s an under all play when it comes to physical vis a vis digital, some of the more savvy people call it a physical kind of strategy. So you have a digital and you have a physical alongside,

and I guess then the credit officer gets to look you in the eye when you go for a loan, exactly, and you have a candid Heart To Heart fellowship as to why they don’t. I believe I am asking for a loan.

Read the full interview.

Headlines you might have missed

Interview of the Week

Have a great week!