- The Daily Brief, by The Kenyan Wall Street

- Posts

- Why NCBA Snubbed Stanbic, turned to Nedbank

Why NCBA Snubbed Stanbic, turned to Nedbank

Kenya's #1 newsletter among business leaders & policy makers

Hello 👋🏽 It's Brian from The Kenyan Wall Street.

In today's newsletter…

We explain why NCBA rejected a merger with Stanbic bank.

The Controller of Budget is warning the gov't to tread lightly in its engagement with the IMF.

Why a couple is in court over alleged fraud in National Oil

These and more…

Why NCBA Snubbed Stanbic, turned to Nedbank

Stanbic bank and NCBA

By Morris Kiruga

Last year, Stanbic Bank reared its ambitious head in the corridors of NCBA Bank, announcing they were interested in a merger. The deal would have birthed Kenya’s third-largest bank, a financial leviathan with KSh1.1 trillion in assets.

It came as a surprise when NCBA announced that Nedbank, Standard Bank's South African rival with an appetite for East Africa, was going to acquire them. So what happened to the talks with Stanbic?

Insiders say that Stanbic wanted NCBA to shed its name, to be swallowed whole, but NCBA would not comply. NCBA turned to Nedbank, who will allow NCBA to retain its brand and gain a deeper balance sheet without losing its soul.

Read about it here >>>>>

KESONIA is here…but Banks take divergent paths

CBK Governor Kamau Thugge

By Harry Njuguna

Kenya’s largest banks are quietly charting different courses under the central bank’s new risk-based loan framework, revealing a subtle divide in how borrowing costs will move in 2026.

Some lenders are tying rates to the pulse of the interbank market, adjusting constantly with liquidity, while others cling to the steadier beat of the official policy rate, repricing only when the Monetary Policy Committee acts. The choices, though technical on the surface, hint at deeper questions of strategy, influence, and who holds sway in Nairobi’s high-stakes banking corridors.

Read the full article here >>>>>

The Couple at the Center of the National Oil Fraud

National Oil

By Brian Nzomo & Fred Obura

In Kenya’s state-owned oil firm, millions of shillings allegedly vanished under the noses of auditors and managers. Gladys Njubi, a former assistant accountant, is accused of exploiting her access to payments systems, diverting KSh 22 million to companies tied to her family network.

Meanwhile, her husband insists he had no knowledge, claiming his documents were misused, while investigators trace the trail through false invoices, altered bank details, and lax oversight. The scheme, spanning two years, exposes not just individual misconduct but systemic failures in supervision, checks, and balances.

Read the article here »»»»»

“We Should Not Take IMF Programs Wholesale" -Controller of Budget

Controller of Budget Dr. Margaret Nyakango

By Fred Obura

Kenya’s renewed engagement with the IMF has sparked a cautious chorus from the country’s budget watchdog, warning that quick fixes could punish households more than heal public finances.

The controller of budget, Dr. Margaret Nyakango flagged the risk that front-loaded fiscal consolidation, coupled with new off-budget vehicles like the National Infrastructure Fund, could erode oversight, squeeze social spending, and deepen inequality.

While the economy shows resilience, stability has yet to translate into improved livelihoods, as rising debt interest and rigid wage commitments continue to crowd out health, education, and social protection. Nyakango cautioned that past IMF programmes have faltered when domestic ownership and sequencing were ignored, leaving ordinary citizens to bear the adjustment.

Read the full article here >>>>>

Heads Up

Coming Soon!

This coming week, Andrew Barden, CEO of The Kenyan Wall Street will moderate a webinar session will examine how global institutions are quietly reshaping the crypto market and what this evolution means for Kenya. Register your attendance here »»»»»

Upcoming Events : KenInvest Announces the Upcoming Kenya International Investment Conference (KIICO) 2026

Taking place at the Radisson Blu Upper Hill on March 25, 2026, the 4th Kenya International Investment Conference (KIICO) 2026 is set to be the largest and most impactful investment promotion conference in Kenya’s history.

During KIICO 2026, Kenya will also host the 2nd COMESA Investment Forum on March 26 and the Africa Green Industrialization Initiative (AGII) on March 27th.

Read more about it here »»»»»

On your Watchlist

Snapshots

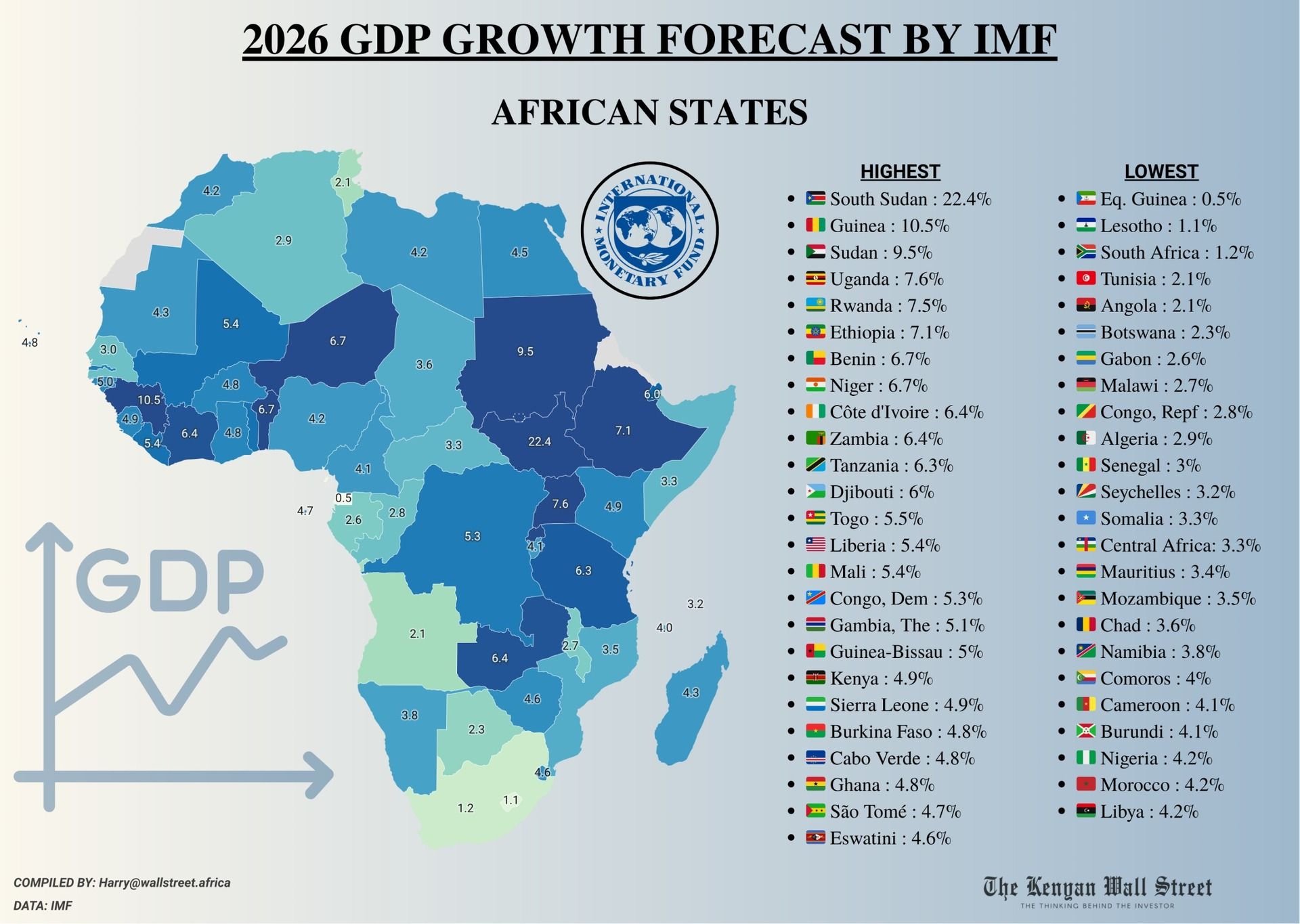

Africa growth forecast by the IMF

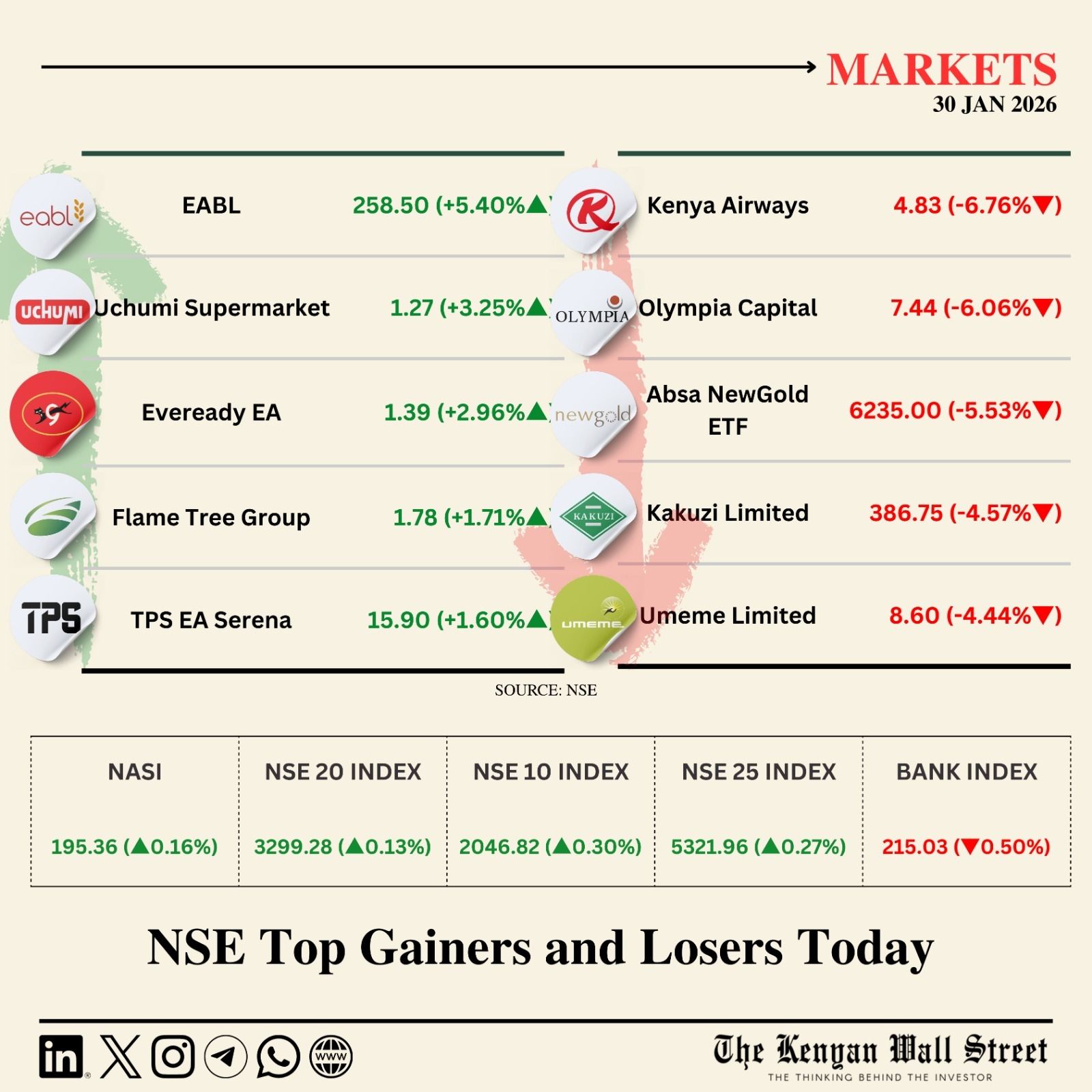

Source : NSE

Today in History

Kenya Airways Flight 431 crashed into the sea shortly after takeoff from Abidjan, killing 169 of the 179 people on board, after pilots misinterpreted a stall warning and lost control of the aircraft in night conditions with no visual reference.

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.