- The Daily Brief, by The Kenyan Wall Street

- Posts

- “Your kids are expensive!” - Treasury CS, Mbadi

“Your kids are expensive!” - Treasury CS, Mbadi

Kenya's #1 newsletter among business leaders & policy makers

In today’s newsletter, the National Treasury signals the end of free education, calling it fiscally unsustainable, despite years of waste and misplaced priorities. And in the betting world, firms must now cough up KSh 100 million to stay in the game, as Kenya rewrites the rules of chance with tighter ads, tougher audits, and a new regulator at the table.

I am Brian from The Kenyan Wall Street and these are our day's business stories:

Free Fall: Kenya’s Education Dream Hits a Budget Wall

Treasury signals a quiet retreat as Kenya’s flagship policy faces fiscal and systemic strain.

By Brian Nzomo

Kenya’s commitment to free education is faltering, with Treasury officials now questioning its long-term sustainability. When President Mwai Kibaki introduced Free Primary Education, there were expectations over the decades to see if the same program could be extended to Secondary and Tertiary schools. But the fiscal chief has noted that it is not possible. In fact, everything has to be scaled back.

While the policy remains intact on paper, funding gaps and delayed disbursements are forcing schools to lean on parents. At the heart of the issue lies a quiet reworking of capitation models and a backlog of unpaid obligations. Education officials face mounting pressure to justify a system plagued by ghost schools and unreliable student data.

Even with a record KSh 702.7 billion allocation this fiscal year, demands continue to outpace resources. Reform proposals are on the table: from university austerity to data system overhauls but budgetary reality is setting the pace. Is Kenya’s proudest social investment quietly being hollowed out? Read More >>>>>

Your Opinion

Do you believe it is necessary to do away with free education to fix Kenya's fiscal health? |

Raising the Stakes for Betting Firms

Kenya hikes capital rules for betting firms to KSh 100 million, rehashing an old rule book as pressure to tame gambling addiction increases.

By Brian Nzomo

In a country where betting shops outnumber libraries and football odds scroll faster than job ads, a Senate committee has approved a bill that could finally make gambling a high-stakes business, in more ways than one.

The newly minted Gambling Control Bill raises the minimum capital for betting firms from a modest KSh 250,000 to a vault-thick KSh 100 million. Enforcement will now be in the hands of a brand new Gambling Regulatory Authority, complete with real-time surveillance tools, a 15% tax on gross revenues, and a moral mission funded by a monthly addiction levy.

The bill outlaws daytime ads, celebrity-fueled jackpots, and gambling on credit, but its subtext is plain: too many Kenyans are chasing luck, and in tightening the leash, the state is seemingly helpless in the long run. Read more >>>>>

Capital Markets

🚬 Giant Tobacco Firm BAT Blames Poor Revenues on Illicit Cigarettes

By Harry Njuguna

British American Tobacco

Despite stagnant revenues and a shrinking asset base, BAT Kenya stunned investors with a 100% dividend hike, rewarding shareholders even as its core business withers.

The company’s net revenue flatlined at KSh 11.7 billion, but profits surged on cost cuts and currency gains, not consumer growth. Management blames illicit cigarettes, now 37% of the market, for declining volumes. The firm warns of KSh 9 billion in annual tax losses. Still, instead of reinvesting, BAT is squeezing more from less: less revenue, less equity, and fewer assets. Read more »»»»»

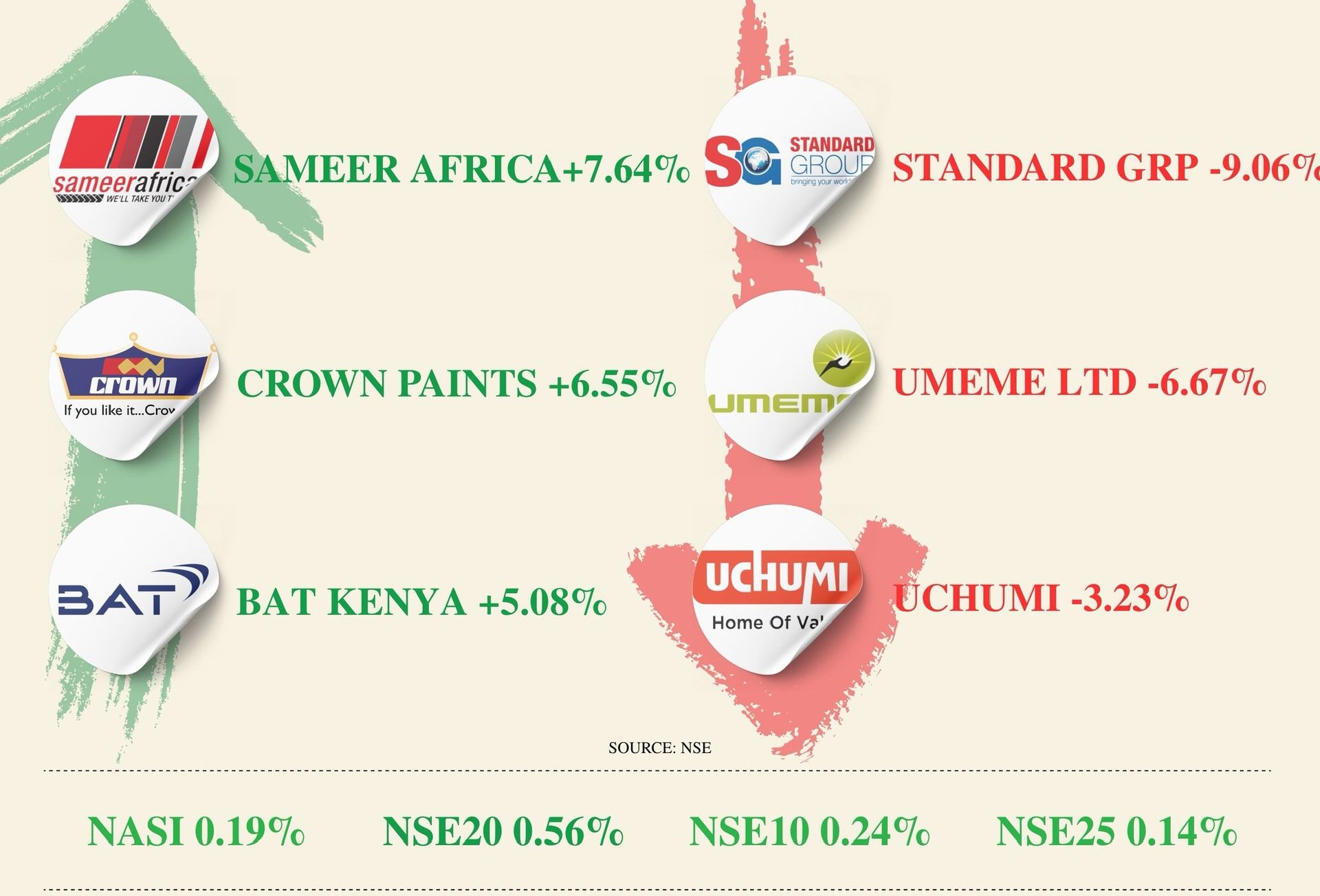

NSE Gainers & Losers

Source : NSE

Tech Frontier

📱 Airtel Africa’s Quiet Revolution

Airtel Africa’s Q1 profit surged over 400% to US$156 million, driven by a boom in mobile money and data usage across its fast-growing markets. With 14 million new subscribers and revenues up 22%, the telco is cashing in on Africa’s digital leap, especially in East Africa, which now contributes nearly half of total revenue. Mobile money alone brought in $290 million, with annualized transaction values hitting $162 billion and margins nearing 53%. With smartphone penetration still under 50%, the company sees plenty of runway and opportunities to seize. Read more »»»»»

Opinion

Kenya Faces a Decision that will Define Payments for Decades to Come

By Edgars Bīberis

Kenya stands at the edge of a payments revolution. A decision by the Central Bank could permanently reshape how money moves by linking M-Pesa and PesaLink, and deciding who controls the rails. Drawing lessons from India and the Maldives, the stakes are nothing short of generational. What Kenya chooses next may define its financial sovereignty. Read this article »»»»»

Stories you missed

♦️ Industry. Rivatex East Africa Ltd, a state-owned textile manufacturer once hailed as a cornerstone of Kenya’s industrial revival, is facing mounting financial strain amid serious revenue integrity concerns and rising losses,

♦️ Telcos. Safaricom PLC has surpassed 50 million customers on its Kenyan mobile network, affirming its position as East Africa’s largest telecommunications provider.

♦️ Energy. Kenya is set to tackle its electricity losses, currently standing at a staggering 24% from generation to the end consumer, through a multi-pronged approach spearheaded by the government.

Yesterday's Poll Results

Do you think it is possible for Rivatex to recover financially and become a manufacturing icon?

🟨🟨🟨🟨⬜️⬜️ Yes (40%)

🟩🟩🟩🟩🟩🟩 No (60%)

On your watchlist

Keep up with what’s happening on our X and LinkedIn pages. Stay updated with the latest financial news on our website The Kenyan Wall Street.